Jizya is a historic tax levied on non-Muslim subjects in Islamic states as a sign of their protection and acceptance of Islamic governance. This tax, differing from zakat paid by Muslims, symbolized a social contract ensuring rights and security in exchange for the contribution. Explore the article to understand the origins, implications, and modern interpretations of jizya in Islamic law.

Table of Comparison

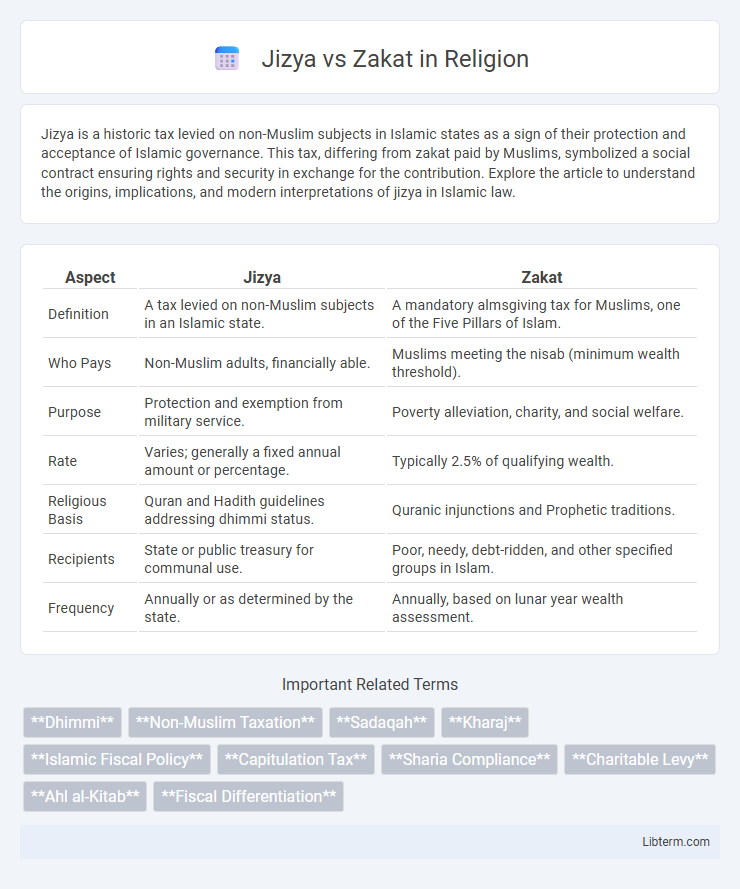

| Aspect | Jizya | Zakat |

|---|---|---|

| Definition | A tax levied on non-Muslim subjects in an Islamic state. | A mandatory almsgiving tax for Muslims, one of the Five Pillars of Islam. |

| Who Pays | Non-Muslim adults, financially able. | Muslims meeting the nisab (minimum wealth threshold). |

| Purpose | Protection and exemption from military service. | Poverty alleviation, charity, and social welfare. |

| Rate | Varies; generally a fixed annual amount or percentage. | Typically 2.5% of qualifying wealth. |

| Religious Basis | Quran and Hadith guidelines addressing dhimmi status. | Quranic injunctions and Prophetic traditions. |

| Recipients | State or public treasury for communal use. | Poor, needy, debt-ridden, and other specified groups in Islam. |

| Frequency | Annually or as determined by the state. | Annually, based on lunar year wealth assessment. |

Understanding Jizya: Definition and Historical Context

Jizya is a historical Islamic tax levied on non-Muslim subjects living under Muslim rule, serving as a form of protection and civic responsibility. Originating in early Islamic governance, it differentiated non-Muslims from Muslims, who paid Zakat--a mandatory almsgiving tax for social welfare within the Muslim community. Understanding Jizya requires examining its role in maintaining societal structure and religious coexistence in pre-modern Islamic states.

What is Zakat? Foundations in Islamic Law

Zakat is a mandatory almsgiving practice in Islam, constituting one of the Five Pillars, requiring Muslims to donate a fixed portion of their wealth annually to eligible recipients. Grounded in the Quran and Hadith, zakat serves as a means to purify wealth, support the needy, and promote social equity within the Islamic community. Unlike jizya, which is a tax levied on non-Muslims under Islamic governance, zakat is exclusively an obligation for financially capable Muslims to ensure economic balance and communal welfare.

Core Objectives: Jizya vs Zakat

Jizya is a per capita tax levied on non-Muslim subjects in an Islamic state, serving as a symbol of protection and exemption from military service, thereby ensuring social and political stability. Zakat is a mandatory almsgiving tax on eligible Muslims, aiming to redistribute wealth, support the needy, and foster economic equity within the Muslim community. Both function as fiscal tools but differ fundamentally in their targeted populations and socio-religious objectives.

Eligibility: Who Pays Jizya and Zakat?

Jizya is a tax levied on non-Muslim adult males who are financially capable living in an Islamic state, exempting women, children, the elderly, and the poor. Zakat is an obligatory almsgiving tax for financially stable Muslim individuals who meet the minimum wealth threshold called Nisab, covering income, savings, and certain assets. Both taxes serve distinct social and religious purposes, with Jizya acting as a protection fee and Zakat as a means of wealth purification and redistribution among Muslims.

Calculation Methods: Jizya and Zakat Amounts

Jizya is calculated as a fixed tax imposed on non-Muslim adult males, typically varying based on their financial capacity, often categorized into three tiers: wealthy, middle class, and poor, with rates ranging approximately from 24 to 48 dirhams annually. Zakat, a compulsory almsgiving for Muslims, is calculated as 2.5% of accumulated wealth exceeding the Nisab threshold, which is equivalent to 85 grams of gold or 595 grams of silver. The distinct calculation methods underscore Jizya's role as a per capita tax on non-Muslims versus Zakat's function as a wealth-based obligatory charity within the Muslim community.

Collection and Distribution: Jizya versus Zakat

Jizya is a per capita tax levied on non-Muslim subjects in an Islamic state, collected annually to acknowledge their protection and exemption from military service, and its revenue primarily supports state administration and defense. Zakat is an obligatory alms tax on Muslim wealth, calculated as a fixed percentage, distributed directly to specified categories including the poor, needy, and other eligible recipients outlined in Islamic law. While Jizya funds government functions and societal protection, Zakat serves as a mechanism for wealth redistribution and social welfare within the Muslim community.

Social and Economic Implications

Jizya and Zakat, both Islamic fiscal obligations, have distinct social and economic implications within Muslim and non-Muslim communities. Jizya, a tax levied on non-Muslim subjects in Islamic states, reinforced social hierarchies by marking religious identity while generating state revenue from diverse populations. Zakat, a mandatory almsgiving for Muslims, promotes wealth redistribution and social welfare by funding aid for the poor, thus reducing economic inequalities within the Muslim community.

Jizya and Zakat in Modern Context

Jizya is a historic tax imposed on non-Muslim citizens in Islamic states, whereas Zakat is an obligatory almsgiving paid by Muslims based on wealth. In the modern context, Jizya is largely obsolete and considered incompatible with contemporary notions of citizenship and equality, while Zakat continues to serve as a critical tool for poverty alleviation and social welfare in many Muslim-majority countries. Contemporary scholars emphasize Zakat's role in economic redistribution, whereas Jizya is rarely applied and often viewed through historical and legal reform perspectives.

Misconceptions Surrounding Jizya and Zakat

Misconceptions surrounding Jizya and Zakat often stem from misunderstandings about their purposes and beneficiaries; Jizya is a historical tax levied on non-Muslims in Islamic states as a form of protection, whereas Zakat is an obligatory almsgiving for Muslims aimed at social welfare and wealth redistribution. Jizya is not a punishment or humiliation but a contractual obligation ensuring non-Muslim citizens' security and exemption from military service, contrasting with Zakat's role as a religious duty to purify wealth and assist the needy. Clarifying these distinctions highlights that Jizya and Zakat serve different social and legal functions within Islamic governance and spirituality.

Jizya vs Zakat: Key Differences Summarized

Jizya is a tax imposed on non-Muslim subjects in an Islamic state, reflecting their exemption from military service and granting protection, while Zakat is a mandatory almsgiving for Muslims, constituting one of the Five Pillars of Islam aimed at wealth purification and social welfare. The Jizya rate varies based on the payer's financial capacity, whereas Zakat is typically calculated as 2.5% of accumulated wealth above a specified threshold called Nisab. Unlike Zakat, which is distributed to specific categories like the poor and needy, Jizya serves as a political and fiscal tool ensuring non-Muslims' contribution to state expenses.

Jizya Infographic

libterm.com

libterm.com