A personal representative is an individual appointed to manage and settle a deceased person's estate, ensuring debts are paid and assets distributed according to the will or state law. This role involves navigating complex legal and financial responsibilities, including inventorying assets, paying taxes, and handling claims against the estate. Discover how understanding the duties and challenges of a personal representative can help you efficiently manage your loved one's estate by reading the full article.

Table of Comparison

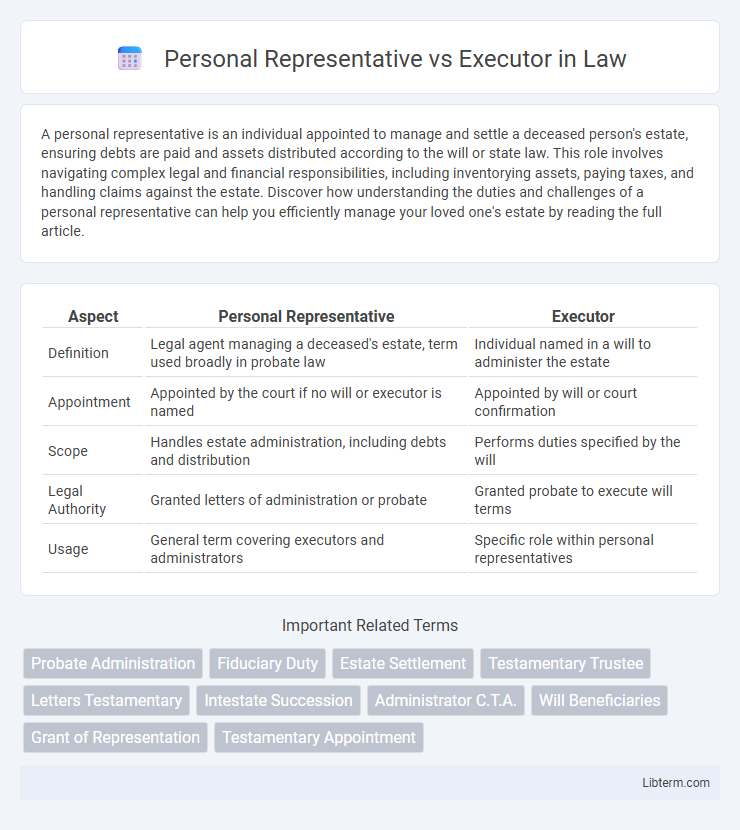

| Aspect | Personal Representative | Executor |

|---|---|---|

| Definition | Legal agent managing a deceased's estate, term used broadly in probate law | Individual named in a will to administer the estate |

| Appointment | Appointed by the court if no will or executor is named | Appointed by will or court confirmation |

| Scope | Handles estate administration, including debts and distribution | Performs duties specified by the will |

| Legal Authority | Granted letters of administration or probate | Granted probate to execute will terms |

| Usage | General term covering executors and administrators | Specific role within personal representatives |

Introduction to Personal Representatives and Executors

A Personal Representative is a general term referring to the individual appointed to administer a deceased person's estate, encompassing roles such as executors and administrators. An Executor is a specific type of Personal Representative named in a will to manage the probate process according to the deceased's wishes. Understanding these roles is essential for navigating estate settlement, as each carries distinct legal responsibilities in managing assets and distributing inheritances.

Defining the Roles: Personal Representative vs Executor

A personal representative is a broad legal term referring to the individual appointed by the court to manage and distribute a deceased person's estate, encompassing both executors and administrators. An executor specifically is a personal representative named in a will to carry out the decedent's wishes as detailed in the will. Understanding the difference hinges on whether the individual is appointed through a will (executor) or by the court in the absence of a will (administrator, also a type of personal representative).

Legal Responsibilities of a Personal Representative

A Personal Representative holds the legal authority to manage and settle a deceased person's estate according to the will or state law if no will exists, ensuring debts are paid and assets distributed properly. This role includes filing necessary documents with probate courts, managing estate assets, and safeguarding heirs' interests while adhering to fiduciary duties. Unlike an Executor specifically named in a will, a Personal Representative may be court-appointed when no executor is designated, but both carry similar legal responsibilities in estate administration.

Key Duties of an Executor

An executor is responsible for managing the deceased's estate by validating the will, inventorying assets, paying debts and taxes, and distributing remaining property to beneficiaries according to the will's terms. Key duties include filing the will with the probate court, obtaining a grant of probate, and handling all legal and financial obligations related to the estate settlement. Executors must also communicate regularly with beneficiaries and keep detailed records throughout the administration process.

Appointment Process: How Each Role Is Assigned

The appointment process for a personal representative typically involves the probate court officially designating an individual to administer the estate, often following the decedent's will or state intestacy laws if no will exists. An executor is specifically named in the decedent's will and is formally confirmed by the court during probate proceedings. Both roles require court approval, but executors are chosen by the testator beforehand, whereas personal representatives may be appointed by the court when no executor is designated.

Differences in Authority and Jurisdiction

A Personal Representative holds broader authority and jurisdiction, often managing estates under both probate and non-probate contexts, including administering assets outside of a will. An Executor's authority is typically limited to executing the terms expressly stated within a valid will and operates strictly within probate court jurisdiction. The Personal Representative's role adapts to state-specific laws, sometimes encompassing administrators or trustees, whereas the Executor's role is tied directly to fulfilling the decedent's testamentary intentions.

State-Specific Terminology and Variations

Personal Representative and Executor are terms used to describe the individual responsible for managing a deceased person's estate, but terminology varies by state law. In states following common law, "Executor" is commonly used when a will exists, while "Personal Representative" is a broader term applied in probate cases with or without a will. Some states, such as California and Texas, exclusively use "Personal Representative," reflecting local probate codes and emphasizing legal uniformity despite functional similarities.

Potential Conflicts and Legal Implications

Potential conflicts between a Personal Representative and an Executor often arise from unclear roles or disagreements among beneficiaries, leading to disputes over asset distribution and estate management. Legal implications include challenges to the validity of the will, liability for breach of fiduciary duty, and possible court intervention to resolve conflicts or remove the representative. Understanding the distinctions between these roles and maintaining transparent communication can mitigate risks and ensure adherence to probate laws.

Choosing the Right Person for Your Estate

Choosing the right person for your estate involves understanding the roles of a Personal Representative and an Executor, as both manage estate distribution but differ based on jurisdiction and legal terminology. A Personal Representative is often appointed by a court in intestate cases or where no will exists, whereas an Executor is named in a will to carry out the decedent's wishes. Selecting a trustworthy, organized individual familiar with legal and financial matters ensures efficient estate administration and reduces potential conflicts among beneficiaries.

Conclusion: Personal Representative or Executor—Which Is Right for You?

Choosing between a personal representative and an executor depends on the estate administration context and jurisdiction. An executor is typically named in a will and handles estate distribution according to its terms, while a personal representative may be appointed by a probate court if no will exists or if the named executor is unable to serve. Understanding your specific legal responsibilities and the probate process in your state ensures you select the role that best suits your or your loved one's estate needs.

Personal Representative Infographic

libterm.com

libterm.com