An agent acts as an intermediary who represents a person or organization in business, legal, or real estate matters, ensuring your interests are protected and effectively communicated. Their expertise helps streamline negotiations, manage contracts, and facilitate transactions with greater efficiency. Discover how working with a skilled agent can benefit your goals by reading the rest of this article.

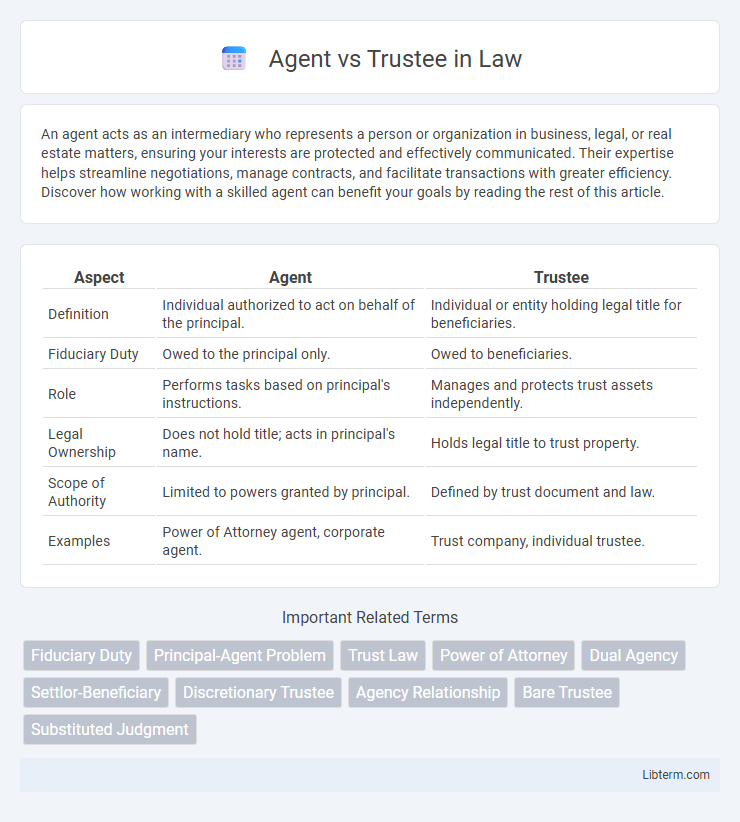

Table of Comparison

| Aspect | Agent | Trustee |

|---|---|---|

| Definition | Individual authorized to act on behalf of the principal. | Individual or entity holding legal title for beneficiaries. |

| Fiduciary Duty | Owed to the principal only. | Owed to beneficiaries. |

| Role | Performs tasks based on principal's instructions. | Manages and protects trust assets independently. |

| Legal Ownership | Does not hold title; acts in principal's name. | Holds legal title to trust property. |

| Scope of Authority | Limited to powers granted by principal. | Defined by trust document and law. |

| Examples | Power of Attorney agent, corporate agent. | Trust company, individual trustee. |

Understanding the Roles: Agent vs Trustee

An agent acts on behalf of a principal to perform specific tasks or make decisions, typically under a power of attorney, with duties centered around representing the principal's interests in transactional or legal matters. A trustee holds legal title to property or assets placed in a trust, managing and administering these assets for the benefit of the beneficiaries according to the terms set forth in the trust agreement. The key distinction lies in the scope of authority and fiduciary duty: agents generally have limited, task-specific authority, while trustees have a broader, ongoing responsibility to manage trust assets prudently and impartially.

Legal Definitions: Agent and Trustee Explained

An agent is an individual authorized to act on behalf of another person, known as the principal, typically involving tasks like negotiating contracts or managing affairs, with fiduciary duties tailored to the scope of authority granted. A trustee holds legal title to property or assets in a trust, managing them for the benefit of designated beneficiaries under strict fiduciary responsibilities defined by trust law. The key legal distinction lies in the trustee's obligation to preserve and manage trust property according to the trust instrument, whereas an agent's authority is generally broader and based on agency law principles.

Duties and Responsibilities Compared

An agent acts on behalf of a principal to perform specific tasks or make decisions with limited fiduciary duties, primarily loyalty and care. A trustee manages and protects trust assets for beneficiaries, bearing extensive fiduciary responsibilities including prudence, impartiality, and accountability. Agents are generally bound by contractual obligations, while trustees must adhere to legal standards and trust terms to safeguard beneficiaries' interests.

Authority and Powers Granted

An agent is granted authority to act on behalf of a principal in specific matters, typically defined by a power of attorney agreement, allowing actions such as managing finances or making decisions within the scope delegated. A trustee holds legal title to trust property with fiduciary duties, exercising broad powers granted by the trust document, including managing assets, distributing funds, and making decisions in the best interest of beneficiaries. Unlike an agent, a trustee's authority is governed by trust law and the terms of the trust, often involving more extensive and ongoing control over assets.

Fiduciary Obligations: Key Differences

Agents have fiduciary obligations to act loyally and in the best interests of the principal, maintaining transparency and avoiding conflicts of interest. Trustees hold a higher standard of fiduciary duty, managing trust assets prudently and solely for the beneficiaries' benefit according to the terms of the trust. Unlike agents, trustees must provide detailed accounting and are subject to stricter legal standards regarding asset management and impartiality.

Appointment and Termination Processes

An agent is appointed through a power of attorney agreement, granting authority to act on behalf of the principal, and this appointment can be terminated by revocation of the power of attorney or upon the principal's death or incapacity. A trustee is appointed by a trust document or court order to manage trust assets and their appointment continues until the trust terms are fulfilled, the trust is revoked, or the trustee resigns or is removed by the court. Termination of a trustee's role often requires formal legal procedures to ensure proper transfer of trust duties and assets, unlike the generally simpler revocation process for agents.

Liability and Accountability Issues

An agent acts on behalf of a principal with limited liability confined to authorized actions, whereas a trustee bears fiduciary responsibility involving strict accountability for managing trust assets in beneficiaries' interests. Agents are liable only for negligence or breaches within their delegated authority, while trustees face broader obligations including duty of loyalty, prudence, and full transparency. Legal consequences for trustees include potential personal liability and removal for misconduct or mismanagement, distinguishing their role from that of agents with comparatively lower accountability.

Use Cases: When to Choose an Agent or Trustee

Agents are ideal for managing financial or legal matters temporarily, such as handling banking transactions during travel or making healthcare decisions under a power of attorney. Trustees are preferred for long-term asset management, such as administering a trust for minors or managing inheritance distributions according to specific terms. Choosing an agent suits situations requiring flexible, revocable authority, while trustees are essential for fiduciary duties involving ongoing oversight and legal accountability.

Benefits and Drawbacks of Each Role

An agent has the benefit of flexible authority to act on behalf of the principal, allowing quick decision-making without court involvement, but faces limitations if powers are not clearly defined or if the principal revokes authority. A trustee manages assets under a trust with fiduciary duties, ensuring legal protection of beneficiaries' interests and structured asset management, though this role involves strict legal obligations and potential liabilities. Agents provide operational convenience, while trustees offer long-term asset control, making the choice dependent on the desired level of oversight and legal responsibility.

Agent vs Trustee: Which Is Right for Your Needs?

Choosing between an agent and a trustee depends on the level of control and responsibility you want to assign over your assets. An agent, appointed through a power of attorney, handles financial or healthcare decisions on your behalf but typically operates under your instructions and for a limited time. A trustee manages trust property with a fiduciary duty to beneficiaries, offering ongoing oversight and tailored asset distribution aligned with your estate planning goals.

Agent Infographic

libterm.com

libterm.com