The Securities Act of 1933 establishes essential regulations for the registration and sale of securities to protect investors from fraud. It mandates full disclosure of important financial information to ensure transparency in the initial offerings of stocks and bonds. Explore this article to understand how the Act impacts your investments and the securities market.

Table of Comparison

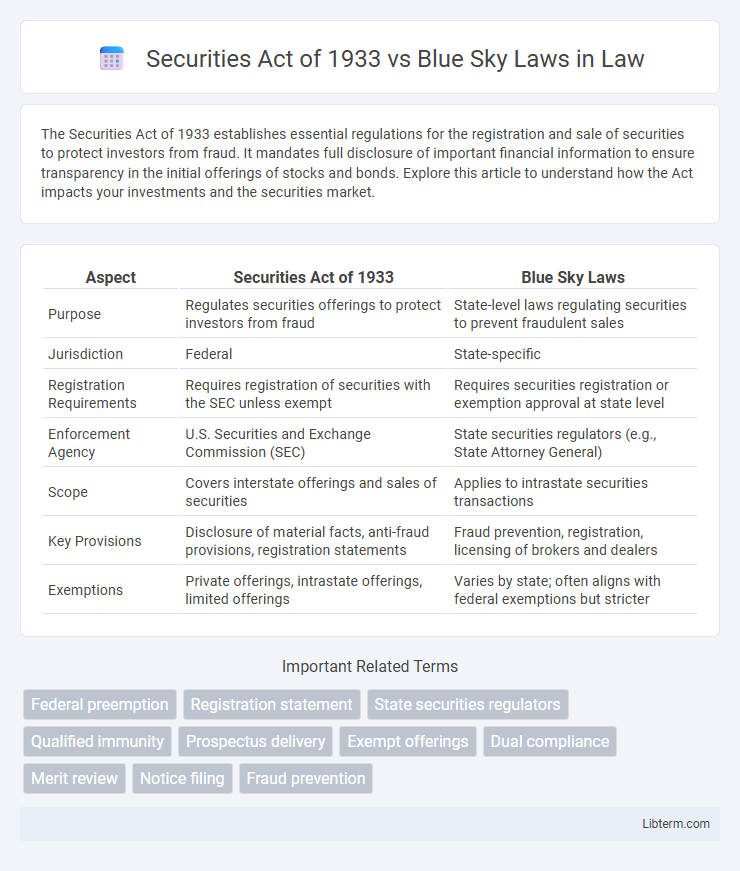

| Aspect | Securities Act of 1933 | Blue Sky Laws |

|---|---|---|

| Purpose | Regulates securities offerings to protect investors from fraud | State-level laws regulating securities to prevent fraudulent sales |

| Jurisdiction | Federal | State-specific |

| Registration Requirements | Requires registration of securities with the SEC unless exempt | Requires securities registration or exemption approval at state level |

| Enforcement Agency | U.S. Securities and Exchange Commission (SEC) | State securities regulators (e.g., State Attorney General) |

| Scope | Covers interstate offerings and sales of securities | Applies to intrastate securities transactions |

| Key Provisions | Disclosure of material facts, anti-fraud provisions, registration statements | Fraud prevention, registration, licensing of brokers and dealers |

| Exemptions | Private offerings, intrastate offerings, limited offerings | Varies by state; often aligns with federal exemptions but stricter |

Overview of the Securities Act of 1933

The Securities Act of 1933 primarily regulates the initial offering and sale of securities to the public, requiring issuers to register securities with the SEC and provide detailed financial disclosures to protect investors from fraud. This federal law establishes transparency through mandatory prospectus filings, enabling informed investment decisions. In contrast, Blue Sky Laws operate at the state level, aiming to prevent securities fraud within individual states by imposing registration requirements and regulatory oversight tailored to local markets.

Introduction to Blue Sky Laws

Blue Sky Laws are state-level regulations designed to protect investors from fraudulent securities offerings and sales by requiring registration and disclosure before securities can be sold. Unlike the Securities Act of 1933, which is a federal law focused on full disclosure and preventing fraud in interstate securities transactions, Blue Sky Laws vary by state and often include more stringent provisions tailored to local investor protection. These laws aim to ensure transparency and prevent deceptive practices within state markets, complementing the federal framework established by the Securities Act of 1933.

Historical Context: Federal vs. State Regulation

The Securities Act of 1933 marked the first significant federal legislation aimed at regulating the securities market to prevent fraud and ensure investor transparency after the 1929 stock market crash. Blue Sky Laws, predating the federal act, were state-level regulations designed to protect investors from fraudulent securities within individual states. The historical context highlights a shift from fragmented state oversight under Blue Sky Laws to a unified federal framework with the Securities Act, establishing comprehensive disclosure requirements and centralized regulatory authority.

Key Provisions of the Securities Act of 1933

The Securities Act of 1933 primarily mandates the registration of securities with the SEC to ensure transparency and prevent fraud in public offerings. It requires issuers to provide detailed financial statements and disclosures, enabling investors to make informed decisions. Unlike Blue Sky Laws, which are state-level regulations focused on preventing securities fraud within individual states, the 1933 Act establishes a uniform federal framework governing interstate securities transactions.

Major Requirements of Blue Sky Laws

Blue Sky Laws require issuers to register securities offerings and provide full disclosure to protect investors from fraud at the state level, often mandating detailed financial statements and background checks of company officers. These laws aim to prevent fraudulent sales practices and ensure transparency through state-specific registration and reporting requirements before securities can be offered or sold within the state. The Securities Act of 1933, in contrast, establishes federal registration and disclosure standards, but Blue Sky Laws impose additional compliance layers tailored to individual state regulations.

Registration Processes Compared

The Securities Act of 1933 mandates federal registration for securities offerings, requiring detailed disclosures to the Securities and Exchange Commission (SEC) to protect investors. Blue Sky Laws operate at the state level, imposing additional registration requirements that vary by state and often include merit-based reviews of the securities' legitimacy. While the 1933 Act creates a uniform federal standard, Blue Sky Laws typically demand separate registration, creating a dual-layered compliance framework for issuers.

Exemptions and Exclusions: Federal vs. State

The Securities Act of 1933 provides federal exemptions such as Regulation D, which includes Rule 506 allowing private placements without full registration, while Blue Sky Laws vary by state with differing exemption criteria often tailored to state-specific investor protections. Federal exemptions generally preempt state registration but do not exempt issuers from state anti-fraud provisions under Blue Sky Laws. State exclusions frequently address intrastate offerings and small, local transactions that federal law may not cover, resulting in dual compliance requirements for certain securities offerings.

Enforcement Mechanisms and Penalties

The Securities Act of 1933 enforces compliance through federal mechanisms such as registration requirements, disclosure obligations, and allows the Securities and Exchange Commission (SEC) to impose fines, injunctions, and criminal charges for violations. Blue Sky Laws, enforced at the state level, require registration of securities offerings and brokers, with state securities regulators possessing authority to suspend or revoke licenses, issue cease-and-desist orders, and impose civil penalties. Both frameworks aim to protect investors, but federal enforcement under the Securities Act is typically broader in scope and can include harsher penalties compared to the more localized and variable enforcement actions under Blue Sky Laws.

Impact on Issuers and Investors

The Securities Act of 1933 established federal registration requirements to ensure issuers disclose accurate information, enhancing transparency and protecting investors from fraud in interstate offerings. Blue Sky Laws, enforced at the state level, impose additional registration and anti-fraud provisions that vary by jurisdiction, potentially increasing compliance costs and legal complexity for issuers. Together, these regulations provide a dual-layered safeguard for investors by promoting disclosure and preventing deceptive practices, while requiring issuers to navigate both federal and state regulatory landscapes.

Harmonization and Ongoing Challenges

The Securities Act of 1933 establishes federal standards for the registration and disclosure of securities to protect investors, while Blue Sky Laws impose state-level regulations that vary widely. Harmonization efforts aim to align these frameworks by promoting uniform disclosure requirements and streamlining registration processes to reduce regulatory duplication and compliance costs. Ongoing challenges include managing jurisdictional overlaps, addressing inconsistencies in state enforcement, and adapting to emerging securities technologies that outpace current regulatory models.

Securities Act of 1933 Infographic

libterm.com

libterm.com