Indemnity provides protection against financial loss by compensating for damages or liabilities incurred. It plays a crucial role in contracts, insurance policies, and legal agreements to minimize your risk exposure. Discover how indemnity clauses work and why they matter in our full article.

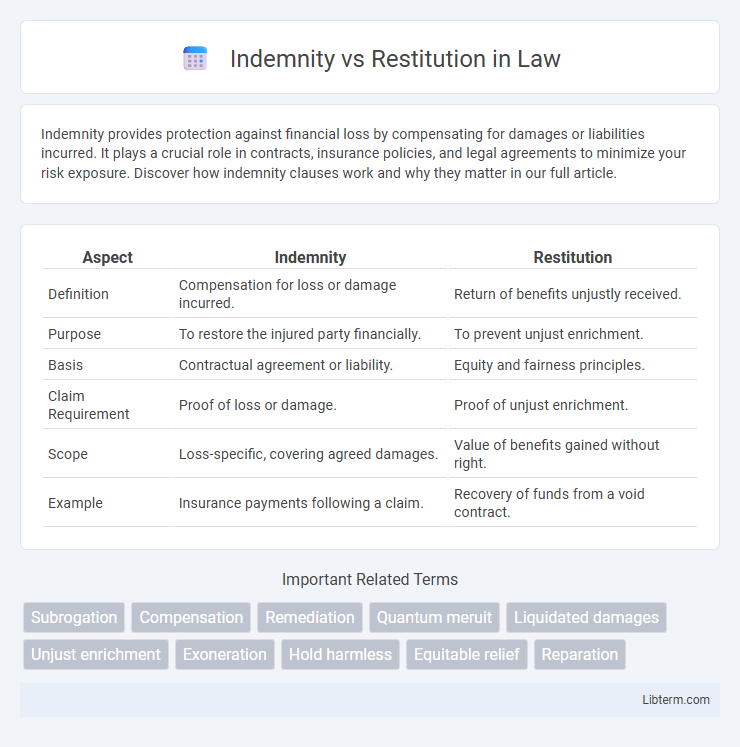

Table of Comparison

| Aspect | Indemnity | Restitution |

|---|---|---|

| Definition | Compensation for loss or damage incurred. | Return of benefits unjustly received. |

| Purpose | To restore the injured party financially. | To prevent unjust enrichment. |

| Basis | Contractual agreement or liability. | Equity and fairness principles. |

| Claim Requirement | Proof of loss or damage. | Proof of unjust enrichment. |

| Scope | Loss-specific, covering agreed damages. | Value of benefits gained without right. |

| Example | Insurance payments following a claim. | Recovery of funds from a void contract. |

Understanding Indemnity: Definition and Legal Context

Indemnity refers to a contractual obligation where one party agrees to compensate another for specific losses or damages incurred, ensuring financial protection against claims or liabilities. In legal contexts, indemnity clauses are commonly used in commercial contracts, insurance policies, and service agreements to allocate risk and define the scope of compensation. Understanding indemnity involves recognizing its role in transferring risk, enforcing liability coverage, and maintaining equitable compensation between parties.

Restitution Explained: Meaning and Importance

Restitution is a legal principle aimed at restoring a party to their original position by requiring the return of unjustly gained benefits or compensation for loss. It plays a crucial role in contract law, preventing unjust enrichment and ensuring fairness between parties by mandating the return of property or the payment of equivalent value. Its importance lies in promoting equity and deterring wrongful conduct without necessarily imposing punitive damages.

Key Differences Between Indemnity and Restitution

Indemnity involves compensating for loss or damage by restoring the injured party to the financial position they occupied before the loss, typically based on a contract or legal obligation. Restitution aims to return the injured party to their original position by reversing unjust enrichment, often requiring the return of benefits or property wrongfully obtained. Key differences include indemnity being focused on loss compensation, while restitution centers on preventing unjust enrichment, with indemnity generally arising from specific agreements and restitution from equitable principles.

Legal Principles Underpinning Indemnity

Indemnity is grounded in the legal principle that one party compensates another for losses or damages incurred, ensuring the indemnified party is restored to their original financial position. This principle is distinct from restitution, which focuses on returning a benefit unjustly gained rather than compensating for loss. Indemnity agreements typically outline clear obligations to cover specific liabilities, reinforcing the contract-based nature of this legal remedy.

Legal Principles Governing Restitution

Restitution is governed by legal principles aimed at preventing unjust enrichment by restoring the injured party to their original position before a loss occurred. It requires the defendant to return the benefit unjustly gained, ensuring fairness and equity in contract and tort law. Unlike indemnity, which involves compensation for loss or damage, restitution focuses on reversing unjust enrichment regardless of fault.

Indemnity: Types and Common Examples

Indemnity involves compensating for loss or damage incurred, typically through contractual agreements that specify the scope and limits of indemnification. Common types of indemnity include general indemnity, where one party agrees to cover all losses; limited indemnity, which restricts coverage to specified damages; and conditional indemnity, dependent on certain conditions or events. Frequent examples include insurance policies indemnifying against risk, construction contracts indemnifying against third-party claims, and employment agreements covering legal costs arising from work-related incidents.

Restitution: Types and Real-World Applications

Restitution involves restoring the injured party to the position they occupied before a loss, typically through the return of property or monetary compensation. It includes types such as legal restitution, equitable restitution, and restitution in integrum, each addressing different circumstances like unjust enrichment or breach of contract. In real-world applications, restitution is commonly seen in cases of contract rescission, fraud recovery, and property disputes, ensuring parties are made whole without punishing the wrongdoer.

Indemnity vs Restitution: Practical Implications

Indemnity involves compensating for specific losses or damages incurred, often through contractual obligation, whereas restitution aims to restore the injured party to their original position by returning unjust gains. In practical terms, indemnity typically covers foreseeable risks and negotiated liabilities, while restitution focuses on fairness by preventing unjust enrichment regardless of fault. Businesses often rely on indemnity clauses for predictable risk allocation, whereas restitution remedies apply when contracts are voided or benefits must be disgorged.

Choosing Between Indemnity and Restitution in Contracts

Choosing between indemnity and restitution in contracts hinges on the nature of the obligation and desired legal remedy. Indemnity involves one party agreeing to compensate the other for specific losses or damages, often pre-determined or foreseeable, ensuring risk allocation in commercial agreements. Restitution aims to restore the injured party to their original position by returning unjust enrichment, typically applied when a contract is void or breached without explicit compensation clauses.

Summary: Indemnity or Restitution—Which Is Right for You?

Choosing between indemnity and restitution depends on the nature of your loss and legal objectives: indemnity aims to compensate for actual damages suffered, shifting financial burden from the indemnified party; restitution focuses on restoring the injured party to their original position by recovering unjust enrichment. Indemnity suits contracts and insurance claims where specific loss coverage is established, whereas restitution applies in cases involving breach of trust or unjust enrichment without a defined damage amount. Assessing contract terms, legal context, and type of loss ensures selecting the appropriate remedy for effective financial protection.

Indemnity Infographic

libterm.com

libterm.com