Individual responsibility plays a crucial role in personal growth and societal progress by encouraging accountability for one's actions and decisions. Embracing this concept empowers you to make ethical choices and positively influence your environment. Discover how fostering individual responsibility can transform your life and community in the following article.

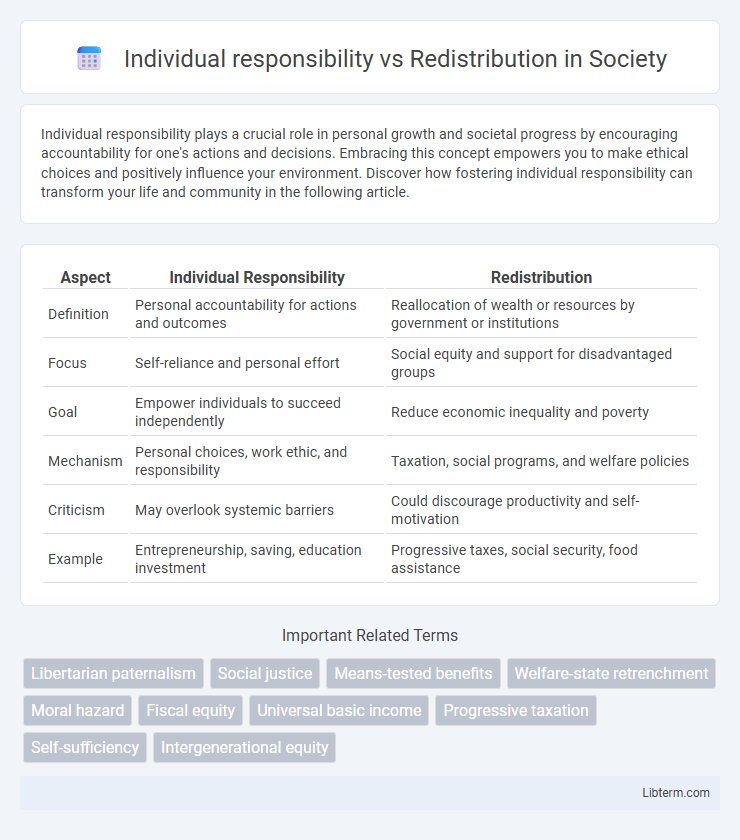

Table of Comparison

| Aspect | Individual Responsibility | Redistribution |

|---|---|---|

| Definition | Personal accountability for actions and outcomes | Reallocation of wealth or resources by government or institutions |

| Focus | Self-reliance and personal effort | Social equity and support for disadvantaged groups |

| Goal | Empower individuals to succeed independently | Reduce economic inequality and poverty |

| Mechanism | Personal choices, work ethic, and responsibility | Taxation, social programs, and welfare policies |

| Criticism | May overlook systemic barriers | Could discourage productivity and self-motivation |

| Example | Entrepreneurship, saving, education investment | Progressive taxes, social security, food assistance |

Defining Individual Responsibility

Individual responsibility refers to the principle that people should be accountable for their own actions and outcomes, emphasizing self-reliance, personal effort, and decision-making. It assumes that individuals have control over their economic and social circumstances, which motivates them to work hard and make prudent choices. This concept is often contrasted with redistribution policies that aim to reduce inequality by reallocating resources through government intervention.

Understanding Redistribution

Redistribution involves reallocating wealth through taxation and social welfare programs to reduce economic inequality. It aims to provide a safety net for vulnerable populations while promoting social equity and cohesion. Understanding redistribution requires analyzing its impact on economic incentives, social mobility, and the balance between individual responsibility and collective support.

Historical Perspectives on Economic Justice

Historical perspectives on economic justice reveal a longstanding debate between individual responsibility and redistribution, tracing back to classical economists like Adam Smith who emphasized personal accountability and market-driven wealth accumulation. Contrasting views from redistributive advocates such as John Rawls argue for fairness through wealth reallocation to correct systemic inequalities and ensure equal opportunity. The tension between these philosophies shapes modern policy discussions on taxation, social welfare, and economic equity worldwide.

Philosophical Foundations of Each Approach

Individual responsibility emphasizes personal accountability and the ethical principle that individuals should bear the consequences of their actions, reflecting philosophies like libertarianism and classical liberalism. Redistribution is rooted in egalitarianism and social justice theories, advocating that society has a moral obligation to reduce economic inequalities through mechanisms such as progressive taxation and welfare programs. These contrasting foundations highlight a debate between prioritizing personal freedom versus collective equity in political philosophy.

Impact on Social Mobility

Individual responsibility emphasizes personal effort and accountability as key drivers of social mobility, encouraging skills development and entrepreneurship. Redistribution policies, such as progressive taxation and social welfare programs, aim to reduce inequality and provide equal opportunities by addressing systemic barriers. The impact on social mobility depends on balancing incentives for personal achievement with support structures that enable disadvantaged groups to access education, healthcare, and economic resources.

The Role of Government in Redistribution

The role of government in redistribution centers on balancing economic equity by reallocating resources through taxation and social welfare programs to support disadvantaged populations. Governments implement progressive tax policies and social safety nets to reduce income inequality and promote social cohesion. Effective redistribution policies rely on targeted interventions that address systemic barriers while preserving incentives for individual responsibility and economic productivity.

Ethical Dilemmas in Policy Making

Ethical dilemmas in policy making often arise when balancing individual responsibility with redistribution, as policies must weigh personal accountability against societal support for equity. Debates center on whether redistributive measures undermine work incentives or fulfill moral obligations to assist vulnerable populations. Policymakers navigate conflicting values of fairness, justice, and economic efficiency, seeking solutions that respect both personal agency and collective welfare.

Economic Outcomes: Growth vs. Equity

Individual responsibility promotes economic growth by incentivizing productivity, innovation, and entrepreneurship, leading to higher GDP and job creation. Redistribution policies focus on equity by reallocating resources through taxation and social programs, reducing income inequality and improving access to education and healthcare. Balancing economic outcomes requires carefully designed policies that foster growth while addressing disparities to enhance social welfare and sustainable development.

Balancing Incentives and Social Safety Nets

Balancing incentives and social safety nets requires carefully designed policies that promote individual responsibility while ensuring adequate redistribution to protect vulnerable populations. Effective social safety nets should minimize disincentives to work by employing means-tested benefits and gradual phase-outs, encouraging productivity and economic participation. Redistribution mechanisms like progressive taxation and targeted welfare programs can reduce inequality without undermining motivation for self-improvement and entrepreneurship.

Future Trends in Social and Economic Policy

Future trends in social and economic policy increasingly emphasize a balanced approach between individual responsibility and redistribution to address growing income inequality and economic insecurity. Policymakers are exploring targeted redistribution mechanisms such as universal basic income and progressive taxation that complement incentives for personal savings, skill development, and entrepreneurship. Advances in data analytics and AI enable more precise identification of vulnerable populations, optimizing the effectiveness of social safety nets while encouraging economic self-sufficiency.

Individual responsibility Infographic

libterm.com

libterm.com