Insider trading involves buying or selling securities based on non-public, material information, violating fair market regulations. This practice undermines investor confidence and can lead to severe legal consequences, including fines and imprisonment. Discover how insider trading impacts financial markets and what measures protect your investments in the full article.

Table of Comparison

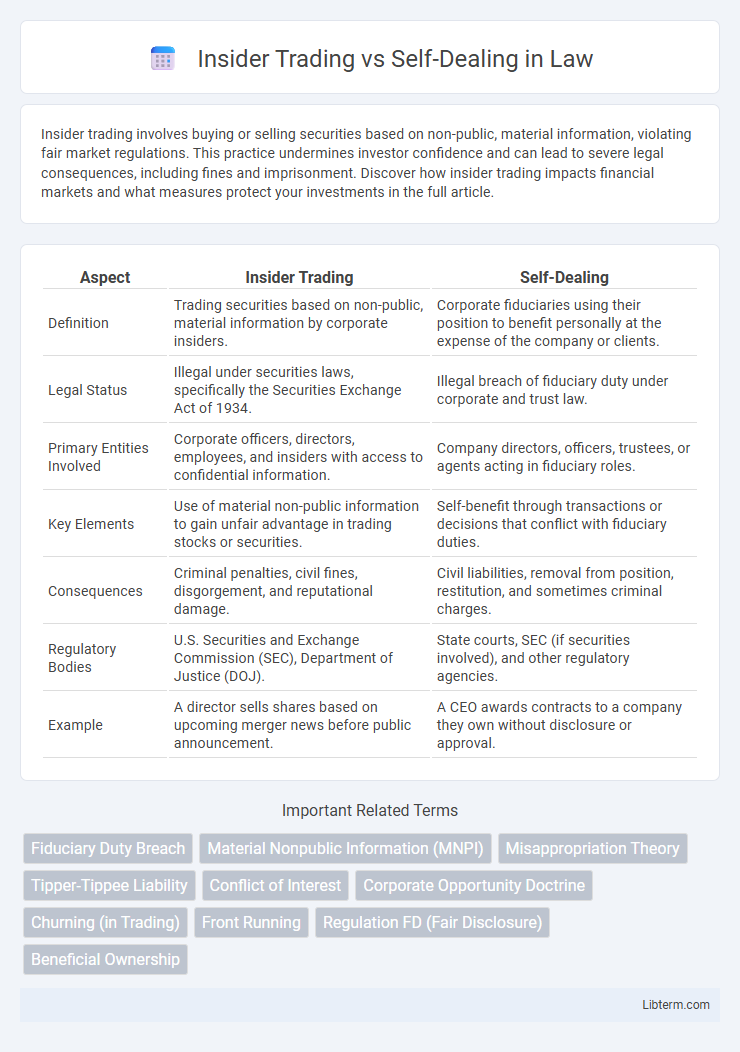

| Aspect | Insider Trading | Self-Dealing |

|---|---|---|

| Definition | Trading securities based on non-public, material information by corporate insiders. | Corporate fiduciaries using their position to benefit personally at the expense of the company or clients. |

| Legal Status | Illegal under securities laws, specifically the Securities Exchange Act of 1934. | Illegal breach of fiduciary duty under corporate and trust law. |

| Primary Entities Involved | Corporate officers, directors, employees, and insiders with access to confidential information. | Company directors, officers, trustees, or agents acting in fiduciary roles. |

| Key Elements | Use of material non-public information to gain unfair advantage in trading stocks or securities. | Self-benefit through transactions or decisions that conflict with fiduciary duties. |

| Consequences | Criminal penalties, civil fines, disgorgement, and reputational damage. | Civil liabilities, removal from position, restitution, and sometimes criminal charges. |

| Regulatory Bodies | U.S. Securities and Exchange Commission (SEC), Department of Justice (DOJ). | State courts, SEC (if securities involved), and other regulatory agencies. |

| Example | A director sells shares based on upcoming merger news before public announcement. | A CEO awards contracts to a company they own without disclosure or approval. |

Understanding Insider Trading: Key Concepts

Insider trading involves buying or selling securities based on non-public, material information about a company, which violates securities laws when it gives an unfair advantage. Key concepts include materiality, confidentiality, and fiduciary duty, highlighting that insiders such as executives, employees, or directors must not exploit privileged information for personal gain. Understanding these elements is crucial to distinguish legal transactions from illegal insider trading and to enforce regulatory compliance effectively.

What is Self-Dealing? Definition and Examples

Self-dealing occurs when a corporate insider, such as an executive or board member, prioritizes personal interests over the company's by engaging in transactions that benefit themselves rather than shareholders. Examples include a CEO awarding contracts to a family-owned supplier or purchasing company assets at below-market prices for personal gain. Regulatory frameworks like the SEC's rules and corporate governance policies aim to prevent self-dealing by enforcing transparency and accountability.

Legal Framework: Insider Trading vs Self-Dealing

The legal framework governing insider trading involves strict regulations such as the Securities Exchange Act of 1934, which prohibits trading based on material, non-public information and enforces penalties through the SEC. Self-dealing is regulated primarily under corporate law statutes, including fiduciary duty principles and the duty of loyalty, aiming to prevent conflicts of interest where insiders benefit at the corporate entity's expense. Courts and regulatory bodies rigorously scrutinize transactions for violations, with insider trading prosecuted under securities laws and self-dealing addressed via corporate governance rules and shareholder derivative suits.

Motivations Behind Insider Trading and Self-Dealing

Insider trading is primarily motivated by the desire to capitalize on non-public information for personal financial gain, leveraging privileged access to market-moving data. Self-dealing, however, centers on exploiting a fiduciary position to benefit oneself at the expense of the company or other stakeholders, often through conflicts of interest in transactions. Both practices undermine market integrity and fiduciary trust, driven by incentives to maximize individual wealth through unethical means.

Identifying Red Flags: How to Spot Each

Insider trading red flags include unusual trading volume or timing before material announcements, inconsistent disclosure by company insiders, and sudden profits by individuals with confidential access. Self-dealing is identified through transactions that benefit insiders at the company's expense, such as related-party contracts without competitive bidding, unexplained asset transfers, or conflicts of interest in decision-making processes. Monitoring SEC filings, analyzing financial reports, and scrutinizing director or executive behavior are critical for early detection of both insider trading and self-dealing activities.

Major Cases: Notorious Incidents in History

Major cases of insider trading include the Raj Rajaratnam Galleon Group scandal, where illegal stock trades based on confidential information resulted in a $92 million fine and prison sentences. Self-dealing cases such as the Tyco International scandal involved former CEO Dennis Kozlowski misappropriating $150 million for personal use, highlighting clear conflicts of interest. These notorious incidents underscore the legal and financial repercussions of unethical corporate governance.

Regulatory Responses: How Authorities Handle Both

Regulatory authorities enforce stringent laws such as the Securities Exchange Act of 1934 to combat insider trading by requiring timely disclosure of material non-public information and imposing severe penalties including fines and imprisonment. Self-dealing is addressed through fiduciary duty regulations, with corporate governance frameworks mandating disclosure and approval by independent directors or shareholders to prevent conflicts of interest. Both violations trigger investigations by agencies like the SEC and the DOJ, employing forensic accounting and whistleblower programs to detect and prosecute wrongdoing.

Consequences: Penalties and Legal Ramifications

Insider trading and self-dealing carry severe penalties including hefty fines, disgorgement of profits, and imprisonment, reflecting the serious breach of fiduciary duty and trust involved. Regulatory bodies such as the SEC in the United States aggressively pursue these violations, often leading to criminal charges and civil lawsuits. Legal ramifications also include reputational damage, loss of professional licenses, and permanent bans from serving as corporate officers or directors.

Prevention Strategies for Organizations

Organizations can prevent insider trading and self-dealing by implementing robust compliance programs that include regular employee training on ethical standards and legal requirements. Establishing strict policies for disclosure, monitoring employee transactions, and enforcing conflict-of-interest guidelines reduces the risk of unethical conduct. Utilizing automated monitoring systems and conducting thorough audits further enhances detection and deterrence of insider trading and self-dealing activities.

Ethical Considerations and Public Perception

Insider trading involves exploiting non-public information for personal gain, raising significant ethical concerns about fairness and market integrity, while self-dealing refers to fiduciaries prioritizing personal interests over those of stakeholders, undermining trust and corporate governance. Both practices erode public confidence by violating principles of transparency and equitable treatment in financial markets. Regulatory frameworks emphasize stringent disclosure and accountability to mitigate these ethical breaches and protect investor interests.

Insider Trading Infographic

libterm.com

libterm.com