Subrogation allows an insurer to pursue a third party responsible for a loss after compensating the insured, ensuring cost recovery and preventing unjust enrichment. This legal mechanism is vital for maintaining fairness in insurance claims and reducing premium costs over time. Discover how subrogation impacts your claims and protects your financial interests by reading the full article.

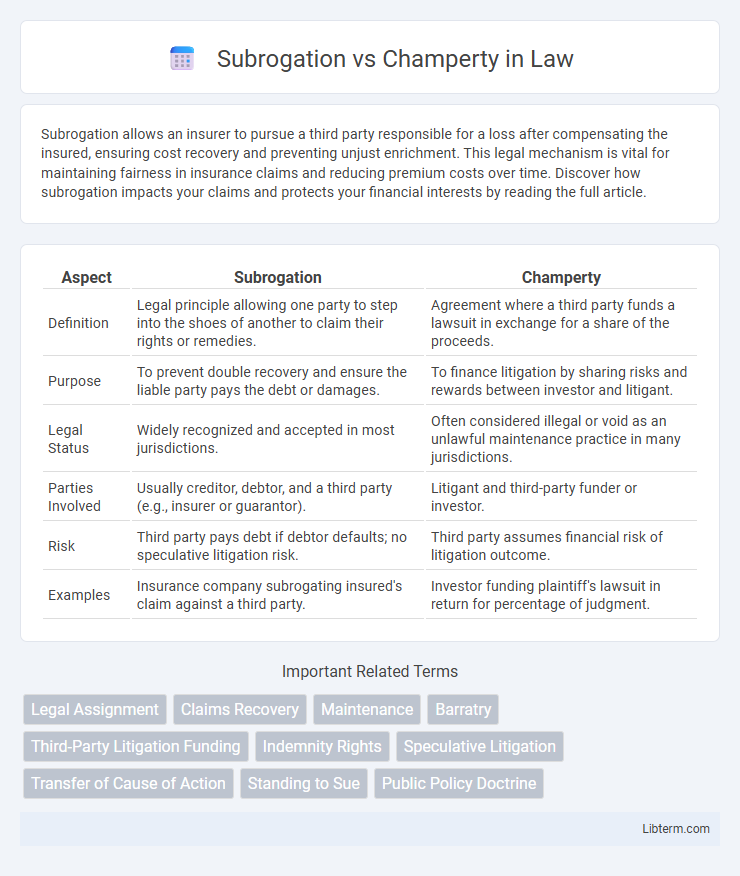

Table of Comparison

| Aspect | Subrogation | Champerty |

|---|---|---|

| Definition | Legal principle allowing one party to step into the shoes of another to claim their rights or remedies. | Agreement where a third party funds a lawsuit in exchange for a share of the proceeds. |

| Purpose | To prevent double recovery and ensure the liable party pays the debt or damages. | To finance litigation by sharing risks and rewards between investor and litigant. |

| Legal Status | Widely recognized and accepted in most jurisdictions. | Often considered illegal or void as an unlawful maintenance practice in many jurisdictions. |

| Parties Involved | Usually creditor, debtor, and a third party (e.g., insurer or guarantor). | Litigant and third-party funder or investor. |

| Risk | Third party pays debt if debtor defaults; no speculative litigation risk. | Third party assumes financial risk of litigation outcome. |

| Examples | Insurance company subrogating insured's claim against a third party. | Investor funding plaintiff's lawsuit in return for percentage of judgment. |

Understanding Subrogation: Definition and Scope

Subrogation is a legal principle allowing an insurer to step into the shoes of the insured to recover costs from a third party responsible for loss or damage. It ensures that the party causing harm ultimately bears the financial burden, preventing unjust enrichment of the insured. The scope of subrogation typically covers contractual claims and tort liabilities, enabling insurers to reclaim payments made under policy terms.

Champerty Explained: Meaning and Legal Implications

Champerty is a legal agreement where a third party funds a plaintiff's lawsuit in exchange for a share of the judgment or settlement, often raising ethical and legal concerns about promoting litigation for profit. This practice is regulated or prohibited in many jurisdictions due to its potential to encourage frivolous lawsuits and interfere with justice administration. Understanding champerty's legal implications helps parties assess the risks of third-party litigation funding and ensures compliance with relevant laws.

Historical Background of Subrogation and Champerty

Subrogation traces its roots to Roman law, where creditors assumed the rights of debtors to recover debts, evolving through English common law to protect parties paying debts on behalf of others. Champerty emerged in medieval England as part of common law prohibitions against third parties funding litigation in exchange for a share of the proceeds, aiming to prevent frivolous lawsuits and maintain judicial integrity. Both doctrines reflect centuries-old legal principles shaping modern dispute resolution and financial liability frameworks.

Key Differences Between Subrogation and Champerty

Subrogation allows a third party, typically an insurer, to step into the shoes of the insured to recover losses from a liable party, while champerty involves an agreement where a party with no prior interest finances litigation in exchange for a share of the judgment. Key differences include the legal permissibility: subrogation is a recognized legal principle facilitating loss recovery, whereas champerty is often prohibited or regulated as it may encourage frivolous lawsuits. Subrogation transfers rights to pursue claims for reimbursement, contrasting with champerty's speculative investment in litigation without any underlying right.

Legal Principles Governing Subrogation

The legal principles governing subrogation establish that a third party who pays a debt or claim is entitled to enforce the rights of the original creditor to recover the amount paid, ensuring equitable reimbursement. Subrogation is rooted in preventing unjust enrichment and is often applied in insurance claims, mortgage payments, and suretyship agreements. Unlike champerty, which involves improper litigation financing and is generally prohibited, subrogation serves to uphold fairness and financial responsibility within legal and contractual relationships.

The Legal Status of Champerty in Modern Jurisdictions

Champerty remains largely prohibited or heavily restricted in many modern jurisdictions due to its potential to encourage frivolous litigation and third-party interference in lawsuits. Courts typically view champerty as an unlawful maintenance agreement where a third party funds litigation in exchange for a portion of the judgment, creating conflicts of interest and ethical concerns. However, some jurisdictions have relaxed these rules under regulated frameworks, allowing third-party litigation funding with specific safeguards to prevent abuse and protect the integrity of the legal process.

Advantages and Disadvantages of Subrogation

Subrogation allows an insurer to step into the shoes of the insured to recover costs from a third party, providing financial relief and promoting fairness by ensuring the responsible party pays. Advantages include reducing insurance premiums through cost recovery and preventing insured parties from receiving double compensation. Disadvantages involve potential delays in claim settlement and conflicts between insurers and insureds over control of the recovery process.

Risks and Controversies Surrounding Champerty

Champerty involves a third party funding litigation in exchange for a share of the proceeds, raising significant ethical and legal risks such as the potential for frivolous lawsuits and conflicts of interest. Courts often scrutinize champerty due to its association with encouraging speculative claims and undermining the integrity of the judicial process. Unlike subrogation, which is widely accepted in insurance contexts, champerty remains controversial and is restricted or prohibited in many jurisdictions due to concerns about its impact on fair legal proceedings.

Landmark Cases: Subrogation vs Champerty

Landmark cases such as *Archer v. Hyde* (1844) clarified the distinction between subrogation, where a party legally steps into the shoes of another to enforce a right, and champerty, which involves an agreement to share litigation proceeds and is often deemed illegal. In *Dillwyn v. Llewelyn* (1862), the court upheld subrogation rights, emphasizing its role in preventing unjust enrichment, while distinguishing it from champerty's prohibitive nature. These cases establish the legal framework separating legitimate subrogation from impermissible champerty in common law.

Practical Implications for Insurers, Litigants, and Lawyers

Subrogation enables insurers to recover costs by stepping into the insured's shoes to pursue third parties responsible for a loss, thus minimizing financial exposure and encouraging efficient claims management. Champerty, the unlawful practice of third parties funding litigation for a share of the proceeds, threatens ethical boundaries and can lead to invalidated claims, complicating legal strategies for litigants and lawyers. Insurers benefit from clear subrogation rights to recoup expenses, while litigants and lawyers must navigate champerty laws carefully to avoid sanctions and ensure legitimate funding of cases.

Subrogation Infographic

libterm.com

libterm.com