An acceleration clause allows a lender to demand full repayment of a loan if the borrower defaults or violates specific terms. This clause protects your interests by enabling prompt action to recover the owed balance, preventing prolonged financial risk. Explore the full article to understand how an acceleration clause impacts your loan agreements and safeguards your investments.

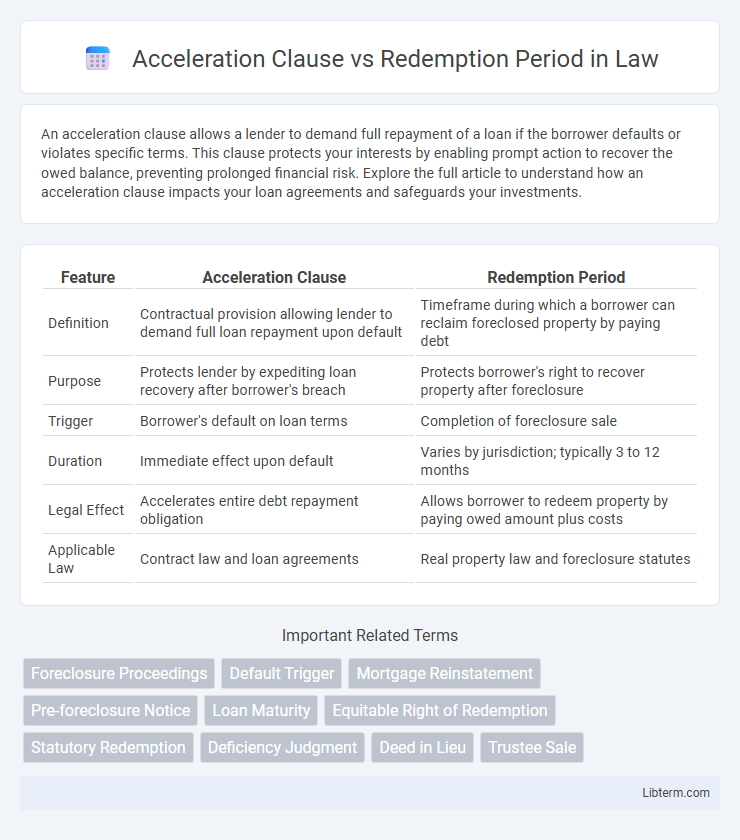

Table of Comparison

| Feature | Acceleration Clause | Redemption Period |

|---|---|---|

| Definition | Contractual provision allowing lender to demand full loan repayment upon default | Timeframe during which a borrower can reclaim foreclosed property by paying debt |

| Purpose | Protects lender by expediting loan recovery after borrower's breach | Protects borrower's right to recover property after foreclosure |

| Trigger | Borrower's default on loan terms | Completion of foreclosure sale |

| Duration | Immediate effect upon default | Varies by jurisdiction; typically 3 to 12 months |

| Legal Effect | Accelerates entire debt repayment obligation | Allows borrower to redeem property by paying owed amount plus costs |

| Applicable Law | Contract law and loan agreements | Real property law and foreclosure statutes |

Understanding the Acceleration Clause

An acceleration clause in a mortgage contract allows the lender to demand full repayment of the outstanding loan balance immediately if the borrower defaults on payments, providing a mechanism to protect the lender's financial interests. This clause triggers the loan's maturity date to accelerate, shortening the repayment schedule from the original term to a much earlier deadline. Understanding the acceleration clause is crucial, as it often leads to the borrower entering the redemption period, during which they can repay the full amount due to stop foreclosure.

What is a Redemption Period?

A redemption period is a specific timeframe after a property foreclosure during which the former owner can reclaim ownership by paying the outstanding debt, including fees and interest. This period varies by state law, typically ranging from several months to a year, providing a crucial opportunity to avoid permanent loss of the property. Understanding the redemption period is essential for both borrowers facing foreclosure and investors assessing property risk.

Key Differences Between Acceleration Clause and Redemption Period

The acceleration clause allows a lender to demand full loan repayment immediately upon borrower default, significantly shortening the loan term and triggering foreclosure processes. The redemption period, on the other hand, provides the borrower a specific timeframe after foreclosure to repay the full amount owed and reclaim the property, acting as a last opportunity to avoid permanent loss. Key differences lie in timing and purpose: acceleration clause speeds up debt collection by enforcing immediate payment, while the redemption period offers a protective window post-foreclosure for borrower recovery.

Legal Implications of Acceleration Clauses

Acceleration clauses allow lenders to demand immediate repayment of the entire loan balance upon borrower default, significantly increasing legal risks for borrowers by triggering potential foreclosure actions sooner. These clauses bypass the redemption period, which typically grants borrowers a limited time to cure defaults or redeem the property after foreclosure initiation, reducing their usual protections. Courts often enforce acceleration clauses strictly, emphasizing the importance of precise contract language to avoid disputes over default triggers and borrower rights.

The Role of Redemption Periods in Foreclosure

Redemption periods in foreclosure provide borrowers a critical timeframe to repay the outstanding debt and avoid losing their property after an acceleration clause has been invoked. This period allows homeowners to redeem the mortgage by paying the full loan amount plus any fees before the property is sold at auction. Understanding redemption periods is essential for assessing the legal protections available to borrowers and the timing of foreclosure proceedings.

How Acceleration Clauses Impact Borrowers

Acceleration clauses require borrowers to repay the entire loan balance immediately if they default, significantly increasing financial pressure and risk of foreclosure. This clause reduces the redemption period's effectiveness by limiting the borrower's time to cure the default or redeem the property. Borrowers face heightened urgency to resolve payment issues to avoid losing valuable rights during the shortened redemption period.

Redemption Periods: Borrower Rights and Limitations

Redemption periods grant borrowers a specific timeframe after foreclosure to reclaim their property by paying the outstanding debt, including interest and fees, providing crucial protection against immediate loss. During this period, borrowers retain certain rights such as curing defaults or negotiating payment plans but face limitations like restricted property use or inability to sell without lender consent. Understanding state-specific redemption laws is essential, as these durations and borrower rights vary significantly, impacting foreclosure outcomes and financial recovery.

Comparing Contractual Consequences

Acceleration clauses trigger the full loan balance as immediately due upon default, creating significant financial pressure on borrowers without a grace period. In contrast, redemption periods provide borrowers a defined timeframe to repay the overdue amounts or reclaim the property before foreclosure proceeds. The contractual consequence of acceleration is accelerated debt liability, while redemption periods offer a temporary legal reprieve to cure defaults and avoid loss of property.

State Laws Affecting Acceleration and Redemption

State laws significantly influence acceleration clauses and redemption periods in foreclosure processes, with variations in definitions and enforcement across jurisdictions. Acceleration clauses allow lenders to demand full loan repayment upon default, while redemption periods grant borrowers time to repay debt post-foreclosure sale to reclaim property. States like California limit acceleration use in judicial foreclosures, and redemption period lengths differ widely, impacting lenders' and borrowers' rights during default.

Practical Tips for Borrowers Facing Foreclosure

Borrowers facing foreclosure should carefully review the acceleration clause in their mortgage agreement, which allows the lender to demand full repayment after a default. Understanding the redemption period is crucial, as this timeframe provides a last chance to pay off the debt and reclaim the property before it is sold. Seeking professional legal advice and negotiating with the lender during the redemption period can improve a borrower's chances of avoiding foreclosure.

Acceleration Clause Infographic

libterm.com

libterm.com