Ushr is a traditional Islamic tax levied on agricultural produce, typically at a rate of 10% or 5% depending on the irrigation method used. It serves as a form of charity, supporting the community and those in need through equitable wealth distribution. Explore the rest of this article to understand how Ushr impacts your agricultural practices and contributes to social welfare.

Table of Comparison

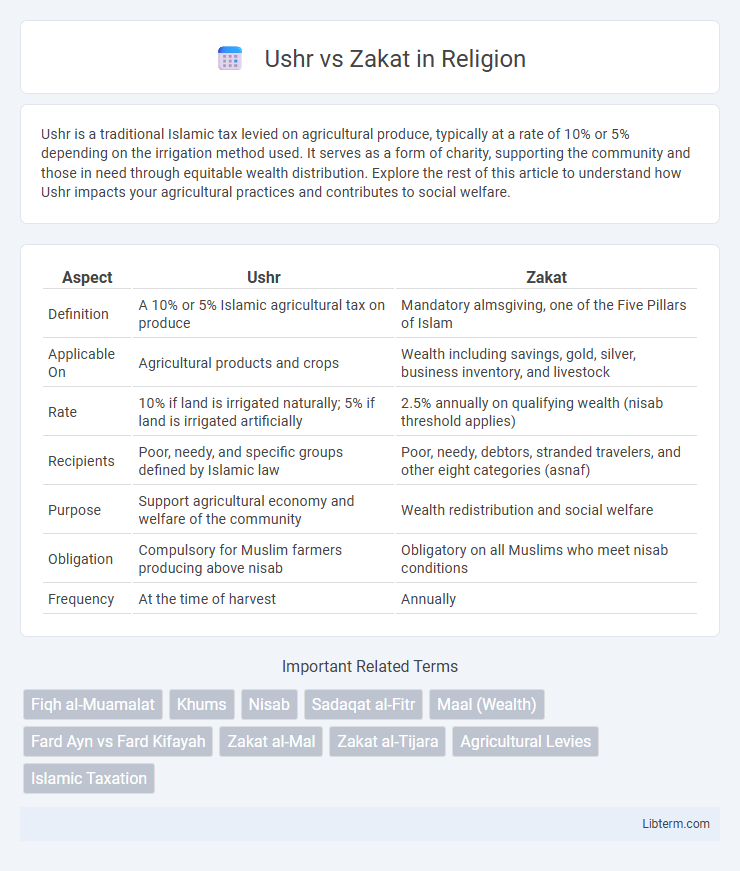

| Aspect | Ushr | Zakat |

|---|---|---|

| Definition | A 10% or 5% Islamic agricultural tax on produce | Mandatory almsgiving, one of the Five Pillars of Islam |

| Applicable On | Agricultural products and crops | Wealth including savings, gold, silver, business inventory, and livestock |

| Rate | 10% if land is irrigated naturally; 5% if land is irrigated artificially | 2.5% annually on qualifying wealth (nisab threshold applies) |

| Recipients | Poor, needy, and specific groups defined by Islamic law | Poor, needy, debtors, stranded travelers, and other eight categories (asnaf) |

| Purpose | Support agricultural economy and welfare of the community | Wealth redistribution and social welfare |

| Obligation | Compulsory for Muslim farmers producing above nisab | Obligatory on all Muslims who meet nisab conditions |

| Frequency | At the time of harvest | Annually |

Introduction to Ushr and Zakat

Ushr and Zakat are two fundamental forms of Islamic almsgiving designed to purify wealth and assist those in need. Ushr is a 10% agricultural tax levied on produce from landowners, reflecting the importance of supporting rural economies and ensuring equitable distribution of agricultural resources. Zakat, calculated as 2.5% of accumulated wealth above a certain threshold (nisab), encompasses various asset types and serves as a broad mechanism for social welfare and poverty alleviation in the Muslim community.

Definition and Concept of Ushr

Ushr is an Islamic agricultural tax levied at a rate of 10% on crops irrigated naturally by rainfall and 5% on those irrigated artificially, serving as a means to support the needy and maintain social welfare. Unlike Zakat, which is a broader wealth tax applicable to earnings, savings, and livestock, Ushr specifically targets agricultural produce. This tax is rooted in Quranic injunctions, emphasizing economic justice and equitable resource distribution among Muslim communities.

Definition and Concept of Zakat

Zakat is a mandatory Islamic financial obligation requiring Muslims to donate a fixed portion of their accumulated wealth to eligible beneficiaries, serving as a means of wealth purification and social welfare. Unlike Ushr, which is a 10% levy on agricultural produce, Zakat applies broadly to various forms of wealth, including savings, livestock, and trade goods, provided they exceed a minimum threshold called nisab. The core concept of Zakat emphasizes economic justice, helping reduce poverty and inequality within the Muslim community through systematic wealth redistribution.

Quranic and Hadith References

Ushr and Zakat are both Islamic obligatory alms, with Ushr being a 10% tax on agricultural produce referenced in the Quran (Surah Al-An'am 6:141) and Zakat being a mandatory social welfare contribution (usually 2.5%) on wealth and savings detailed in various Quranic verses such as Surah At-Tawbah 9:60. The Prophet Muhammad emphasized Zakat's importance in multiple Hadiths, notably stating it as a pillar of Islam, while Ushr is supported by Hadiths encouraging fair taxation on crops to support the community. Both reflect Quranic principles of social justice and economic redistribution vital for Muslim societies.

Key Differences Between Ushr and Zakat

Ushr is an Islamic agricultural tax levied at 10% on harvested crops from irrigated lands and 5% on rain-fed lands, while Zakat is a broader wealth tax imposed at 2.5% on monetary assets, inventory, and savings exceeding the Nisab threshold. Ushr specifically targets agricultural produce and contributes to the welfare of farmers and rural communities, whereas Zakat encompasses various forms of wealth to support the needy, charity, and socioeconomic balance. The collection and distribution processes of Ushr and Zakat differ, reflecting their distinct purposes within the Islamic fiscal system.

Eligibility and Applicability Criteria

Ushr applies specifically to agricultural produce from land that meets certain water usage criteria, typically imposed on Muslims who own farmland and yield crops above a defined threshold. Zakat eligibility extends to various forms of wealth, including cash, gold, business inventory, and livestock, requiring a minimum nisab (wealth threshold) and a full lunar year of ownership by a Muslim adult of sound mind. Ushr is obligatory on farmers regardless of wealth status when applicable, whereas Zakat is due only by Muslims whose net assets exceed the nisab, reflecting broader economic participation beyond agriculture.

Calculation Methods for Ushr and Zakat

Ushr is calculated at a fixed rate of 10% on agricultural produce when irrigation relies solely on rain, and 5% if water is drawn from other sources like wells or rivers. Zakat calculation varies by asset type, typically 2.5% on accumulated wealth such as savings, gold, and business inventory, provided they exceed the nisab threshold. Both require precise valuation of assets, but Ushr targets agricultural yield while Zakat encompasses a broader range of wealth categories.

Recipients of Ushr vs Zakat

Ushr and Zakat have distinct recipient categories based on Islamic law; Ushr is primarily allocated to needy farmers and agricultural workers impacted by land produce, while Zakat beneficiaries encompass a broader range including the poor (Al-Fuqara), the needy (Al-Masakin), those employed to collect Zakat, those whose hearts are to be reconciled, freeing captives, debtors, and those striving in the cause of Allah. Ushr's focus limits distribution mainly to individuals connected with agricultural productivity, reflecting its origin as a tithe on agricultural yields, whereas Zakat derives from wealth types such as savings, livestock, and trade goods, offering support across multiple socio-economic groups to alleviate poverty and promote social welfare. Understanding these distinct recipient frameworks helps ensure compliance with Shariah mandates, ensuring that wealth redistribution adheres strictly to its designated purposes within the Islamic economic system.

Socioeconomic Impact of Both Obligations

Ushr and Zakat, as Islamic financial obligations, significantly influence socioeconomic structures by promoting wealth redistribution and poverty alleviation. Ushr imposes a 10% levy on agricultural produce, supporting rural economies and ensuring food security, while Zakat targets a wider array of wealth holdings, including savings and business assets, facilitating income redistribution and social welfare. Both mechanisms foster economic equilibrium by empowering the underprivileged and stimulating economic circulation in Muslim communities.

Common Misconceptions About Ushr and Zakat

Ushr and Zakat are often confused due to their shared role as Islamic financial obligations, but they have distinct criteria and purposes. A common misconception is that Ushr applies to all agricultural produce, whereas it specifically targets produce from land owned by the farmer, typically at a rate of 10% or 5% depending on irrigation. Zakat differs as a broader wealth purification tax, applicable to savings, gold, business assets, and livestock, calculated at 2.5%, and is obligatory once the nisab threshold is met annually.

Ushr Infographic

libterm.com

libterm.com