A representative action allows one or more individuals to bring a lawsuit on behalf of a larger group with similar claims, streamlining the legal process and ensuring consistent outcomes. It protects your rights by consolidating multiple cases into one efficient proceeding, often seen in consumer protection, employment, and securities law. Discover how representative actions can support your interests and what you need to know to navigate this legal tool effectively in the rest of the article.

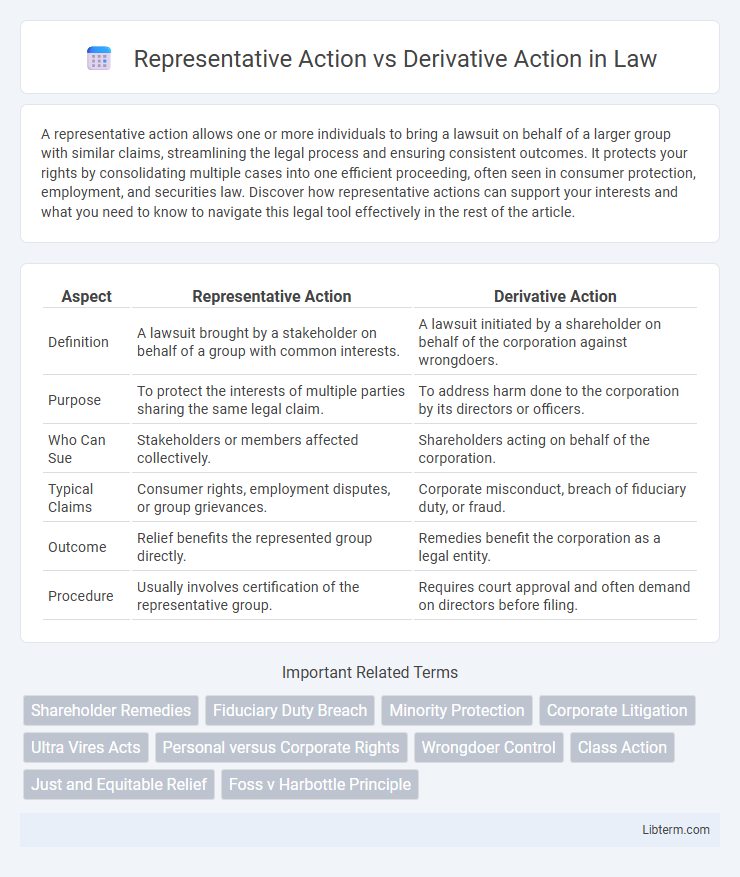

Table of Comparison

| Aspect | Representative Action | Derivative Action |

|---|---|---|

| Definition | A lawsuit brought by a stakeholder on behalf of a group with common interests. | A lawsuit initiated by a shareholder on behalf of the corporation against wrongdoers. |

| Purpose | To protect the interests of multiple parties sharing the same legal claim. | To address harm done to the corporation by its directors or officers. |

| Who Can Sue | Stakeholders or members affected collectively. | Shareholders acting on behalf of the corporation. |

| Typical Claims | Consumer rights, employment disputes, or group grievances. | Corporate misconduct, breach of fiduciary duty, or fraud. |

| Outcome | Relief benefits the represented group directly. | Remedies benefit the corporation as a legal entity. |

| Procedure | Usually involves certification of the representative group. | Requires court approval and often demand on directors before filing. |

Introduction to Representative and Derivative Actions

Representative actions allow one or more individuals to file a lawsuit on behalf of a larger group with common interests, streamlining legal processes and reducing duplicative litigation. Derivative actions are legal claims brought by shareholders on behalf of a corporation, targeting wrongdoings by directors or officers that harm the company. Understanding the distinct purposes and procedural requirements of representative and derivative actions is crucial for effectively addressing collective legal rights and corporate governance issues.

Definition of Representative Action

Representative action is a legal procedure allowing a single plaintiff to sue on behalf of themselves and a larger group with common interests, typically used in consumer protection or class action lawsuits. This mechanism consolidates numerous similar claims into one court process to improve efficiency and consistency in verdicts. Unlike derivative actions, which are brought by shareholders on behalf of a corporation, representative actions address collective grievances of individuals directly affected by the defendant's conduct.

Definition of Derivative Action

Derivative action is a legal mechanism allowing shareholders to sue on behalf of the corporation, typically against directors or officers for breach of fiduciary duty or mismanagement, when the corporation itself fails to take action. This type of lawsuit enables shareholders to address harm to the company's interests that is ignored by its leadership. Unlike representative action, which involves suing for the individual interests of shareholders, derivative actions aim to protect the corporation as a whole.

Legal Basis and Framework

Representative action is governed by procedural rules allowing one or more plaintiffs to sue on behalf of a larger group sharing common legal claims, often codified in civil procedure codes such as Rule 23 of the Federal Rules of Civil Procedure in the U.S. Derivative action, rooted in corporate law principles, permits shareholders to initiate lawsuits on behalf of the corporation against insiders, based on statutes like the Delaware General Corporation Law Section 327. Both actions serve different purposes: representative actions address collective rights of individuals, while derivative actions protect corporate interests from managerial misconduct within established legal frameworks.

Key Differences Between Representative and Derivative Actions

Representative actions involve a party suing on behalf of a group with similar claims, primarily to consolidate individual claims into one lawsuit, whereas derivative actions are initiated by shareholders on behalf of the corporation to address wrongs committed against the company. In derivative actions, any recovery belongs to the corporation, while in representative actions, recoveries directly benefit the individual members of the represented group. Key differences include the plaintiff's capacity, the nature of the claim, and the allocation of damages awarded.

Eligibility and Standing to Sue

Representative actions allow a plaintiff to sue on behalf of a larger group with common interests, typically requiring the plaintiff to be a member of the group or class affected by the harm. Derivative actions enable shareholders to initiate lawsuits on behalf of a corporation, demanding that the shareholder has standing by proving ownership of shares at the time of the wrong and that the corporation itself has not taken appropriate legal action. Eligibility for representative actions focuses on group membership and commonality, while standing for derivative actions hinges on shareholder status and the need to address corporate wrongs when management fails to act.

Typical Scenarios for Each Action

Representative action typically arises in scenarios involving consumer protection, where a group of affected individuals collectively sues a defendant for similar grievances, such as defective products or fraudulent practices. Derivative action is common in corporate governance disputes, where shareholders initiate a lawsuit on behalf of the corporation against directors or officers for breaches of fiduciary duty or mismanagement harming the company. Both actions serve distinct purposes, with representative actions addressing public or group harms and derivative actions protecting corporate interests from internal misconduct.

Procedure and Requirements

Representative actions require the plaintiff to demonstrate commonality of legal interests among the group and typically involve filing a complaint on behalf of all members, with court approval needed before proceeding. Derivative actions must establish that the plaintiff is a shareholder at the time of the alleged wrong, has made a demand on the board to address the issue, or show demand futility, and the court scrutinizes the adequacy of representation and the best interest of the corporation. Procedural differences include that representative actions focus on collective relief for individual claims, while derivative actions seek remedy for harm done to the corporation, necessitating distinct legal standing and procedural safeguards.

Remedies and Outcomes

Representative action allows a shareholder to sue on behalf of others in cases where individual claims share common issues, often resulting in remedies like injunctions or damages distributed to all affected parties. Derivative action enables shareholders to pursue claims directly against corporate insiders for breaches of fiduciary duty, with awarded remedies typically benefiting the corporation rather than individual shareholders. Outcomes of representative actions focus on collective relief for the group, whereas derivative actions emphasize corporate governance reform and compensation to the company.

Comparative Advantages and Limitations

Representative actions allow a plaintiff to sue on behalf of a group with common claims, enabling efficient resolution of widespread harm while minimizing court congestion, but may limit individual control over the lawsuit and the recovery distribution. Derivative actions empower shareholders to enforce rights on behalf of the corporation, addressing internal wrongs directly and protecting corporate interests, yet often involve stricter procedural requirements and potential personal liability for litigation costs. Representative actions excel in collective claims management, whereas derivative actions are more effective for corporate governance enforcement, each facing unique procedural and strategic constraints.

Representative Action Infographic

libterm.com

libterm.com