Interpleader is a legal procedure that allows a party holding property or funds to compel multiple claimants to litigate their conflicting claims, preventing double liability. This mechanism is commonly used in insurance, escrow, and trust disputes to ensure a fair resolution without risking multiple payments. Discover how interpleader can protect your interests and simplify complex disputes by reading the full article.

Table of Comparison

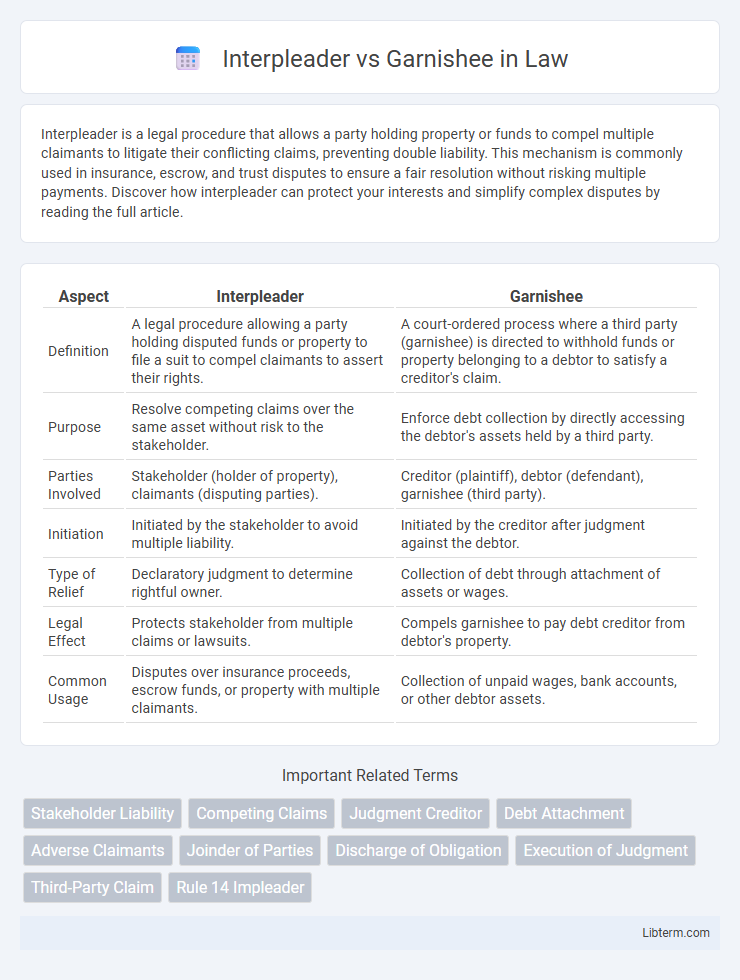

| Aspect | Interpleader | Garnishee |

|---|---|---|

| Definition | A legal procedure allowing a party holding disputed funds or property to file a suit to compel claimants to assert their rights. | A court-ordered process where a third party (garnishee) is directed to withhold funds or property belonging to a debtor to satisfy a creditor's claim. |

| Purpose | Resolve competing claims over the same asset without risk to the stakeholder. | Enforce debt collection by directly accessing the debtor's assets held by a third party. |

| Parties Involved | Stakeholder (holder of property), claimants (disputing parties). | Creditor (plaintiff), debtor (defendant), garnishee (third party). |

| Initiation | Initiated by the stakeholder to avoid multiple liability. | Initiated by the creditor after judgment against the debtor. |

| Type of Relief | Declaratory judgment to determine rightful owner. | Collection of debt through attachment of assets or wages. |

| Legal Effect | Protects stakeholder from multiple claims or lawsuits. | Compels garnishee to pay debt creditor from debtor's property. |

| Common Usage | Disputes over insurance proceeds, escrow funds, or property with multiple claimants. | Collection of unpaid wages, bank accounts, or other debtor assets. |

Introduction to Interpleader and Garnishee

Interpleader is a legal procedure used when multiple parties claim the same property or funds, allowing the holder to initiate a single lawsuit to determine the rightful owner and avoid multiple liabilities. Garnishee involves a court order directing a third party, usually an employer or bank, to withhold and transfer a debtor's funds or wages to satisfy a creditor's claim. Both processes are crucial in resolving disputes over property and debts, with interpleader focusing on competing claims and garnishment targeting debt recovery.

Definition of Interpleader

Interpleader is a legal procedure used to resolve disputes when multiple parties claim rights to the same property or funds held by a third party, known as the stakeholder. This action protects the stakeholder from multiple liabilities by allowing the court to determine the rightful claimant. Garnishee, in contrast, refers to a third party ordered by the court to withhold and pay debts owed by a debtor directly to a creditor.

Definition of Garnishee

Garnishee refers to a third party legally ordered to withhold funds or property belonging to a debtor and pay them directly to a creditor to satisfy a debt. Unlike interpleader, where a neutral party deposits disputed funds with the court to resolve conflicting claims, a garnishee is actively involved in the debt enforcement process. Garnishment is commonly used in wage garnishment or bank account garnishment scenarios where the garnishee holds the debtor's assets.

Purpose and Legal Basis of Interpleader

Interpleader is a legal procedure designed to resolve disputes when multiple parties claim entitlement to the same property or funds held by a neutral third party, preventing the stakeholder from facing multiple liabilities. Its legal basis stems from equity jurisdiction and federal statutes like the Federal Interpleader Act, allowing the stakeholder to initiate a single lawsuit to determine rightful ownership. Garnishee, contrastingly, involves a third party holding assets of a debtor subject to court order for debt repayment, focusing on enforcing a creditor's claim rather than resolving ownership disputes.

Purpose and Legal Basis of Garnishee

Garnishee proceedings serve to satisfy a creditor's claim by directing a third party, usually a bank or employer, to withhold funds owed to the debtor and remit them to the creditor, as authorized under rules of civil procedure and specific garnishment statutes. The legal basis of garnishee is rooted in enabling creditors to access a debtor's assets held by third parties without initiating a separate lawsuit against the third party. Unlike interpleader, which resolves competing claims over the same property, garnishment specifically enforces debt collection through withholding payments directly from debts owed to the debtor.

Key Differences Between Interpleader and Garnishee

Interpleader involves a neutral third party holding disputed property or funds while multiple claimants assert their rights, aiming to resolve conflicting claims in a single legal action. Garnishee refers to a procedure where a creditor seeks to collect a debt by legally seizing assets or wages held by a third party (garnishee) who owes money to the debtor. The key difference lies in interpleader preventing multiple liabilities for the stakeholder by consolidating claims, whereas garnishment directly enforces debt repayment by intercepting debtor's assets from a third party.

Procedures for Filing an Interpleader Action

Filing an interpleader action requires the stakeholder to deposit the disputed funds or property into the court registry and initiate a complaint naming all potential claimants to the asset. The complaint must clearly state the conflicting claims and request the court to determine the rightful owner, thereby protecting the stakeholder from multiple liabilities. Procedural rules may vary by jurisdiction but generally mandate timely service of process to all claimants and compliance with strict jurisdictional requirements to ensure proper resolution.

Steps in Initiating Garnishee Proceedings

Initiating garnishee proceedings begins with the judgment creditor filing a garnishment claim against a third party who holds the debtor's assets, such as an employer or bank. The court issues a garnishment order to the garnishee, mandating the withholding and transfer of the debtor's funds or property to satisfy the outstanding judgment. The garnishee must respond within a specified timeframe, either by acknowledging possession of the debtor's assets or contesting the garnishment.

Real-life Examples: Interpleader vs Garnishee

An interpleader action occurs when a third party, such as an insurance company, holds funds claimed by multiple parties and files a lawsuit to compel claimants to resolve their disputes, as when an insurer receives conflicting beneficiary claims after a policyholder's death. A garnishee proceeding involves a creditor suing a third party, like an employer or bank, who owes money to the debtor, to seize those funds for debt repayment, often seen in wage garnishments for unpaid child support. While interpleader protects the stakeholder from multiple liabilities by determining the rightful claimant, garnishment directly enforces debt collection by diverting the debtor's assets through a legal order.

Conclusion: Choosing the Appropriate Legal Remedy

Choosing between interpleader and garnishee actions depends on the dispute's nature and the parties involved. Interpleader suits efficiently resolve conflicting claims over the same property by allowing the holder to deposit the disputed assets with the court, avoiding multiple liabilities. Garnishee proceedings enable a creditor to directly seize assets or earnings owed to a debtor, making it suitable for enforcing individual judgments or debts.

Interpleader Infographic

libterm.com

libterm.com