Social insurance provides a safety net by offering financial protection against risks such as unemployment, illness, disability, and retirement. It ensures that individuals receive support during times of need, helping maintain economic stability and peace of mind. Explore the rest of this article to understand how social insurance can benefit your financial future.

Table of Comparison

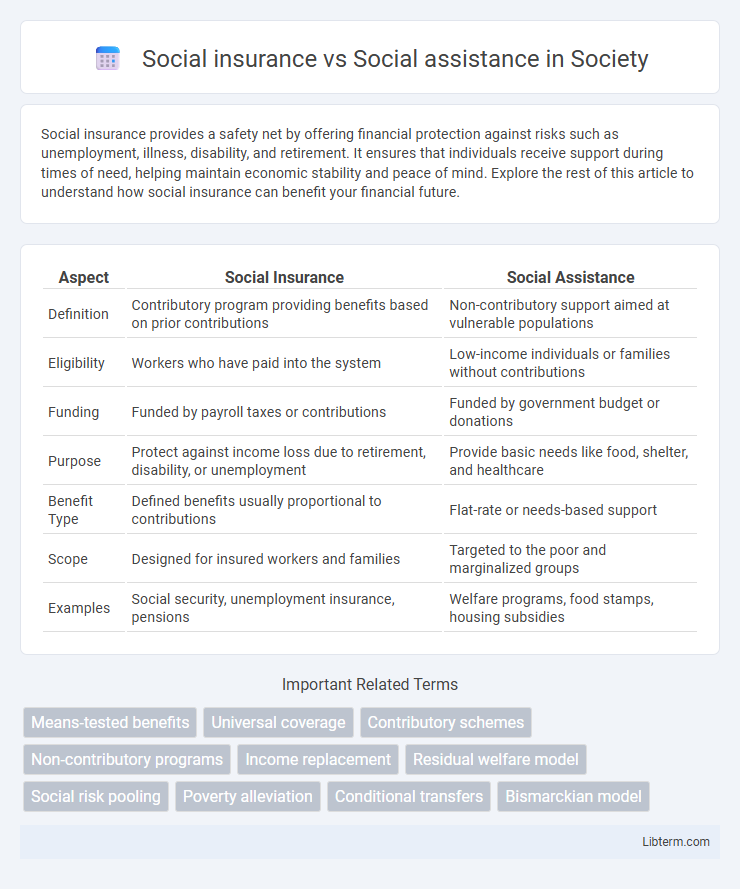

| Aspect | Social Insurance | Social Assistance |

|---|---|---|

| Definition | Contributory program providing benefits based on prior contributions | Non-contributory support aimed at vulnerable populations |

| Eligibility | Workers who have paid into the system | Low-income individuals or families without contributions |

| Funding | Funded by payroll taxes or contributions | Funded by government budget or donations |

| Purpose | Protect against income loss due to retirement, disability, or unemployment | Provide basic needs like food, shelter, and healthcare |

| Benefit Type | Defined benefits usually proportional to contributions | Flat-rate or needs-based support |

| Scope | Designed for insured workers and families | Targeted to the poor and marginalized groups |

| Examples | Social security, unemployment insurance, pensions | Welfare programs, food stamps, housing subsidies |

Introduction to Social Insurance and Social Assistance

Social insurance is a government-run program that provides financial protection to individuals against life risks such as unemployment, disability, or retirement through mandatory contributions. Social assistance refers to need-based government aid aimed at supporting impoverished or vulnerable populations without requiring prior contributions. Both frameworks serve as pillars of social welfare but differ fundamentally in eligibility criteria and funding mechanisms.

Defining Social Insurance

Social insurance is a government program that provides financial protection through contributions from employees, employers, or both, covering risks such as unemployment, illness, disability, and retirement. It operates on the principle of social solidarity, where benefits are tied to prior contributions, ensuring a sustainable funding mechanism. Unlike social assistance, which is need-based and funded by general taxation, social insurance aims to replace lost income and promote economic security.

Defining Social Assistance

Social assistance refers to government programs aimed at providing financial aid and support to individuals and families experiencing poverty or hardship, typically without requiring prior contributions. These programs are means-tested and designed to ensure a basic standard of living through direct cash transfers, housing benefits, or food subsidies. Social assistance contrasts with social insurance, which involves contributory schemes where eligibility depends on previous work-related payments.

Key Differences Between Social Insurance and Social Assistance

Social insurance is a contributory program where beneficiaries pay premiums or taxes to receive benefits like unemployment, pensions, or health coverage, ensuring financial protection based on prior contributions. Social assistance, on the other hand, is non-contributory and targeted at low-income or vulnerable groups, providing direct aid such as cash transfers or food subsidies to alleviate poverty and ensure basic needs. The key differences lie in funding mechanisms, eligibility criteria, and the purpose of support, with social insurance emphasizing earned entitlements and social assistance focusing on need-based aid.

Funding Mechanisms: Contributions vs. Taxation

Social insurance is primarily funded through mandatory contributions from employees and employers, creating a pooled fund for benefits like pensions and unemployment support. Social assistance relies on general taxation, distributing funds collected from various tax sources to provide aid to the needy without prior contributions. The funding mechanism distinguishes social insurance as contributory and earnings-related, whereas social assistance is non-contributory and means-tested.

Eligibility Criteria and Accessibility

Social insurance requires eligibility based on prior contributions through employment, making it accessible primarily to formal sector workers who have accumulated sufficient work credits. Social assistance targets vulnerable populations without contribution requirements, offering accessibility to low-income individuals and marginalized groups regardless of employment history. Eligibility for social assistance is typically means-tested, ensuring support for those facing financial hardship or social exclusion.

Benefits and Coverage Scope

Social insurance programs provide benefits based on prior contributions, offering financial support such as unemployment, disability, and retirement pensions to insured individuals. Social assistance targets vulnerable populations without work history, delivering need-based support including cash transfers, food subsidies, and healthcare aid. Coverage scope of social insurance is typically broader but restricted to contributors, while social assistance ensures minimal welfare access for the impoverished and marginalized groups.

Administrative Structures and Implementation

Social insurance programs operate through contributory schemes managed by government agencies or quasi-independent bodies, ensuring funding via payroll taxes for benefits like pensions, unemployment, and health insurance. Social assistance, by contrast, is typically administered directly by welfare departments or local governments, funded through general taxation to provide need-based support such as cash transfers, food aid, or housing subsidies. Implementation of social insurance relies on formal employment data and consistent contribution mechanisms, whereas social assistance programs depend on means-testing and vulnerability assessments to target resources effectively.

Impact on Poverty Reduction and Social Equity

Social insurance programs, such as unemployment benefits and pensions, provide financial support based on prior contributions, effectively reducing poverty by ensuring income security for working individuals and retirees. Social assistance targets vulnerable groups without prior contributions, offering means-tested support that directly alleviates extreme poverty and promotes social equity for marginalized populations. Combining both approaches creates a comprehensive social safety net that addresses poverty reduction while advancing equitable access to resources across different socioeconomic groups.

Challenges and Future Trends in Social Protection Systems

Social insurance faces challenges such as aging populations, rising healthcare costs, and the need for sustainable funding models, which strain pension and unemployment insurance schemes. Social assistance programs encounter issues including limited coverage, insufficient targeting, and dependency risks, demanding enhanced data-driven policy design and integration with active labor market policies. Future trends in social protection systems emphasize digitalization for improved accessibility, development of universal basic income models, and increased emphasis on inclusive, adaptive frameworks to address evolving socioeconomic inequalities.

Social insurance Infographic

libterm.com

libterm.com