The Commerce Clause grants Congress the power to regulate trade among the states, with foreign nations, and with Native American tribes, serving as a critical foundation for federal economic authority. This constitutional provision shapes laws affecting businesses, interstate commerce, and the national economy, influencing landmark Supreme Court decisions. Discover how the Commerce Clause impacts Your rights and the modern legal landscape in the rest of this article.

Table of Comparison

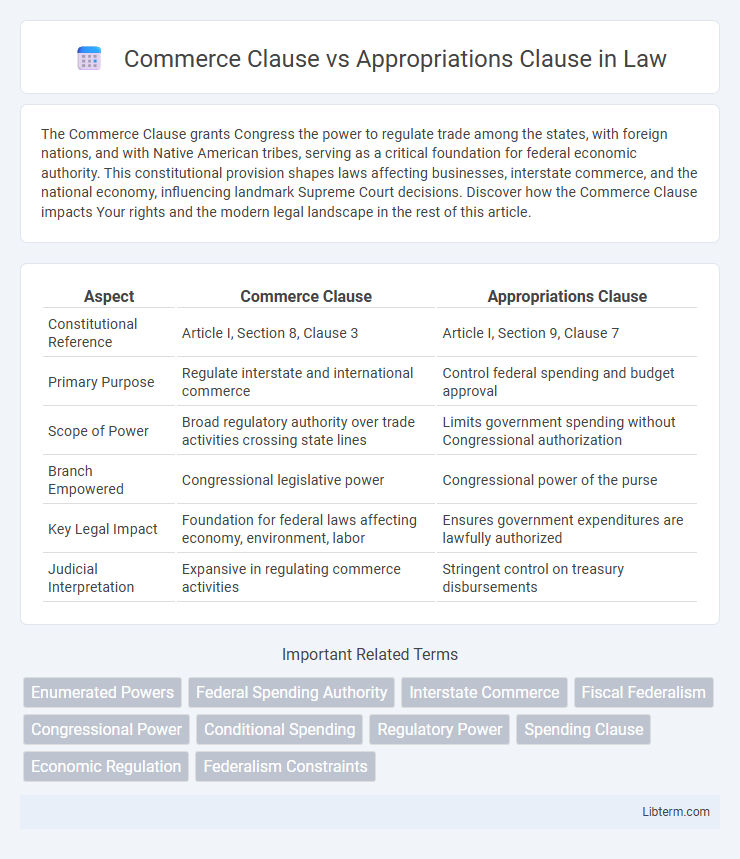

| Aspect | Commerce Clause | Appropriations Clause |

|---|---|---|

| Constitutional Reference | Article I, Section 8, Clause 3 | Article I, Section 9, Clause 7 |

| Primary Purpose | Regulate interstate and international commerce | Control federal spending and budget approval |

| Scope of Power | Broad regulatory authority over trade activities crossing state lines | Limits government spending without Congressional authorization |

| Branch Empowered | Congressional legislative power | Congressional power of the purse |

| Key Legal Impact | Foundation for federal laws affecting economy, environment, labor | Ensures government expenditures are lawfully authorized |

| Judicial Interpretation | Expansive in regulating commerce activities | Stringent control on treasury disbursements |

Introduction to the Commerce Clause

The Commerce Clause, found in Article I, Section 8, Clause 3 of the U.S. Constitution, grants Congress the power to regulate commerce with foreign nations, among the several states, and with Indian tribes. This clause has been a central basis for federal regulation of economic activities and interstate trade. In contrast, the Appropriations Clause, located in Article I, Section 9, Clause 7, restricts the use of federal funds, requiring that no money be drawn from the Treasury without congressional appropriation.

Overview of the Appropriations Clause

The Appropriations Clause, found in Article I, Section 9, Clause 7 of the U.S. Constitution, grants Congress the exclusive power to allocate federal funds for government operations. It ensures that no money can be drawn from the Treasury without explicit legislative approval, reinforcing Congressional control over federal expenditures. This clause acts as a critical check on the executive branch, preventing unauthorized spending and maintaining the constitutional balance of powers.

Historical Origins and Constitutional Placement

The Commerce Clause, found in Article I, Section 8, Clause 3 of the U.S. Constitution, was established to grant Congress the power to regulate interstate commerce, reflecting the founders' intent to create a unified national economy after the economic conflicts under the Articles of Confederation. The Appropriations Clause, located in Article I, Section 9, Clause 7, restricts Congress to spend money only as appropriated by law, ensuring legislative control over federal expenditures as a safeguard against executive fiscal overreach. Both clauses illustrate the framers' balance of power principles, with the Commerce Clause expanding federal regulatory authority and the Appropriations Clause reinforcing congressional budgetary oversight.

Key Powers Granted by the Commerce Clause

The Commerce Clause grants Congress the power to regulate interstate and foreign commerce, enabling federal authority over trade activities that cross state lines or affect multiple states. This power includes regulating transportation, communication, and economic activities that substantially impact the national economy. In contrast, the Appropriations Clause specifically empowers Congress to control federal spending and allocate funds, rather than regulating commercial activity.

Authority Established by the Appropriations Clause

The Appropriations Clause grants Congress the exclusive power to control federal expenditures by mandating that no money can be drawn from the Treasury without congressional authorization, thereby establishing a fundamental check on executive spending. This authority ensures that federal funds are allocated according to legislative priorities, contrasting with the Commerce Clause, which primarily empowers Congress to regulate interstate commerce. The Appropriations Clause thus provides a critical mechanism for congressional oversight and fiscal governance within the federal government.

Significant Supreme Court Decisions: Commerce Clause

Significant Supreme Court decisions on the Commerce Clause include Gibbons v. Ogden (1824), which established broad federal power to regulate interstate commerce, and Wickard v. Filburn (1942), which expanded this authority to include intrastate activities affecting interstate markets. United States v. Lopez (1995) marked a limitation, ruling that Congress exceeded its Commerce Clause powers by regulating gun possession near schools. These rulings illustrate the evolving interpretation of congressional authority under the Commerce Clause, balancing federal and state powers.

Major Judicial Interpretations: Appropriations Clause

Major judicial interpretations of the Appropriations Clause primarily emphasize congressional authority over federal spending, ensuring that no money can be drawn from the Treasury without explicit legislative approval. Courts have upheld this clause to maintain a strict separation of powers, preventing executive overreach in budgetary matters. Landmark cases such as *The Antelope* and *Office of Personnel Management v. Richmond* reinforce Congress's exclusive control over public funds, validating appropriations as a critical check on governmental fiscal authority.

Points of Conflict and Overlap

The Commerce Clause grants Congress the power to regulate interstate commerce, often leading to broad federal authority over economic activities, while the Appropriations Clause restricts Congress to spending only through legally enacted appropriations. Conflict arises when Congress attempts to regulate commerce through funding conditions or when executive agencies bypass appropriations by using regulatory power. Overlap occurs as both clauses influence Congressional control over federal spending and policy implementation, shaping the balance between legislative and executive branches.

Modern Implications for Federal Power

The Commerce Clause grants Congress broad authority to regulate interstate commerce, enabling expansive federal legislation affecting economic activities across state lines. The Appropriations Clause constrains federal spending by requiring congressional approval of budget allocations, serving as a critical check on executive power. Modern implications reveal ongoing tensions where the Commerce Clause often justifies regulatory reach, while the Appropriations Clause limits spending scope, shaping federal power balance in policy enforcement.

Conclusion: Comparing Their Constitutional Roles

The Commerce Clause empowers Congress to regulate interstate commerce, promoting economic unity and preventing trade barriers among states. The Appropriations Clause restricts Congress's power by requiring legislative approval for government spending, ensuring fiscal accountability and separation of powers. Together, these clauses balance federal authority over economic regulation with constitutional control over budgetary expenditures.

Commerce Clause Infographic

libterm.com

libterm.com