Equitable title grants you a beneficial interest in a property, allowing you to enjoy the rights and benefits of ownership even before legal title is transferred. This concept plays a crucial role in real estate transactions, providing protection and clarity during the sale process. Explore the rest of the article to understand how equitable title affects your property rights and investment security.

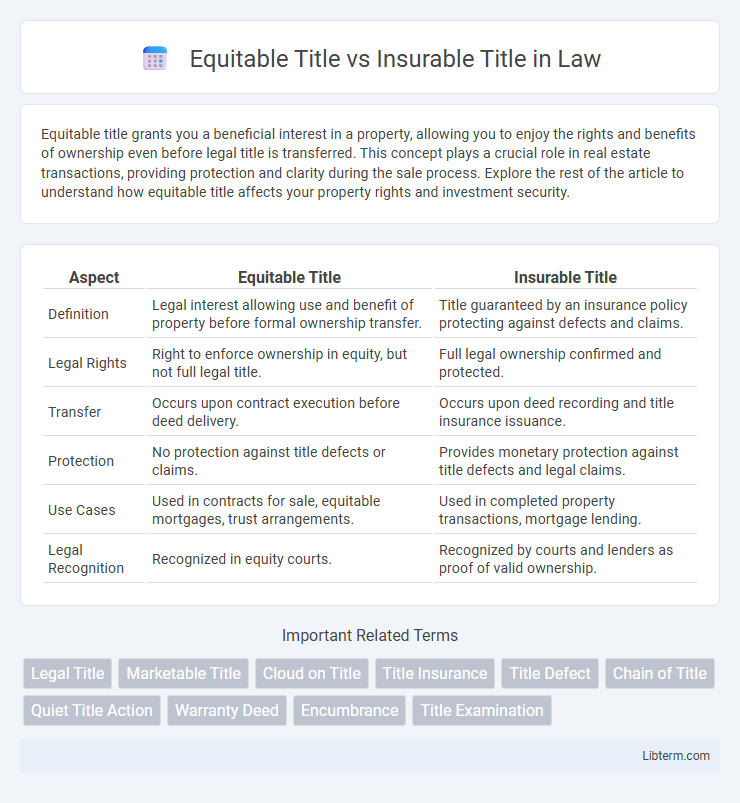

Table of Comparison

| Aspect | Equitable Title | Insurable Title |

|---|---|---|

| Definition | Legal interest allowing use and benefit of property before formal ownership transfer. | Title guaranteed by an insurance policy protecting against defects and claims. |

| Legal Rights | Right to enforce ownership in equity, but not full legal title. | Full legal ownership confirmed and protected. |

| Transfer | Occurs upon contract execution before deed delivery. | Occurs upon deed recording and title insurance issuance. |

| Protection | No protection against title defects or claims. | Provides monetary protection against title defects and legal claims. |

| Use Cases | Used in contracts for sale, equitable mortgages, trust arrangements. | Used in completed property transactions, mortgage lending. |

| Legal Recognition | Recognized in equity courts. | Recognized by courts and lenders as proof of valid ownership. |

Understanding Equitable Title: Definition and Key Concepts

Equitable title represents the right to obtain full ownership of a property, granting the holder a beneficial interest even before the legal title is transferred. It allows the holder to benefit from the property and enforce ownership rights in equity, typically arising during real estate transactions under contracts for deed or land contracts. Understanding equitable title is essential for recognizing rights and responsibilities distinct from the legal title held by others until the transaction is completed.

What Is Insurable Title: Meaning and Importance

Insurable title refers to a property title that, while it may have potential unresolved issues or defects, can be insured by a title insurance company to protect the buyer and lender from financial loss. The importance of an insurable title lies in its ability to secure ownership rights and provide financial protection against claims, liens, or disputes that may arise after the property transfer. Title insurance policies ensure that any hidden title defects discovered post-purchase are covered, offering peace of mind in real estate transactions.

Legal Differences Between Equitable and Insurable Title

Equitable title grants the holder a right to obtain full ownership of a property, reflecting an interest recognized by courts even before the transfer of legal title is complete. Insurable title guarantees that the title is free from significant defects, allowing title insurance companies to protect buyers or lenders against potential losses due to undiscovered title issues. The key legal difference is that equitable title represents a beneficial interest enforceable in equity, whereas insurable title ensures marketable title with protections backed by insurance coverage.

How Equitable Title Impacts Real Estate Transactions

Equitable title grants a buyer the right to obtain full ownership of property, significantly influencing real estate transactions by creating enforceable interest before legal title transfer. This interest allows buyers to possess and use the property, impacting financing options and contract enforcement. Understanding equitable title is crucial for resolving disputes and assessing risks during property sales.

The Role of Insurable Title in Property Purchases

Insurable title plays a critical role in property purchases by providing buyers and lenders with protection against future title disputes or defects that could affect ownership rights. Unlike equitable title, which represents a buyer's right to obtain full ownership after closing, insurable title ensures clear, marketable ownership verified through a title insurance policy. This insurance covers potential legal claims, liens, or encumbrances, offering financial security and confidence in real estate transactions.

Risks Associated with Equitable Title Ownership

Equitable title grants the owner a right to obtain full ownership, yet lacks legal title, exposing the holder to risks such as liens, claims, or prior undisclosed encumbrances that can jeopardize their interest. Unlike insurable title, which provides protection through title insurance against defects and claims, equitable title holders may face costly legal disputes and potential loss of property rights. Understanding these risks is crucial in real estate transactions to ensure clear ownership and minimize financial exposure.

Benefits of Securing an Insurable Title

Securing an insurable title provides legal protection against potential defects or claims that may arise after property purchase, reducing financial risk for buyers and lenders. This type of title ensures marketability by allowing owners to obtain title insurance, which covers losses from undiscovered liens or ownership disputes. Insurable titles enhance buyer confidence and facilitate smoother real estate transactions by confirming clear ownership status.

Equitable Title vs Insurable Title: Practical Examples

Equitable title grants the buyer the right to obtain full ownership once contractual obligations, such as payment, are met, exemplified when a purchaser holds equitable title during a land contract before full deed transfer. Insurable title ensures a title insurance company guarantees protection against defects or claims, illustrated when a homebuyer receives insurable title coverage to secure their investment against title disputes. Understanding the distinction helps parties in real estate transactions manage risk, with equitable title emphasizing possession rights and insurable title focusing on legal protection.

Title Insurance: Protecting Against Ownership Disputes

Equitable title grants the right to obtain full ownership of a property, whereas insurable title ensures the title is free from defects that could cause ownership disputes. Title insurance protects buyers and lenders by covering financial losses arising from undiscovered title issues such as liens, encumbrances, or fraud. This protection is essential for safeguarding property rights and preventing costly legal battles over ownership claims.

Choosing the Right Title Type for Your Real Estate Deal

Choosing the right title type for your real estate deal involves understanding that equitable title grants a buyer the right to obtain full ownership once conditions of the sale are met, while insurable title guarantees the property is free of liens or disputes through title insurance. Opting for insurable title protects buyers and lenders from potential legal claims, making it preferable for securing financing and ensuring clear ownership. Evaluating the transaction's complexity and risk tolerance is crucial to determine whether equitable or insurable title best fits your investment strategy.

Equitable Title Infographic

libterm.com

libterm.com