Fitrah represents the innate nature or original disposition within every human, guiding individuals towards recognizing truth and morality. Understanding your fitrah can help align your actions with your natural purpose and inner peace. Explore the rest of this article to deepen your insight into the profound concept of fitrah and its impact on your life.

Table of Comparison

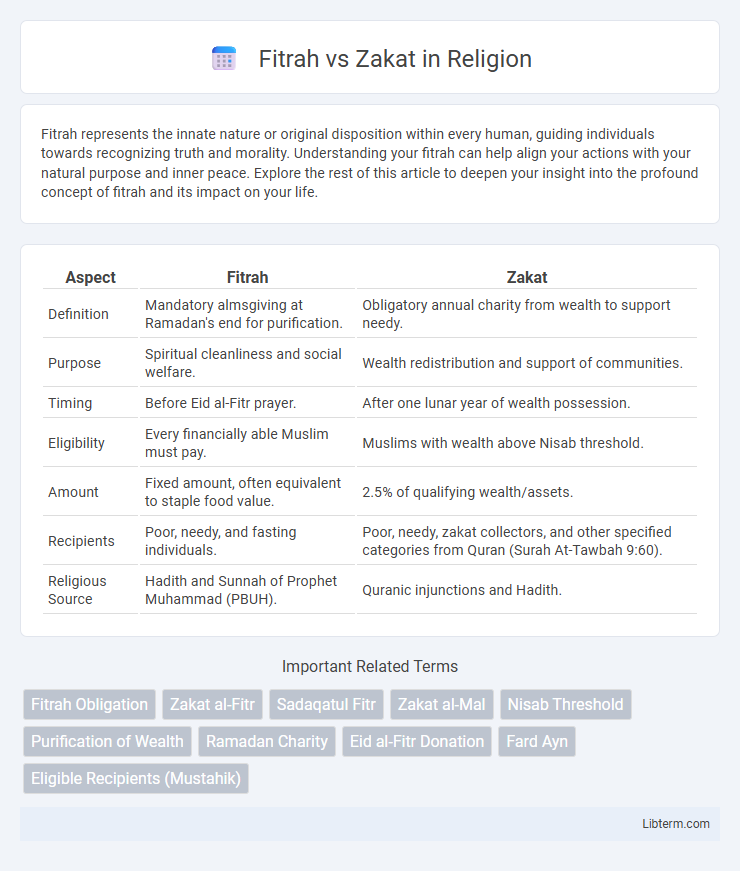

| Aspect | Fitrah | Zakat |

|---|---|---|

| Definition | Mandatory almsgiving at Ramadan's end for purification. | Obligatory annual charity from wealth to support needy. |

| Purpose | Spiritual cleanliness and social welfare. | Wealth redistribution and support of communities. |

| Timing | Before Eid al-Fitr prayer. | After one lunar year of wealth possession. |

| Eligibility | Every financially able Muslim must pay. | Muslims with wealth above Nisab threshold. |

| Amount | Fixed amount, often equivalent to staple food value. | 2.5% of qualifying wealth/assets. |

| Recipients | Poor, needy, and fasting individuals. | Poor, needy, zakat collectors, and other specified categories from Quran (Surah At-Tawbah 9:60). |

| Religious Source | Hadith and Sunnah of Prophet Muhammad (PBUH). | Quranic injunctions and Hadith. |

Understanding Fitrah and Zakat: Key Differences

Fitrah is a mandatory charitable donation given by Muslims during Ramadan to purify their fast and support those in need, typically calculated based on staple food items like grain or dates. Zakat, one of the Five Pillars of Islam, is an obligatory almsgiving that requires Muslims to give 2.5% of their accumulated wealth annually to eligible beneficiaries, including the poor and needy. The key difference lies in Fitrah's role as a purification for fasting and its fixed amount per person, whereas Zakat functions as a wealth redistribution mechanism based on a calculated percentage of savings and assets.

The Concept of Fitrah in Islamic Tradition

Fitrah in Islamic tradition represents the innate purity and natural disposition with which every human is born, signifying a state of spiritual cleanliness and connection to God. It is closely linked to the ritual of giving Zakat al-Fitr, a mandatory charity performed at Ramadan's end to purify those fasts and assist the needy. Unlike regular Zakat, which is calculated based on accumulated wealth, Fitrah focuses on spiritual purification and social solidarity during Eid celebrations.

Zakat: The Pillar of Financial Purification

Zakat, a fundamental pillar of Islam, serves as a mandatory financial purification process that requires eligible Muslims to give a fixed portion, typically 2.5%, of their accumulated wealth annually to those in need. Distinct from Fitrah, which is a charitable contribution made during Ramadan, Zakat encompasses broader wealth categories such as savings, investments, and business assets to promote social equity and economic justice. The systematic distribution of Zakat helps reduce poverty, supports community welfare, and fulfills a spiritual obligation, reinforcing its critical role in maintaining financial and societal balance within the Islamic framework.

Eligibility Criteria for Fitrah and Zakat

Fitrah eligibility targets every Muslim with the financial means to pay before Eid al-Fitr prayer, calculated per person including dependents, ensuring purification of fast and communal support for the needy. Zakat eligibility requires Muslims possessing wealth exceeding the nisab threshold, held for a lunar year, covering assets like savings, gold, and business inventory, aimed at wealth redistribution among eight eligible categories such as the poor, needy, and debtors. Both Fitrah and Zakat emphasize economic capacity but differ in timing and qualifying wealth types, reinforcing the pillars of charity in Islam.

Calculating Fitrah vs Calculating Zakat

Calculating Fitrah involves determining a fixed amount of staple food or its monetary equivalent, typically based on the average local cost of essentials like wheat, barley, dates, or rice, with the amount per person usually set at one sa' (approximately 2.5 to 3 kg). In contrast, calculating Zakat requires assessing 2.5% of a Muslim's accumulated wealth exceeding the nisab threshold, including savings, investments, business inventory, and gold or silver, after a lunar year has passed. Fitrah is obligatory per individual before Eid al-Fitr, whereas Zakat applies annually to total qualifying assets and income.

Recipients: Who Can Receive Fitrah and Zakat?

Fitrah is primarily distributed to the needy, including the poor, orphans, and travelers who lack sufficient means, ensuring they can celebrate Eid al-Fitr with dignity. Zakat recipients are more broadly defined in Islamic law to include the poor, the destitute, those employed to collect Zakat, those in debt, and others mentioned in the Quran, such as new Muslims and those striving in the path of Allah. Both forms of charity emphasize supporting vulnerable groups but differ in timing, calculation, and specific eligibility criteria.

Timing and Deadline for Paying Fitrah and Zakat

Fitrah must be paid before the Eid al-Fitr prayer, typically during Ramadan, ensuring purification and support for the needy before the festival day. Zakat al-Mal has a year-round deadline based on the lunar calendar, payable once a full hijri year passes since a Muslim's wealth reaches the nisab threshold. Missing the timely payment of either Fitrah or Zakat delays their spiritual benefits and impacts the rightful recipients.

Spiritual and Social Benefits of Fitrah and Zakat

Fitrah purifies the fasting person by expiating minor sins and promotes social solidarity by providing food for the needy during Eid, fostering community cohesion and empathy. Zakat redistributes wealth, reducing economic inequality and ensuring social justice while spiritually cleansing the giver's wealth and encouraging generosity. Both acts strengthen societal bonds and individual spirituality by fulfilling religious obligations and supporting the welfare of marginalized groups.

Common Misconceptions about Fitrah and Zakat

Fitrah and Zakat are both obligatory Islamic charitable contributions but differ significantly in purpose and timing, with Fitrah specifically intended to purify fasting Muslims during Ramadan and Zakat serving as an annual almsgiving based on wealth thresholds. A common misconception is that Fitrah can be given at any time of the year like Zakat, while its payment is specifically required before Eid prayers to fulfill its spiritual role. Another misunderstanding is that Zakat and Fitrah amounts are interchangeable; Fitrah is a fixed amount per person, often measured in staple food or monetary equivalent, whereas Zakat is calculated as 2.5% of qualifying wealth.

Practical Tips for Fulfilling Fitrah and Zakat Obligations

Fulfilling Fitrah and Zakat obligations involves precise calculation based on current nisab thresholds to ensure accurate giving aligned with Islamic law. Practical tips include using reliable local market prices to assess zakat on assets like gold, cash, or business inventory, while paying fitrah requires measuring staple food amounts per household member before Eid. Timely payment before Eid prayers helps fulfill the spiritual intent of these duties, supporting community welfare and personal purification.

Fitrah Infographic

libterm.com

libterm.com