A corporation is a legal entity separate from its owners, offering limited liability protection and the ability to raise capital through stock issuance. Understanding the structure and benefits of corporations can help you make informed decisions about business formation and investment opportunities. Explore the rest of this article to learn how corporations operate and their impact on the economy.

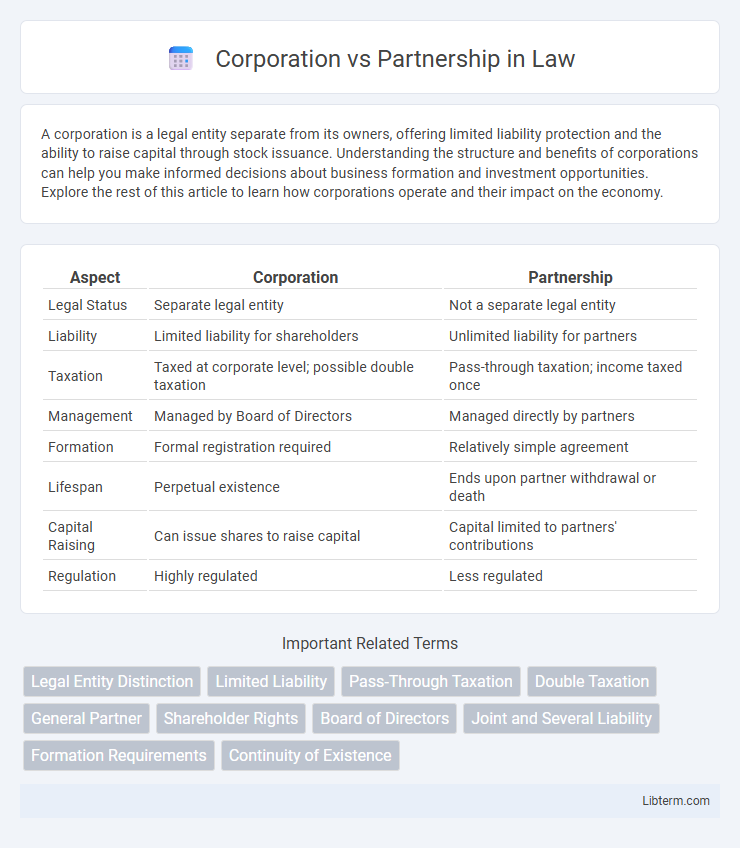

Table of Comparison

| Aspect | Corporation | Partnership |

|---|---|---|

| Legal Status | Separate legal entity | Not a separate legal entity |

| Liability | Limited liability for shareholders | Unlimited liability for partners |

| Taxation | Taxed at corporate level; possible double taxation | Pass-through taxation; income taxed once |

| Management | Managed by Board of Directors | Managed directly by partners |

| Formation | Formal registration required | Relatively simple agreement |

| Lifespan | Perpetual existence | Ends upon partner withdrawal or death |

| Capital Raising | Can issue shares to raise capital | Capital limited to partners' contributions |

| Regulation | Highly regulated | Less regulated |

Introduction to Business Structures

Corporations provide limited liability protection and can raise capital by issuing stock, making them suitable for larger business ventures and investors. Partnerships involve two or more individuals sharing profits, losses, and management responsibilities, offering flexibility but exposing partners to personal liability. Choosing the correct business structure influences tax obligations, legal requirements, and operational control.

Definition of Corporation

A corporation is a legal entity separate from its owners, established under state laws, with the ability to own assets, incur liabilities, and enter into contracts independently. It is characterized by limited liability for shareholders, perpetual existence, and centralized management through a board of directors. Corporations can raise capital by issuing stock, making them suitable for large-scale businesses seeking investment and growth.

Definition of Partnership

A partnership is a business structure where two or more individuals share ownership, profits, liabilities, and decision-making responsibilities. Unlike a corporation, a partnership does not have a separate legal entity status, meaning partners are personally liable for the debts and obligations of the business. This form of organization allows for flexible management but exposes partners to unlimited personal liability.

Key Differences Between Corporations and Partnerships

Corporations feature limited liability for shareholders, centralized management through a board of directors, and perpetual existence, whereas partnerships involve joint liability among partners, direct management by partners, and typically dissolve upon a partner's departure. Taxation differs significantly: corporations face double taxation on profits and dividends, while partnerships benefit from pass-through taxation, avoiding corporate tax levels. Raising capital is generally easier for corporations due to stock issuance, whereas partnerships rely on personal contributions and loans.

Legal Formation and Documentation

A corporation requires filing articles of incorporation with the state, establishing bylaws, and issuing stock to shareholders, ensuring limited liability and formal governance structure. In contrast, a partnership forms through a partnership agreement, which can be oral or written, detailing roles, profit sharing, and responsibilities, but offers less formal liability protection. Corporate formation demands stringent compliance with state regulations and ongoing documentation, while partnerships face fewer legal formalities but involve unlimited personal liability for partners.

Ownership and Management Structure

Corporations feature a distinct separation between ownership and management, where shareholders own the company but elected directors and officers handle daily operations. Partnerships combine ownership and management, with partners jointly sharing decision-making authority and responsibilities based on their partnership agreement. This structure influences liability, control, and profit distribution within each business entity type.

Taxation: Corporation vs Partnership

Corporations face double taxation, where profits are taxed at the corporate level and dividends taxed again at the shareholder level, whereas partnerships benefit from pass-through taxation, avoiding corporate tax as profits are reported directly on partners' individual tax returns. Corporate tax rates vary but are generally higher and involve more complex filing requirements compared to partnerships, which file informational returns without paying income tax themselves. The choice between corporation and partnership impacts tax liability, with corporations providing potential tax deferral opportunities while partnerships often offer simpler taxation and flexibility in profit distribution.

Liability and Risk Considerations

Corporations provide limited liability protection, meaning shareholders are not personally responsible for business debts and legal obligations, reducing personal financial risk. In partnerships, partners have joint and several liability, making each partner personally liable for business debts and risks, potentially exposing personal assets. Structuring as a corporation is generally preferred when minimizing liability and protecting personal assets is a primary concern.

Pros and Cons of Each Structure

Corporations offer limited liability protection, meaning shareholders are not personally responsible for business debts, and they provide easier access to capital through stock issuance, but they face double taxation on profits and complex regulatory requirements. Partnerships benefit from pass-through taxation, avoiding corporate taxes, and simpler formation processes, yet partners have joint and several liability, exposing personal assets to business risks. Choosing between these structures depends on factors such as liability tolerance, taxation preferences, fundraising needs, and administrative capacity.

Choosing the Right Structure for Your Business

Selecting the right business structure hinges on factors such as liability protection, taxation, and management flexibility. Corporations offer limited liability for shareholders and potential tax benefits through various deductions but require more regulatory compliance. Partnerships provide simpler setup and pass-through taxation, yet partners bear personal liability for debts, making careful consideration of ownership roles essential.

Corporation Infographic

libterm.com

libterm.com