Public ownership refers to assets, enterprises, or resources owned and managed by the government or community on behalf of its citizens. This model ensures that essential services and infrastructure prioritize public welfare over profit. Discover how public ownership can impact your community's development and access to resources in the rest of the article.

Table of Comparison

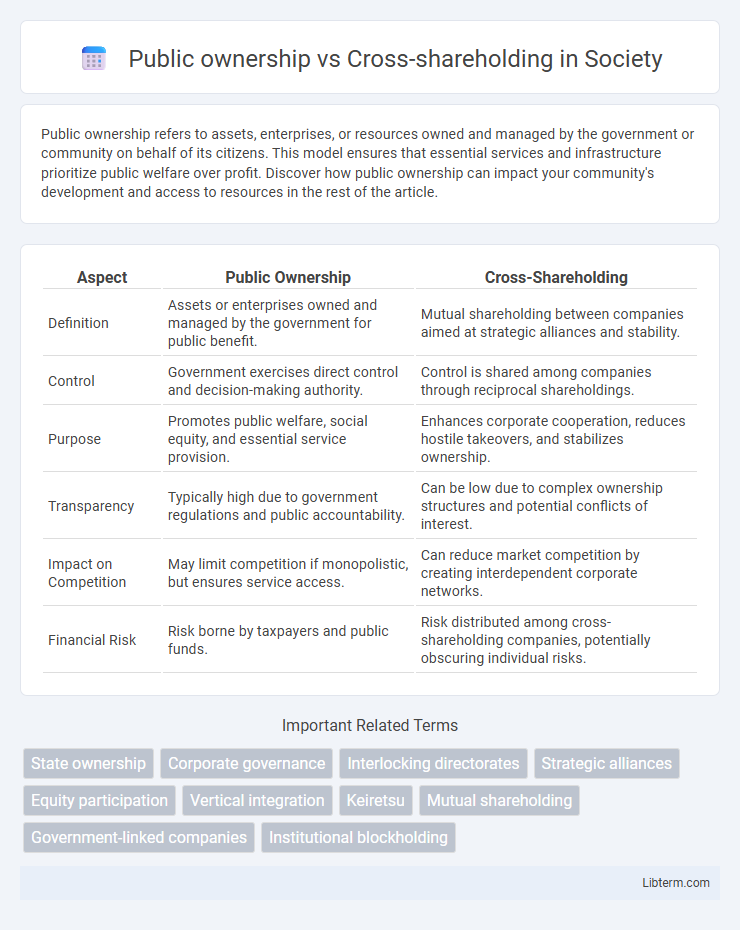

| Aspect | Public Ownership | Cross-Shareholding |

|---|---|---|

| Definition | Assets or enterprises owned and managed by the government for public benefit. | Mutual shareholding between companies aimed at strategic alliances and stability. |

| Control | Government exercises direct control and decision-making authority. | Control is shared among companies through reciprocal shareholdings. |

| Purpose | Promotes public welfare, social equity, and essential service provision. | Enhances corporate cooperation, reduces hostile takeovers, and stabilizes ownership. |

| Transparency | Typically high due to government regulations and public accountability. | Can be low due to complex ownership structures and potential conflicts of interest. |

| Impact on Competition | May limit competition if monopolistic, but ensures service access. | Can reduce market competition by creating interdependent corporate networks. |

| Financial Risk | Risk borne by taxpayers and public funds. | Risk distributed among cross-shareholding companies, potentially obscuring individual risks. |

Introduction to Public Ownership and Cross-Shareholding

Public ownership refers to government control or majority stake in enterprises, ensuring that public interests and social welfare guide business operations. Cross-shareholding describes a strategic exchange of equity stakes between companies to foster mutual cooperation, stabilize ownership, and protect against hostile takeovers. Both frameworks influence corporate governance, affecting decision-making power, accountability, and financial transparency in diverse market environments.

Definitions and Key Concepts

Public ownership refers to assets or companies owned by the government or community, ensuring control and accountability to the public interest, while cross-shareholding involves companies holding shares in each other to strengthen business alliances and defend against hostile takeovers. Public ownership emphasizes transparency, social welfare, and public accountability, whereas cross-shareholding focuses on strategic partnerships, shareholding networks, and mutual influence among corporations. Understanding these concepts highlights differing objectives in corporate governance and investment structures, where public ownership prioritizes communal benefits and cross-shareholding drives corporate control and cooperation.

Historical Evolution of Ownership Structures

The historical evolution of ownership structures reveals public ownership as a model prioritizing dispersed shares among numerous shareholders, fostering market liquidity and regulatory transparency since the 19th century's rise of joint-stock companies. Cross-shareholding emerged notably in post-World War II Japan and Germany, where interconnected shareholdings between firms established stability, mutual control, and long-term strategic alliances, contrasting with the more liquid public ownership model. These distinct ownership evolution paths reflect differing economic priorities: public ownership encourages market-driven governance, while cross-shareholding promotes corporate network resilience and stakeholder alignment.

Advantages of Public Ownership

Public ownership offers greater transparency and accountability due to regulatory requirements and open access to financial information, enhancing investor confidence. It provides companies with easier access to capital markets, facilitating the raising of funds through the issuance of stocks and bonds. Moreover, public ownership enables liquidity for shareholders, allowing them to buy and sell shares freely, which supports market efficiency and value discovery.

Benefits and Drawbacks of Cross-Shareholding

Cross-shareholding fosters long-term business stability and mutual support among allied companies, enhancing collaboration and reducing hostile takeovers. However, it may lead to reduced market transparency, decreased corporate governance accountability, and potential conflicts of interest. Public ownership promotes greater liquidity and shareholder diversity but can expose firms to market volatility and short-term profit pressures.

Corporate Governance Implications

Public ownership enhances corporate transparency and accountability by distributing shares among a broad base of investors, reducing the risk of concentrated control and promoting shareholder rights. Cross-shareholding, where companies mutually hold shares, can create complex interdependencies that may weaken external monitoring and entrench management, potentially leading to conflicts of interest and reduced board independence. Effective corporate governance requires balancing these ownership structures to ensure oversight mechanisms protect minority shareholders and uphold fiduciary responsibilities.

Market Competition and Economic Efficiency

Public ownership ensures state control over key industries, often prioritizing social welfare over profit maximization, which can reduce market competition but enhance economic stability. Cross-shareholding, where companies hold shares in each other, often leads to reduced competition through mutual shareholding agreements and potential collusion, diminishing market efficiency. While public ownership may result in bureaucratic inefficiencies, cross-shareholding can create barriers to entry, limiting innovation and distort economic efficiency in competitive markets.

Risk Management and Financial Stability

Public ownership provides direct control over corporate governance, enhancing risk management through accountability and regulatory oversight, which can improve financial stability by aligning company objectives with public interest. Cross-shareholding creates interconnected corporate networks that may obscure risk exposure and propagate financial distress across firms, potentially undermining market discipline and weakening overall financial stability. Effective risk management in these contexts requires transparent disclosure and robust regulatory frameworks to mitigate systemic vulnerabilities inherent in complex ownership structures.

Regulatory Frameworks and Policy Perspectives

Regulatory frameworks for public ownership typically emphasize transparency, accountability, and protection of minority shareholders, mandating disclosures and governance standards to prevent conflicts of interest. In contrast, cross-shareholding structures pose challenges for regulators due to intertwined ownership that can dilute accountability and complicate antitrust enforcement, prompting policies that limit reciprocal shareholding percentages to promote market competition. Policy perspectives advocate strengthening disclosure requirements and monitoring mechanisms to address risks of reduced market efficiency and potential manipulation inherent in cross-shareholding arrangements.

Future Trends and Global Comparisons

Future trends in public ownership emphasize increased transparency, shareholder activism, and ESG integration, reshaping governance models across global markets. Cross-shareholding, prevalent in regions like Japan and South Korea, faces scrutiny for potentially limiting market fluidity but remains a strategic tool for corporate alliances and stability. Comparative analysis reveals Western markets prioritize dispersed ownership and regulatory transparency, while East Asian markets utilize cross-shareholding to enhance long-term collaboration and control.

Public ownership Infographic

libterm.com

libterm.com