Block grants provide state and local governments with flexible funding to address broad policy areas such as education, health, or community development. These grants allow recipients to tailor programs to better meet the unique needs of their populations while maintaining accountability for spending. Discover how block grants can impact your community and shape public services by reading the rest of the article.

Table of Comparison

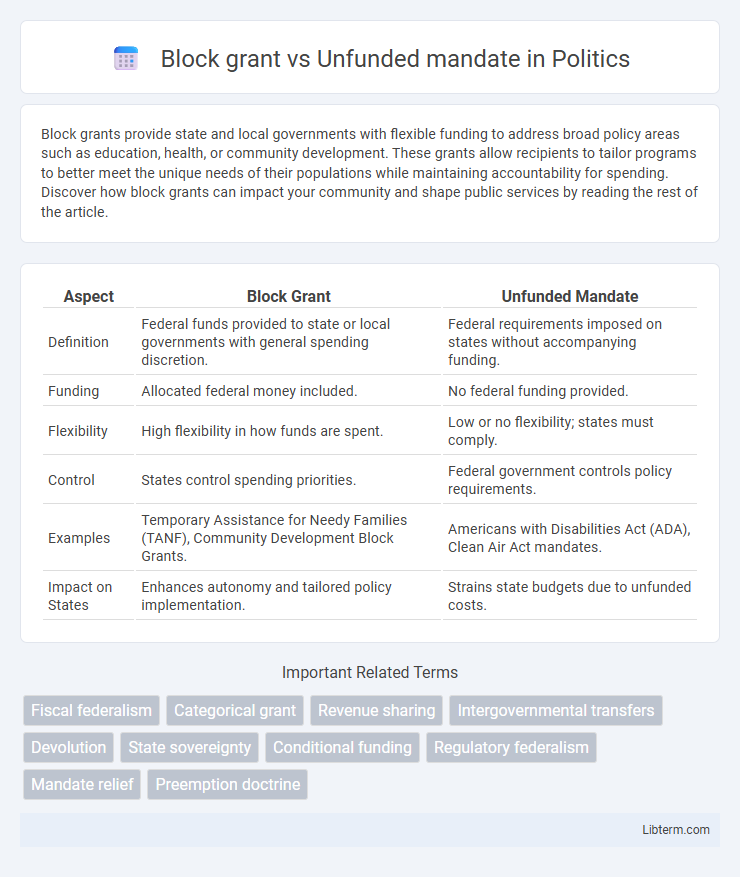

| Aspect | Block Grant | Unfunded Mandate |

|---|---|---|

| Definition | Federal funds provided to state or local governments with general spending discretion. | Federal requirements imposed on states without accompanying funding. |

| Funding | Allocated federal money included. | No federal funding provided. |

| Flexibility | High flexibility in how funds are spent. | Low or no flexibility; states must comply. |

| Control | States control spending priorities. | Federal government controls policy requirements. |

| Examples | Temporary Assistance for Needy Families (TANF), Community Development Block Grants. | Americans with Disabilities Act (ADA), Clean Air Act mandates. |

| Impact on States | Enhances autonomy and tailored policy implementation. | Strains state budgets due to unfunded costs. |

Introduction to Block Grants and Unfunded Mandates

Block grants are fixed sums of money granted by the federal government to state or local governments for broad purposes without stringent federal oversight, allowing flexibility in allocation. Unfunded mandates require state or local governments to perform specific actions or comply with federal regulations without receiving corresponding funding, often creating financial strain. Understanding the fundamental distinction between block grants and unfunded mandates is crucial for analyzing federal-state fiscal relationships and policy implementation.

Defining Block Grants: Key Features

Block grants are fixed-sum funds allocated by the federal government to state or local governments for broad purposes, allowing recipients flexibility in how the money is spent. These grants reduce federal oversight by providing lump-sum financial support, enabling tailored use based on local priorities and needs. In contrast, unfunded mandates require state or local governments to comply with federal regulations or programs without accompanying financial assistance, often creating fiscal strain.

Understanding Unfunded Mandates

Unfunded mandates require state or local governments to comply with federal regulations without providing federal funding, often straining local budgets and resources. These mandates can cover areas such as education, healthcare, and environmental regulations, compelling governments to reallocate funds or increase taxes to meet requirements. Understanding the financial burden and policy implications of unfunded mandates is critical for governments to effectively manage compliance while maintaining essential public services.

Historical Context: Evolution of Federal Funding

Block grants emerged in the 1960s as a flexible federal funding mechanism consolidating multiple categorical grants into broader categories, allowing states greater discretion in allocating resources. In contrast, unfunded mandates gained prominence in the late 20th century as federal requirements imposed on states without accompanying funding, often leading to budgetary strains at the state and local levels. The evolution reflects a shift from cooperative federalism emphasizing federal-state partnership to a more directive federal approach imposing obligations without financial support.

Flexibility and Autonomy: Block Grants' Advantages

Block grants provide states and local governments significant flexibility in allocating federal funds based on local priorities, which enhances autonomy in program design and implementation. Unlike unfunded mandates that impose specific requirements without financial support, block grants allow recipients to adjust spending within broad policy areas, fostering innovation and responsiveness to community needs. This autonomy streamlines decision-making and improves efficiency by reducing federal oversight and administrative burdens.

Financial Burdens: Impact of Unfunded Mandates

Unfunded mandates impose significant financial burdens on state and local governments by requiring them to implement programs or services without providing corresponding federal funding, often straining budgets and forcing reallocation of resources from other critical areas. In contrast, block grants offer bundled federal funds with more flexible usage, enabling governments to address specific local needs while maintaining financial discretion. The lack of financial support in unfunded mandates frequently leads to increased taxes, reduced public services, or budget deficits.

Case Studies: Real-World Examples

Block grants provide states with flexible funding to address local needs, exemplified by the Temporary Assistance for Needy Families (TANF) program, which grants states discretion in welfare administration. In contrast, unfunded mandates, like the Americans with Disabilities Act (ADA), impose federal requirements without accompanying funds, often burdening state budgets and forcing reallocation of resources. Case studies reveal that block grants promote tailored policy solutions, while unfunded mandates can strain state finances and complicate implementation.

Policy Implications for State and Local Governments

Block grants provide state and local governments with flexible funding to address broad policy goals, enabling tailored program implementation and prioritization based on local needs. Unfunded mandates require these governments to comply with federal regulations without providing corresponding financial support, often straining local budgets and limiting policy autonomy. The reliance on unfunded mandates can reduce the effectiveness of state and local governance by diverting resources from other critical areas and constraining fiscal planning.

Comparative Analysis: Efficiency and Accountability

Block grants offer states flexible funding with greater efficiency by consolidating resources and reducing administrative costs, enabling tailored local program implementation. Unfunded mandates impose federal requirements without financial support, often leading to inefficiencies and strained state budgets due to unfunded compliance burdens. Accountability in block grants is clearer through outcome-based reporting, whereas unfunded mandates complicate accountability by shifting financial responsibility without direct federal oversight.

Conclusion: Choosing the Right Funding Approach

Selecting the appropriate funding approach depends on balancing flexibility and accountability; block grants offer states broad discretion to allocate resources based on local priorities, enhancing tailored program implementation. Unfunded mandates impose specific federal requirements without financial support, often creating budgetary strain but ensuring uniform compliance nationwide. Decision-makers must weigh the benefits of local autonomy against the necessity of standardized policy enforcement to optimize program success and fiscal responsibility.

Block grant Infographic

libterm.com

libterm.com