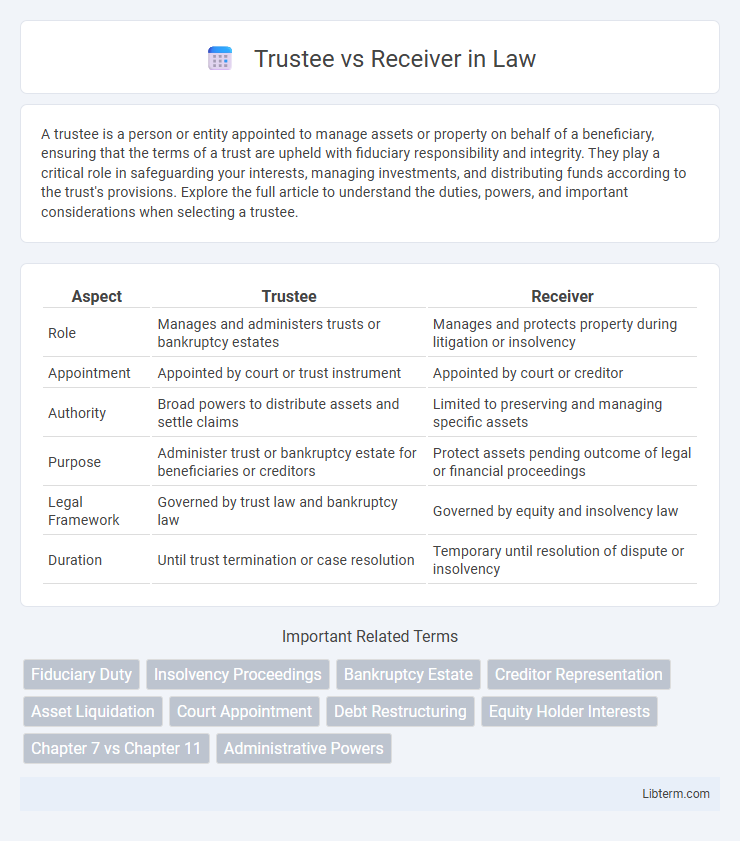

A trustee is a person or entity appointed to manage assets or property on behalf of a beneficiary, ensuring that the terms of a trust are upheld with fiduciary responsibility and integrity. They play a critical role in safeguarding your interests, managing investments, and distributing funds according to the trust's provisions. Explore the full article to understand the duties, powers, and important considerations when selecting a trustee.

Table of Comparison

| Aspect | Trustee | Receiver |

|---|---|---|

| Role | Manages and administers trusts or bankruptcy estates | Manages and protects property during litigation or insolvency |

| Appointment | Appointed by court or trust instrument | Appointed by court or creditor |

| Authority | Broad powers to distribute assets and settle claims | Limited to preserving and managing specific assets |

| Purpose | Administer trust or bankruptcy estate for beneficiaries or creditors | Protect assets pending outcome of legal or financial proceedings |

| Legal Framework | Governed by trust law and bankruptcy law | Governed by equity and insolvency law |

| Duration | Until trust termination or case resolution | Temporary until resolution of dispute or insolvency |

Trustee vs Receiver: Key Differences

Trustees manage and protect assets on behalf of beneficiaries in various legal contexts, including bankruptcy and estate administration, while receivers are court-appointed officials tasked with preserving and liquidating assets during legal disputes or insolvency. Trustees have fiduciary duties to act in the best interests of beneficiaries, overseeing asset distribution and compliance with legal obligations, whereas receivers primarily focus on safeguarding assets and maximizing creditor recovery. The main difference lies in the scope of authority: trustees administer trust assets long-term, whereas receivers temporarily control assets to resolve specific legal or financial issues.

Roles and Responsibilities Explained

A trustee manages and oversees assets held in a trust, ensuring fiduciary duties are met by distributing assets according to the trust agreement and acting in beneficiaries' best interests. A receiver is appointed by a court to take control of property or business assets during litigation or bankruptcy, preserving value and managing operations to protect creditors' rights. Trustees focus on trust administration and beneficiary interests, while receivers prioritize asset preservation and dispute resolution under judicial supervision.

Appointment Process for Trustees and Receivers

Trustees are typically appointed by a court or named in a trust document, with the process involving formal acceptance of fiduciary duties and court approval when necessary. Receivers are usually appointed by a court during litigation to take control of property or assets, often to preserve them pending the outcome of a case. The receiver's appointment requires a judicial order based on demonstrated need, while trustees assume their role through legal documentation or court selection.

Powers and Authority in Asset Management

A trustee holds fiduciary powers granted by a trust agreement, enabling management, investment, and distribution of trust assets according to beneficiaries' interests and legal guidelines. A receiver is appointed by a court to take control of assets during litigation or insolvency proceedings, possessing authority to preserve, manage, and liquidate property to satisfy creditor claims. Trustees generally operate under ongoing fiduciary duties with discretionary powers, whereas receivers exercise court-supervised authority focused on asset protection and orderly disposition.

Legal Framework Governing Trustees and Receivers

The legal framework governing trustees is primarily rooted in trust law, which mandates fiduciary duties such as loyalty, prudence, and impartiality to manage trust assets for beneficiaries' benefit. Receivers, governed by court orders and insolvency statutes, act as neutral parties appointed to take control of distressed assets or entities to protect creditor interests during legal disputes or bankruptcy proceedings. Distinct statutes like the Uniform Trust Code regulate trustees, while receivership is commonly authorized under state laws and federal bankruptcy rules, reflecting their disparate roles and responsibilities within legal contexts.

Scenarios for Appointing Trustees vs Receivers

Trustees are typically appointed in scenarios involving bankruptcy cases, estate administration, or trust management to oversee assets and ensure equitable distribution to beneficiaries or creditors. Receivers are appointed in court-ordered situations to take control of a company or property facing financial distress, mismanagement, or legal disputes, aiming to preserve asset value for creditors. While trustees manage ongoing fiduciary duties under legal frameworks, receivers often act as temporary custodians to stabilize and recover assets during litigation or insolvency.

Impact on Creditors and Stakeholders

A trustee manages assets in bankruptcy proceedings with a fiduciary duty to maximize creditor recovery, ensuring equitable distribution according to legal priorities. A receiver, often appointed by courts or creditors, oversees specific property or business operations to preserve value and mitigate losses for stakeholders. Creditors typically experience more structured and transparent asset liquidation under trustees, while receivers may provide faster control and protection of assets but with varying impacts on creditor recoveries depending on case complexity.

Duration of Appointment and Termination

A trustee's appointment typically lasts for the duration of the trust or until the trust's objectives are fulfilled, potentially spanning years or decades, with termination occurring through trust closure, resignation, or court order. A receiver's appointment is generally temporary and court-ordered, designed to manage or protect assets during litigation or until a specific issue is resolved, often ending once the court's directives are satisfied or the underlying dispute is resolved. Trustees operate under long-term fiduciary duties, while receivers serve short-term custodial roles focused on asset preservation and dispute resolution.

Fiduciary Duties and Accountability

Trustees hold fiduciary duties to manage trust assets prudently and act in beneficiaries' best interests, ensuring transparency and accountability through detailed record-keeping and reporting. Receivers are court-appointed officers responsible for preserving and managing property during litigation, maintaining impartiality while safeguarding assets from dissipation. Both roles demand high accountability and adherence to fiduciary standards, but trustees operate within trust law while receivers function under equitable principles imposed by courts.

Choosing Between Trustee and Receiver: Factors to Consider

Choosing between a trustee and a receiver depends on the specific goals and legal context of asset management or debt recovery. Trustees typically manage assets in bankruptcy or trust administration, focusing on protecting beneficiaries' interests and ensuring compliance with fiduciary duties. Receivers are appointed by courts to take control of property during litigation or insolvency, prioritizing asset preservation and creditor repayment under court supervision.

Trustee Infographic

libterm.com

libterm.com