Window tax was a property tax imposed in England and other parts of Great Britain from the late 17th century until the mid-19th century, based on the number of windows in a building. This tax led many homeowners to brick up their windows to avoid higher charges, impacting architectural design and indoor lighting. Discover how this unique tax influenced history, architecture, and social conditions throughout the article.

Table of Comparison

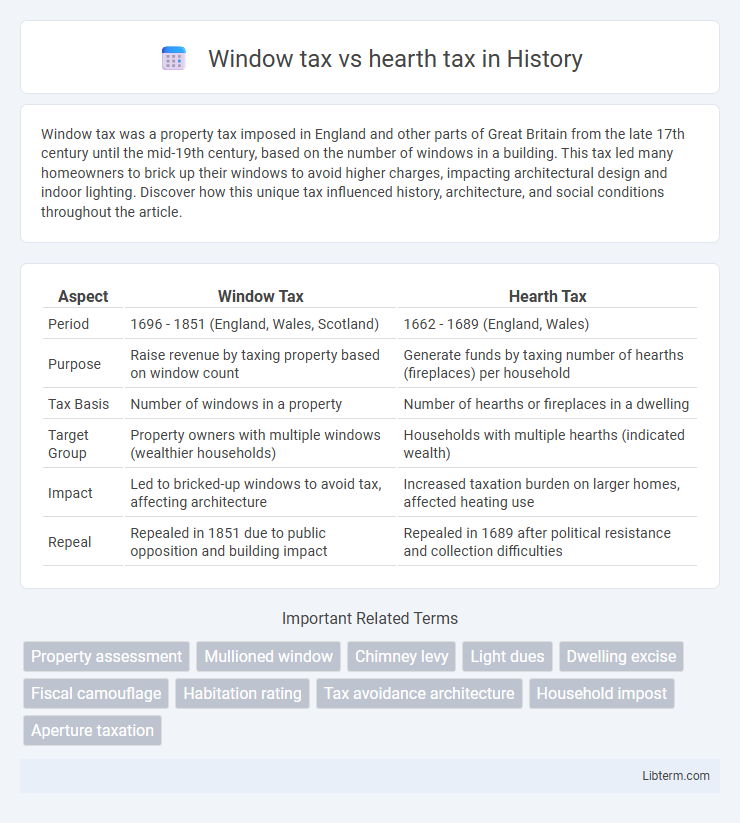

| Aspect | Window Tax | Hearth Tax |

|---|---|---|

| Period | 1696 - 1851 (England, Wales, Scotland) | 1662 - 1689 (England, Wales) |

| Purpose | Raise revenue by taxing property based on window count | Generate funds by taxing number of hearths (fireplaces) per household |

| Tax Basis | Number of windows in a property | Number of hearths or fireplaces in a dwelling |

| Target Group | Property owners with multiple windows (wealthier households) | Households with multiple hearths (indicated wealth) |

| Impact | Led to bricked-up windows to avoid tax, affecting architecture | Increased taxation burden on larger homes, affected heating use |

| Repeal | Repealed in 1851 due to public opposition and building impact | Repealed in 1689 after political resistance and collection difficulties |

Introduction to Historical Property Taxes

Window tax and hearth tax were historical property taxes imposed in England and parts of Europe during the 17th and 18th centuries. Window tax was levied based on the number of windows in a building, reflecting the homeowner's wealth and property size, while hearth tax charged homeowners according to the number of fireplaces within the property. Both taxes aimed to generate revenue from property owners by assessing visible household features, influencing architectural design and social conditions of the period.

Origins of the Window Tax

The window tax originated in England in 1696 as a property tax based on the number of windows in a building, intended to serve as a proxy for wealth and property size. It aimed to generate revenue without directly taxing income or property values but led to architectural modifications, such as bricked-up windows, to reduce tax liability. In contrast, the hearth tax, established earlier in 1662, taxed households based on the number of hearths or fireplaces, reflecting the home's size and occupants' wealth.

Development of the Hearth Tax

The Hearth Tax, introduced in England in 1662, was a property tax based on the number of hearths or fireplaces within a dwelling, reflecting the occupant's wealth and status. Unlike the earlier Window Tax, which taxed openings and potentially influenced architectural design, the Hearth Tax directly targeted domestic heating facilities as a straightforward indicator of wealth. Its development aimed to generate consistent revenue for the crown by exploiting tangible household features that correlated with affluence, ultimately influencing building practices and social assessments.

Purpose and Rationale Behind Each Tax

The Window Tax was primarily implemented in England from 1696 to 1851 to raise revenue based on the number of windows in a property, aiming to tax wealth indirectly by targeting housing features associated with affluence. In contrast, the Hearth Tax, levied between 1662 and 1689, focused on the number of hearths or fireplaces to assess household wealth, reflecting the owner's ability to heat larger or multiple rooms. Both taxes sought to generate income for the state but differed in their approach: the Window Tax targeted property wealth via architectural aspects, while the Hearth Tax measured wealth through domestic heating capacity.

Social and Economic Impacts

Window tax, introduced in 1696 in England, imposed financial burdens on property owners based on the number of windows, leading to bricked-up windows and reduced natural light, which negatively affected health and living standards among lower-income families. Hearth tax, levied from 1662, targeted households based on the number of chimneys, disproportionately impacting poorer households and causing social resentment due to invasions of privacy and aggressive tax collection methods. Both taxes influenced social stratification by penalizing visible wealth indicators, reducing domestic comfort, and incentivizing architectural modifications that compromised housing quality.

Public Reactions and Evasion Tactics

Public reactions to the Window Tax and Hearth Tax were largely negative, with many viewing these levies as intrusive and unfair burdens on households. Homeowners often employed evasion tactics such as bricking up windows to reduce their Window Tax liability or minimizing the use of hearths to lower their Hearth Tax payments. Both taxes prompted widespread resentment, contributing to alterations in architectural design and sparking protests against perceived government overreach.

Architectural Consequences

The window tax imposed a direct influence on the architectural design of buildings, as homeowners often bricked up windows to reduce tax liabilities, leading to darker interiors and altered facades. In contrast, the hearth tax, based on the number of fireplaces, encouraged the consolidation or reduction of hearths, which affected internal layouts and heating efficiency. Both taxes significantly shaped domestic architecture by incentivizing modifications that prioritized fiscal savings over natural light and comfort.

Comparison of Window Tax vs Hearth Tax

The Window Tax, imposed in England from 1696 to 1851, levied property owners based on the number of windows, incentivizing bricked-up windows to reduce tax liability. The Hearth Tax, enforced between 1662 and 1689, charged households per hearth or fireplace, serving as a proxy for wealth and property size. Both taxes aimed to assess wealth indirectly but differed in their focus--windows reflecting light and architectural features versus hearths indicating heating capacity and household size.

Abolition and Lasting Legacy

The window tax was abolished in 1851 due to public outcry over its impact on health and building design, while the hearth tax was repealed much earlier in 1689 as it proved difficult to enforce and unpopular among taxpayers. Both taxes left a lasting legacy on architectural features, with bricked-up windows from the window tax era still visible in many historic buildings, and hearth tax records providing valuable insights into household wealth and population distribution in early modern Britain. Their abolition marked a shift towards more equitable taxation methods, influencing future fiscal policies focused on fairness and economic growth.

Modern Perspectives on Historical Taxation

The window tax and hearth tax, both prominent in 17th and 18th century England, offer modern scholars insight into early fiscal policies targeting property features to assess wealth. Contemporary analyses emphasize how these taxes influenced architectural design and urban planning, reducing window size and altering home heating arrangements to minimize tax liability. Understanding these historical taxes provides valuable context for current discussions on tax equity and the socioeconomic impacts of property-based taxation systems.

Window tax Infographic

libterm.com

libterm.com