Danegeld was a historical tax levied by Anglo-Saxon and later English kings to pay off Viking raiders and prevent their attacks. This tribute often strained the economy but temporarily secured peace and buy time for military strengthening. Explore the full article to understand how Danegeld shaped medieval English history and its lasting impact on governance.

Table of Comparison

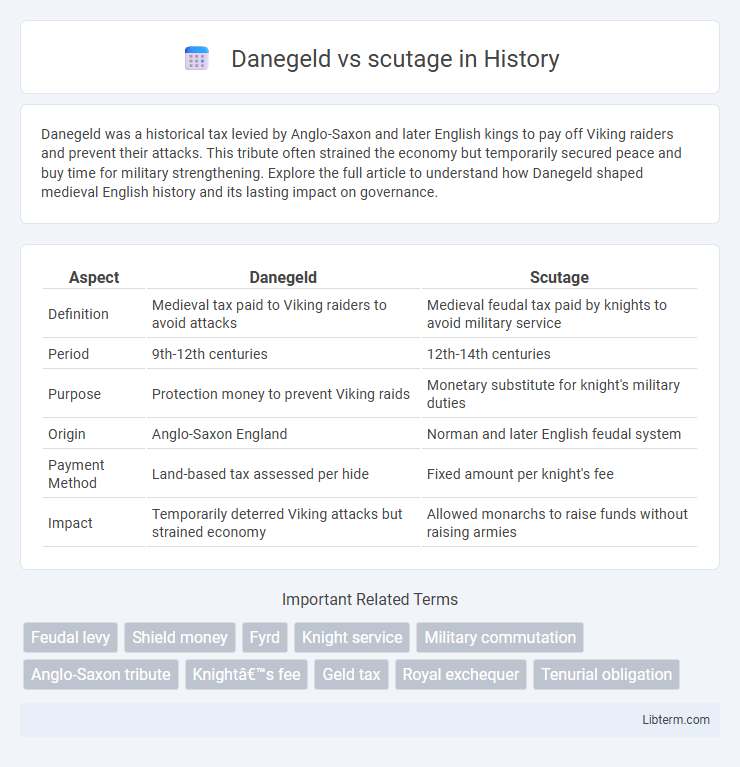

| Aspect | Danegeld | Scutage |

|---|---|---|

| Definition | Medieval tax paid to Viking raiders to avoid attacks | Medieval feudal tax paid by knights to avoid military service |

| Period | 9th-12th centuries | 12th-14th centuries |

| Purpose | Protection money to prevent Viking raids | Monetary substitute for knight's military duties |

| Origin | Anglo-Saxon England | Norman and later English feudal system |

| Payment Method | Land-based tax assessed per hide | Fixed amount per knight's fee |

| Impact | Temporarily deterred Viking attacks but strained economy | Allowed monarchs to raise funds without raising armies |

Introduction to Danegeld and Scutage

Danegeld was a medieval tax levied primarily in England during the Viking Age to raise funds for paying off Viking raiders, effectively a tribute to avoid attacks. Scutage, emerging later in the feudal period, was a monetary payment made by vassals to their lords in lieu of military service, allowing lords to hire professional soldiers. Both Danegeld and Scutage illustrate early examples of financial instruments replacing direct military obligations in medieval governance.

Historical Origins of Danegeld

Danegeld originated in 9th-century England as a tax imposed to raise funds for paying Viking raiders to avoid plundering, representing an early form of protection money. Unlike scutage, which evolved later as a feudal payment allowing knights to avoid military service, Danegeld was primarily a direct royal levy collected from landholders. This tax reflects Anglo-Saxon efforts to manage external threats through financial means rather than armed conflict.

The Emergence of Scutage

The emergence of scutage marked a strategic shift in medieval England's feudal system by allowing vassals to pay a monetary fee instead of providing military service, distinguishing it from the earlier Danegeld tax that primarily funded defense against Viking incursions. Scutage evolved as monarchs sought more flexible revenue streams to finance professional armies, reducing reliance on feudal levies. This transformation underscored the gradual centralization of royal power and the monetization of military obligations in the 12th and 13th centuries.

Purpose and Use of Danegeld

Danegeld was a medieval tax originally levied to pay off Viking raiders and later used by English monarchs to fund military campaigns or domestic expenses without calling parliament. Unlike scutage, which allowed knights to pay a fee to avoid military service, Danegeld was a broader land tax imposed on all landholders to raise immediate revenue for defense. The primary purpose of Danegeld was to secure peace by buying off invaders or financing defensive measures, making it a crucial tool in early medieval fiscal policy.

Evolution from Danegeld to Scutage

Danegeld, originally a land tax levied by the Anglo-Saxons to fund military defense against Viking invasions, evolved into scutage as feudal obligations shifted during the Norman period. Scutage replaced the collective levy of Danegeld by allowing vassals to pay a monetary fee instead of providing direct military service, reflecting the increasing monetization of feudal relationships. This transformation marked a significant development in medieval taxation, aligning military funding with cash payments and enabling the Crown greater fiscal flexibility.

Economic Impact of Danegeld

Danegeld, a tax levied primarily by the English monarchy to pay off Viking raiders, had significant economic consequences by redirecting substantial royal revenues away from local economies and infrastructure investment. Unlike scutage, which allowed knights to pay a fee in lieu of military service, danegeld represented a direct monetary burden on landowners and peasants, often resulting in increased taxation and economic strain. This continuous outflow of wealth to external threats hindered economic growth and stability, exacerbating social tensions within the kingdom.

Scutage’s Role in Medieval England

Scutage in medieval England functioned as a monetary payment made by knights to avoid personal military service, providing the crown with flexible financial resources for warfare without relying on feudal levies. Unlike Danegeld, which was a land tax originally imposed to pay off Viking raiders, scutage directly tied feudal obligations to a financial system allowing lords to hire mercenaries or fund military campaigns. This system enhanced the king's control over military mobilization and transformed feudal duties into a significant revenue stream during the 12th and 13th centuries.

Social Implications of Both Taxes

Danegeld, imposed in medieval England primarily to pay off Viking raiders, created social resentment as it was a heavy burden disproportionately affecting peasants and small landholders, leading to economic strain and occasional unrest. Scutage, evolving later as a monetary substitute for military service owed by knights, altered feudal obligations by commodifying military duty, which shifted power dynamics within the nobility and enabled wealthier lords to avoid personal combat. Both taxes influenced social hierarchies by redistributing military and financial responsibilities, impacting class relations and contributing to gradual changes in feudal obligations and land tenure systems.

Comparative Analysis: Danegeld vs Scutage

Danegeld was a specific tax imposed primarily in medieval England to pay off Viking raiders, while scutage evolved as a feudal levy allowing knights to pay money instead of military service. Danegeld was a reactive, external protection tax, often irregular and crisis-driven, whereas scutage functioned as a systematic substitute for feudal military obligations, enabling lords to raise funds for professional armies. The key difference lies in danegeld's defensive nature against invasions compared to scutage's role in supporting the lord's military campaigns through flexible financial contributions.

Legacy and Decline of Medieval Taxation

Danegeld and scutage represent key medieval taxation systems, with Danegeld originating as a land tax to fund defense against Viking incursions, while scutage evolved as a monetary payment replacing military service owed by feudal tenants. The legacy of these taxes illustrates the gradual shift from in-kind obligations to standardized monetary levies, reflecting broader economic centralization and administrative development in medieval England. Decline in their use emerged as monarchs gained alternative revenue sources and military reforms reduced reliance on feudal levies, signaling a transformation in medieval fiscal and military frameworks.

Danegeld Infographic

libterm.com

libterm.com