A life estate grants an individual the right to use and benefit from a property for the duration of their life, after which ownership passes to another designated party. This arrangement can protect your interests by outlining clear terms for property use and inheritance. Explore the rest of the article to understand how a life estate might impact your estate planning decisions.

Table of Comparison

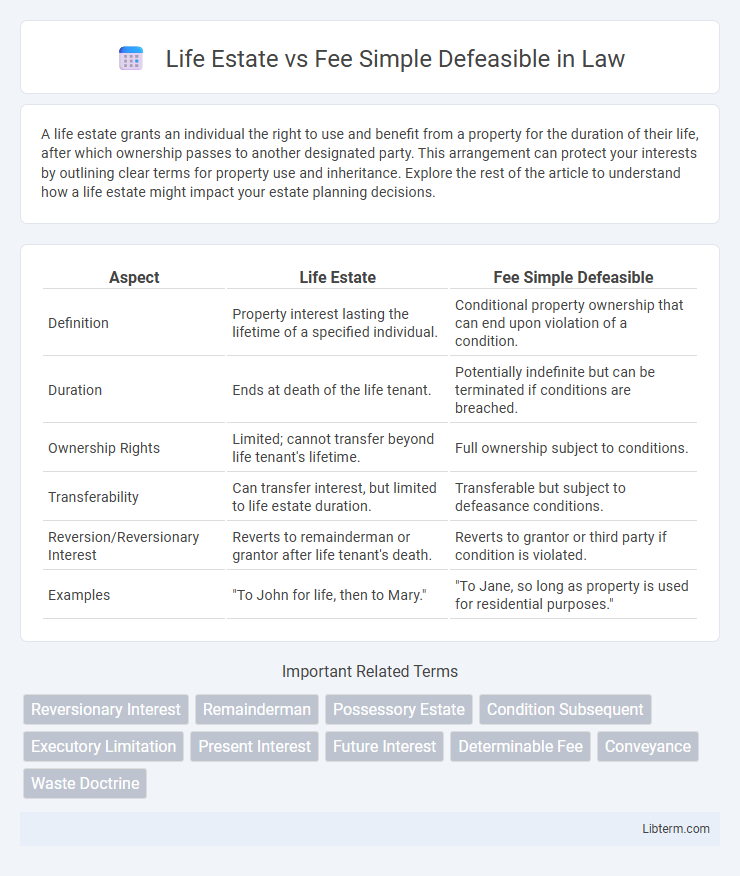

| Aspect | Life Estate | Fee Simple Defeasible |

|---|---|---|

| Definition | Property interest lasting the lifetime of a specified individual. | Conditional property ownership that can end upon violation of a condition. |

| Duration | Ends at death of the life tenant. | Potentially indefinite but can be terminated if conditions are breached. |

| Ownership Rights | Limited; cannot transfer beyond life tenant's lifetime. | Full ownership subject to conditions. |

| Transferability | Can transfer interest, but limited to life estate duration. | Transferable but subject to defeasance conditions. |

| Reversion/Reversionary Interest | Reverts to remainderman or grantor after life tenant's death. | Reverts to grantor or third party if condition is violated. |

| Examples | "To John for life, then to Mary." | "To Jane, so long as property is used for residential purposes." |

Understanding Life Estate and Fee Simple Defeasible

Life Estate grants ownership rights for the duration of a person's life, after which the property passes to a designated remainderman, limiting control and transferability during the life tenant's tenure. Fee Simple Defeasible provides ownership subject to specific conditions or restrictions, which, if violated, can result in automatic forfeiture or reversion of the property to the grantor or heirs. Understanding the distinctions between Life Estate and Fee Simple Defeasible is essential for estate planning, as they affect property rights, inheritance, and potential legal obligations.

Key Legal Definitions

A life estate grants ownership rights to an individual for the duration of their lifetime, after which the property passes to a designated remainderman or reverts to the grantor. Fee simple defeasible is a conditional ownership interest that may be terminated if specific conditions are violated or not met, causing the property to revert to the original owner or a third party. Key legal distinctions include the duration of ownership--life estate being limited to lifespan, while fee simple defeasible remains until a condition breaches--and the presence of future interests, such as remainders or reversions.

Creation and Establishment

Life estates are created through explicit language in a deed or will, granting ownership interest lasting for the duration of a specified person's life, typically the life tenant. Fee simple defeasible estates are established by conveying property with conditional phrases such as "so long as" or "until," which impose restrictions or conditions that may lead to termination of ownership upon violation. Both forms require clear documentation to define the scope and duration of the estate, with life estates emphasizing lifetime possession and fee simple defeasible focusing on conditional limitations.

Rights and Responsibilities of Property Holders

Life estate holders have the right to use and occupy the property during their lifetime but must maintain it without committing waste or damage. Fee simple defeasible owners hold full ownership rights subject to conditions; if violated, ownership may revert to the grantor or a third party. Responsibilities for fee simple defeasible include adherence to stipulated conditions, while life estate holders focus on preserving the property's value for future interest holders.

Duration and Termination Conditions

A life estate grants ownership rights limited to the duration of a specified person's life, terminating automatically upon that person's death. Fee simple defeasible provides ownership rights with the potential for forfeiture if a specific condition is violated or a triggering event occurs. The key distinction lies in the life estate's fixed duration tied to life, whereas fee simple defeasible's duration is potentially indefinite but subject to conditional termination.

Transferability and Alienation

A Life Estate grants ownership for the duration of a person's life, limiting transferability since the interest terminates upon the life tenant's death and reverts to the remainderman or grantor. Fee Simple Defeasible allows ownership that can be terminated if a specific condition is violated, offering more flexible alienation but with the risk of automatic forfeiture. Unlike Life Estates, Fee Simple Defeasible interests can be sold or transferred freely during ownership, though subject to the condition's enforcement.

Common Uses and Examples

Life estates commonly grant property use to an individual for their lifetime, often used in estate planning to provide for a surviving spouse while preserving the remainder interest for heirs. Fee simple defeasible estates include conditions that can cause the property to revert or transfer upon violation, frequently employed in land use restrictions or charitable donations with reversion clauses. Typical examples of life estates involve a widow living in the family home until death, whereas fee simple defeasible occurs when granting land for educational purposes with strict conditions attached.

Advantages and Disadvantages

Life estate grants property rights limited to the duration of an individual's life, offering advantages such as retaining control during the lifetime and avoiding probate, but disadvantages include limited transferability and potential property depreciation after the life tenant's death. Fee simple defeasible provides ownership subject to specific conditions, allowing for automatic reversion if conditions are violated, which benefits owners by maintaining property use restrictions but risks losing ownership unexpectedly. Both estate types present unique implications for control, transferability, and inheritance, requiring careful consideration in estate planning and property management.

Legal Considerations and Pitfalls

Life estates grant ownership for the duration of an individual's life, reverting the property to a remainderman upon death, limiting the current holder's ability to sell or mortgage the property freely. Fee simple defeasible provides ownership with conditions that, if violated, result in automatic forfeiture or reversion, creating potential complexities in enforcement and unclear title issues. Legal pitfalls include ensuring precise drafting to avoid unintended loss of ownership rights and understanding restrictions on transferability and future interests tied to each estate type.

Choosing the Right Estate Type

Choosing between a life estate and a fee simple defeasible hinges on the desired level of control and duration of property interest. A life estate grants possession and use for the lifetime of a specified individual, reverting to another party afterward, ideal for estate planning to provide for loved ones without transferring full ownership. Fee simple defeasible offers ownership that can be lost upon violation of specified conditions, suitable for property owners seeking to enforce use restrictions or reversion upon breach, balancing ownership rights with conditional limitations.

Life Estate Infographic

libterm.com

libterm.com