A breach of fiduciary duty occurs when an individual entrusted to manage another party's assets or interests acts in their own favor instead of prioritizing the beneficiary's best interests. This violation can lead to significant financial losses and legal consequences, emphasizing the importance of trust and accountability in fiduciary relationships. Explore the rest of the article to understand how breaches happen and what steps you can take to protect your rights.

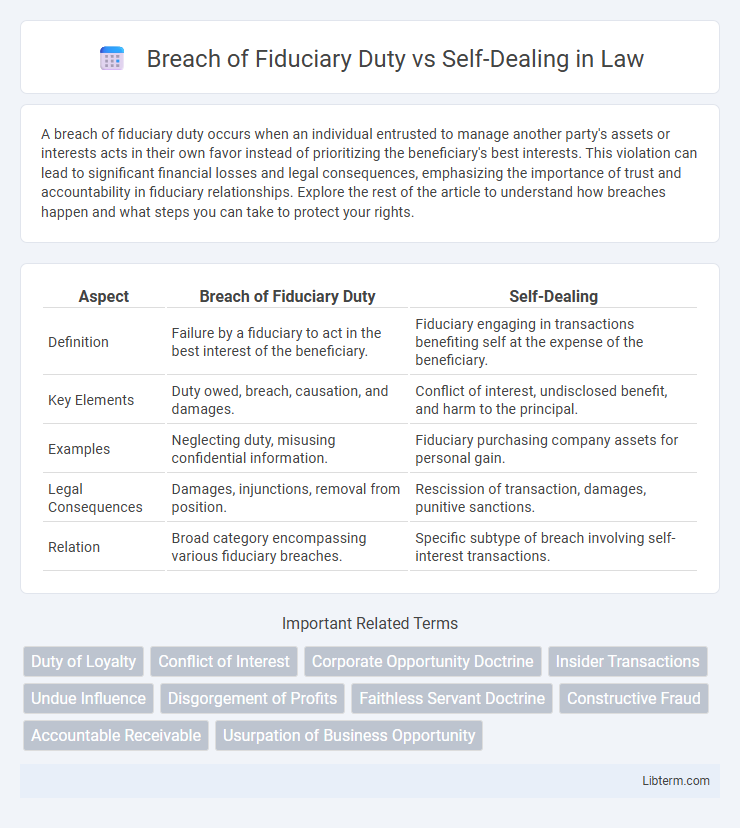

Table of Comparison

| Aspect | Breach of Fiduciary Duty | Self-Dealing |

|---|---|---|

| Definition | Failure by a fiduciary to act in the best interest of the beneficiary. | Fiduciary engaging in transactions benefiting self at the expense of the beneficiary. |

| Key Elements | Duty owed, breach, causation, and damages. | Conflict of interest, undisclosed benefit, and harm to the principal. |

| Examples | Neglecting duty, misusing confidential information. | Fiduciary purchasing company assets for personal gain. |

| Legal Consequences | Damages, injunctions, removal from position. | Rescission of transaction, damages, punitive sanctions. |

| Relation | Broad category encompassing various fiduciary breaches. | Specific subtype of breach involving self-interest transactions. |

Understanding Fiduciary Duty

Fiduciary duty represents the legal obligation of one party to act in the best interest of another, often involving trust and confidence, such as between a corporate director and shareholders. Breach of fiduciary duty occurs when the fiduciary fails to fulfill these duties, leading to harm or loss for the beneficiary. Self-dealing is a specific form of breach, where the fiduciary exploits their position for personal gain rather than prioritizing the beneficiary's interests.

What Constitutes a Breach of Fiduciary Duty?

A breach of fiduciary duty occurs when an individual in a position of trust, such as a corporate director or trustee, fails to act in the best interest of the beneficiary or organization, violating their obligation to act with loyalty, care, and good faith. Self-dealing, a common form of breach, involves the fiduciary using their position to benefit personally at the expense of the entity they serve, such as engaging in transactions that personally enrich the fiduciary without full disclosure or consent. Courts evaluate whether the fiduciary's actions were fair, transparent, and intended to benefit the principal rather than the fiduciary's own interests.

Defining Self-Dealing in Legal Context

Self-dealing occurs when a fiduciary acts in their own interest rather than the interests of the principal or beneficiary, violating their duty of loyalty. This legal breach involves transactions where the fiduciary benefits personally, often through conflicts of interest or undisclosed arrangements. Courts scrutinize self-dealing to protect stakeholders from exploitation and ensure fiduciaries uphold their ethical and legal obligations.

Key Differences Between Breach of Fiduciary Duty and Self-Dealing

Breach of fiduciary duty occurs when a fiduciary fails to act in the best interest of the beneficiary, violating their duty of loyalty, care, or good faith. Self-dealing, a specific form of breach, involves the fiduciary engaging in transactions that benefit themselves at the expense of the beneficiary. Key differences include that self-dealing always implies a conflict of interest with personal gain, whereas breach of fiduciary duty can encompass a broader range of misconduct beyond self-interested transactions.

Common Examples of Fiduciary Breaches

Common examples of fiduciary breaches include misappropriation of assets, conflicts of interest, and failure to disclose important information to beneficiaries or stakeholders. Self-dealing occurs when a fiduciary exploits their position to benefit personally, such as approving transactions that unfairly enrich themselves at the expense of those they represent. Both breaches undermine trust and legal obligations inherent in fiduciary relationships.

Notable Self-Dealing Cases

Notable self-dealing cases highlight clear breaches of fiduciary duty where corporate officers or trustees exploite their positions for personal gain at the expense of shareholders or beneficiaries. Key examples include the landmark case of Guth v. Loft, where the court scrutinized corporate takeover strategies tied to personal interests, establishing strict liability for self-dealing transactions. These cases underscore the importance of rigorous judicial standards in identifying conflicts of interest and enforcing remedies to protect fiduciary responsibilities.

Legal Consequences of Breach of Fiduciary Duty

Breach of fiduciary duty occurs when a fiduciary fails to act in the best interest of the beneficiary, resulting in damages and potential civil liability. Legal consequences include monetary damages, restitution, injunctions, and in severe cases, removal from position or criminal charges. Courts rigorously enforce these duties to maintain trust and accountability in corporate, estate, and financial relationships.

Remedies and Penalties for Self-Dealing

Remedies for self-dealing primarily involve rescission of the transaction, restitution of profits gained, and damages awarded to the harmed party. Courts often impose penalties such as disgorgement of ill-gotten gains, fiduciary removal, and sometimes punitive damages to deter future misconduct. Equitable remedies and legal sanctions aim to restore fairness and uphold fiduciary responsibilities by targeting the wrongful benefits obtained through self-dealing.

Preventing Breach and Self-Dealing in Organizations

Preventing breach of fiduciary duty and self-dealing in organizations requires implementing strict internal controls and comprehensive compliance policies. Regular training on ethical responsibilities and transparent disclosure requirements help detect and mitigate conflicts of interest early. Robust oversight mechanisms, such as independent audits and board reviews, ensure accountability and protect organizational integrity.

When to Seek Legal Advice for Fiduciary Misconduct

Seek legal advice promptly when signs of breach of fiduciary duty surface, such as unauthorized transactions or conflicts of interest indicating self-dealing. Early consultation with an attorney specializing in fiduciary law ensures protection of your rights and assets, especially when evidence shows trustees or directors acting for personal gain rather than beneficiaries' interests. Legal intervention is critical when fiduciary misconduct causes financial harm or raises complex disputes requiring expert resolution.

Breach of Fiduciary Duty Infographic

libterm.com

libterm.com