Indemnity protects you from financial loss by ensuring compensation for damages or losses incurred due to another party's actions. It is commonly included in contracts to allocate risk and safeguard your interests in case of legal claims or unforeseen events. Explore the full article to understand how indemnity clauses can affect your agreements and liabilities.

Table of Comparison

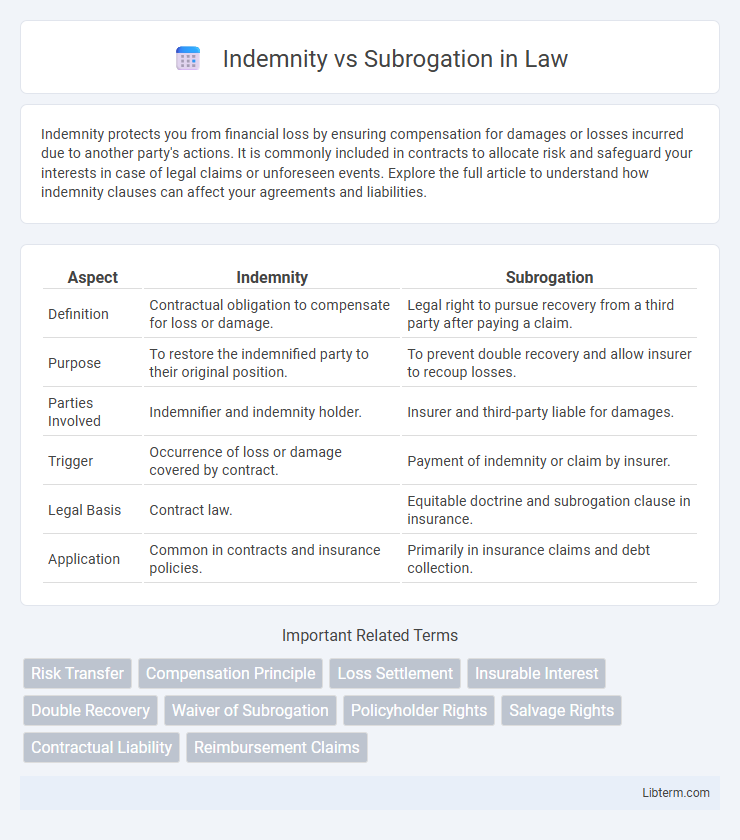

| Aspect | Indemnity | Subrogation |

|---|---|---|

| Definition | Contractual obligation to compensate for loss or damage. | Legal right to pursue recovery from a third party after paying a claim. |

| Purpose | To restore the indemnified party to their original position. | To prevent double recovery and allow insurer to recoup losses. |

| Parties Involved | Indemnifier and indemnity holder. | Insurer and third-party liable for damages. |

| Trigger | Occurrence of loss or damage covered by contract. | Payment of indemnity or claim by insurer. |

| Legal Basis | Contract law. | Equitable doctrine and subrogation clause in insurance. |

| Application | Common in contracts and insurance policies. | Primarily in insurance claims and debt collection. |

Introduction to Indemnity and Subrogation

Indemnity is a legal principle where one party agrees to compensate another for loss or damage incurred, ensuring financial protection against specified risks. Subrogation allows an insurer to step into the shoes of the insured after a claim payment, enabling recovery of the amount from a third party responsible for the loss. Both concepts play crucial roles in risk management and insurance law, balancing liability and financial responsibility.

Definition of Indemnity

Indemnity refers to a contractual obligation by one party to compensate another for loss or damage incurred, ensuring financial protection against specific risks. It typically involves restoring the injured party to the position they were in before the loss occurred. This principle is fundamental in insurance contracts and liability agreements, providing a legal framework for risk management and loss recovery.

Definition of Subrogation

Subrogation is a legal principle allowing an insurer to pursue recovery from a third party responsible for a loss after compensating the insured. It enables the insurer to "step into the shoes" of the insured to claim damages and prevent double recovery. This mechanism ensures equitable distribution of liability and helps control insurance costs by shifting financial responsibility to the party at fault.

Key Differences Between Indemnity and Subrogation

Indemnity involves one party agreeing to compensate another for a loss or damage incurred, typically outlined in a contract, while subrogation allows an insurer to step into the shoes of the insured to recover costs from a third party responsible for the loss. Indemnity focuses on restoring the insured to their original financial position without a profit, whereas subrogation aims to shift the financial burden to the liable party after compensation has been provided. The key difference lies in indemnity being a contractual obligation between parties, while subrogation is a legal right exercised by insurers to recoup paid claims.

Legal Principles Governing Indemnity

The legal principles governing indemnity center on one party agreeing to compensate another for a loss or damage, often established through contracts or statutory obligations. Indemnity involves a direct obligation to restore the indemnified party to their original financial position without imposing liability, distinguishing it from subrogation, where the indemnifier gains the right to pursue third parties for recovery. Courts interpret indemnity clauses strictly, emphasizing clear contractual language to define the scope and extent of indemnification responsibilities.

Legal Principles Governing Subrogation

The legal principles governing subrogation establish the right of an insurer or party who has compensated a loss to step into the shoes of the insured and pursue recovery from the third party responsible for the damage. Subrogation operates under equitable doctrines that prevent unjust enrichment by ensuring the indemnified party does not receive double recovery while holding the liable party accountable. Key principles include indemnity, the existence of a valid underlying liability, and the requirement that the subrogee's rights are no greater than the subrogor's original rights.

Practical Examples of Indemnity in Insurance

Indemnity in insurance involves compensating the insured for losses, such as reimbursing a homeowner for fire damage repair costs up to the policy limit. Subrogation allows the insurance company to recover those costs by pursuing a third party responsible for the loss, like a negligent contractor causing the fire. Practical examples include auto insurance paying for vehicle repairs and then suing the at-fault driver to reclaim those expenses.

Practical Examples of Subrogation in Insurance

Subrogation in insurance allows an insurer to recover costs from a third party responsible for a loss after compensating the insured. For example, if a driver's insurance pays for repairs to their car after an accident caused by another motorist, the insurer can seek reimbursement from the at-fault driver's insurer. This practical mechanism ensures that the financial burden falls on the party responsible, reducing overall insurance costs and preventing double compensation for the insured.

Importance of Indemnity and Subrogation in Risk Management

Indemnity and subrogation play crucial roles in risk management by ensuring financial protection and recovery in the event of a loss. Indemnity provides assurance that the insured party will be compensated for damages, minimizing financial disruption, while subrogation allows insurers to recover costs from responsible third parties, thus reducing overall claim expenses. Together, these mechanisms maintain balance in risk allocation and promote efficient loss recovery processes.

Conclusion: Choosing Between Indemnity and Subrogation

Choosing between indemnity and subrogation depends on the nature of risk transfer and recovery objectives; indemnity offers direct compensation for losses, while subrogation allows insurers to pursue third parties responsible for damages. Optimal selection hinges on contract terms, legal jurisdiction, and the strategic advantage in minimizing financial exposure. Understanding these distinctions ensures effective risk management and financial protection in insurance and legal frameworks.

Indemnity Infographic

libterm.com

libterm.com