Capitation is a payment arrangement in healthcare where providers receive a set amount per patient regardless of services rendered. This model encourages efficient care management and cost control by shifting financial risk to providers. Discover how capitation can impact your healthcare expenses and quality by reading the rest of the article.

Table of Comparison

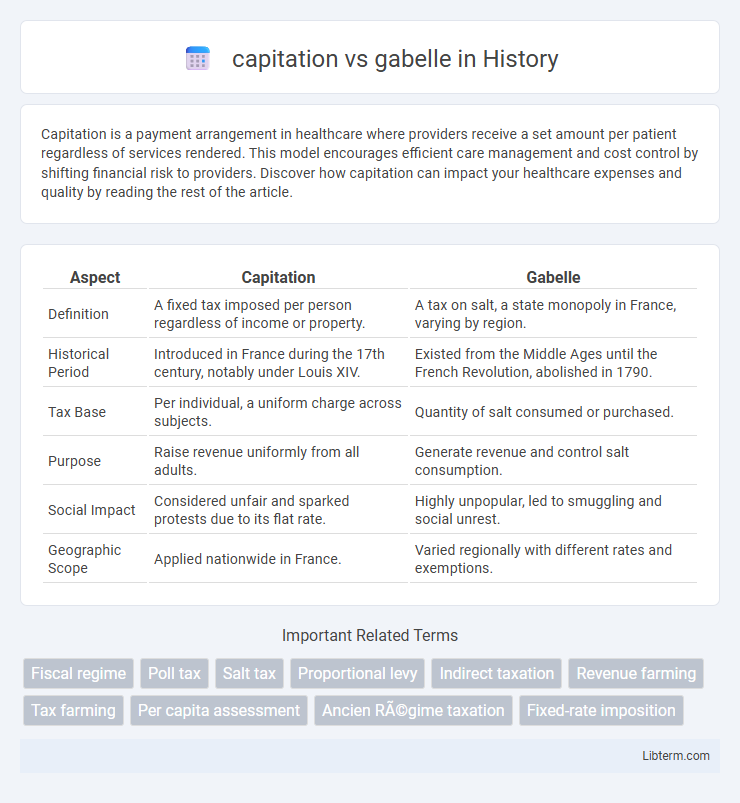

| Aspect | Capitation | Gabelle |

|---|---|---|

| Definition | A fixed tax imposed per person regardless of income or property. | A tax on salt, a state monopoly in France, varying by region. |

| Historical Period | Introduced in France during the 17th century, notably under Louis XIV. | Existed from the Middle Ages until the French Revolution, abolished in 1790. |

| Tax Base | Per individual, a uniform charge across subjects. | Quantity of salt consumed or purchased. |

| Purpose | Raise revenue uniformly from all adults. | Generate revenue and control salt consumption. |

| Social Impact | Considered unfair and sparked protests due to its flat rate. | Highly unpopular, led to smuggling and social unrest. |

| Geographic Scope | Applied nationwide in France. | Varied regionally with different rates and exemptions. |

Introduction to Capitation and Gabelle

Capitation was a system of taxation in pre-revolutionary France where each person paid a fixed amount regardless of income or wealth, introduced in 1695 to finance wars. The gabelle was a highly unpopular salt tax that varied regionally and was essential for royal revenue, often leading to widespread smuggling and resistance. Both taxes exemplify the fiscal inequalities and burdens that contributed to social unrest before the French Revolution.

Historical Origins of Capitation and Gabelle

The capitation tax originated in ancient civilizations such as Rome, where it was levied as a fixed amount per individual to fund state expenses, reflecting a direct and personal approach to taxation. The gabelle emerged in medieval France as a specific tax on salt, essential for food preservation and trade, evolving into a symbol of economic control and royal authority. These taxes illustrate early governmental efforts to balance public revenue with societal needs through distinct and strategic fiscal mechanisms.

Definition and Mechanism of Capitation

Capitation is a fixed payment system where providers receive a set amount per patient regardless of the number of services delivered, ensuring predictable healthcare costs and incentivizing efficient care management. This mechanism contrasts with gabelle, which was a historical tax on salt in France, based on the quantity consumed or purchased, serving as a form of indirect taxation generating state revenue. Capitation aligns healthcare provider incentives with patient outcomes by transferring financial risk, whereas gabelle functioned purely as a consumption-based fiscal levy.

Definition and Mechanism of Gabelle

The Gabelle was a historic French tax on salt, imposed as a form of indirect taxation requiring individuals to purchase salt exclusively from government-regulated sources at fixed prices. Its mechanism involved strict state control and enforcement, compelling citizens to buy a set quota of salt, making it a highly unpopular and oppressive fiscal policy. In contrast, capitation is a type of direct tax levied as a fixed amount per individual, unrelated to consumption or goods, highlighting the Gabelle's unique role in economic and social control through commodity taxation.

Economic Impacts of Capitation vs Gabelle

Capitation, a fixed tax per individual, provided predictable revenue but limited economic flexibility, often burdening lower-income populations disproportionately. The gabelle, a tax on salt, generated significant state income but distorted market prices, encouraging smuggling and black-market activities. Both systems influenced economic behavior: capitation reduced disposable income uniformly, while the gabelle created regional economic imbalances and incentivized illegal trade.

Social and Political Implications

The capitation tax, imposed uniformly per individual, often sparked widespread social unrest due to its perceived inequity, disproportionately burdening lower-income populations and fueling resentment toward ruling authorities. In contrast, the gabelle, a tax on salt, not only affected daily subsistence but also became a symbol of governmental control, exacerbating tensions between social classes and catalyzing political dissent. Both taxes significantly influenced revolutionary movements by undermining public trust and highlighting fiscal policies' role in social stratification and political instability.

Advantages and Disadvantages Comparison

Capitation offers predictable healthcare costs by paying a fixed amount per patient, promoting cost control and preventive care, while its disadvantage lies in potential under-service to reduce expenses. The gabelle, a historical salt tax in France, generated significant state revenue and was easy to collect but caused widespread public resentment and economic burden on lower classes. Comparing both, capitation emphasizes cost management and patient care efficiency, whereas the gabelle represents an unpopular fiscal policy with socioeconomic repercussions.

Case Studies and Notable Examples

The Capitation tax imposed a fixed amount per person and was notably exemplified by pre-revolutionary France, where it contributed to widespread public dissent due to its uniform burden despite varying incomes. In contrast, the Gabelle was a salt tax with significant case studies in France's ancien regime, where regional disparities in salt prices fueled smuggling and civil unrest, profoundly impacting the economy and social order. Both taxes highlight historical fiscal challenges and societal responses within French tax systems prior to the 18th century reforms.

Legacy and Abolition of Capitation and Gabelle

The capitation tax, a fixed per-person levy introduced in medieval France, became deeply unpopular due to its regressive burden on peasants and lower classes, leading to widespread resistance and contributing to its abolition during the French Revolution in 1791. The gabelle, a highly detested salt tax with uneven regional impositions, symbolized fiscal injustice and fueled social unrest, particularly in provinces heavily burdened by it; it was officially abolished in 1946 in post-war France as part of broader tax reforms aimed at modernization and fairness. Both taxes left a legacy of fiscal centralization and resentment that influenced subsequent tax policies and the development of more equitable tax systems in France.

Modern Lessons from Historical Taxation Systems

Capitation and gabelle, two historic taxation systems, offer modern lessons on economic impact and social equity within fiscal policy. Capitation enforced a uniform tax per individual, highlighting challenges in fairness amid diverse income levels, while gabelle, a tax on salt, exemplified how targeted commodity taxes can foment public resistance and black markets. Understanding these systems informs contemporary tax design by emphasizing balance between revenue generation and minimizing social unrest.

capitation Infographic

libterm.com

libterm.com