Points are fundamental units used in various fields such as mathematics, gaming, and geography to denote specific values or locations. Understanding how points function can enhance your skills in scoring, navigation, and data analysis. Explore the full article to discover practical applications and tips for maximizing your use of points.

Table of Comparison

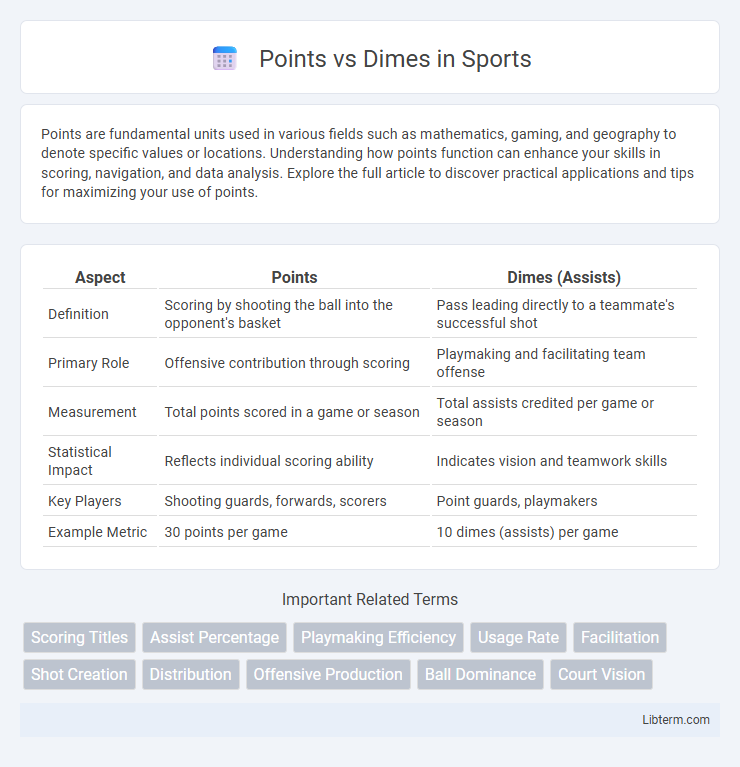

| Aspect | Points | Dimes (Assists) |

|---|---|---|

| Definition | Scoring by shooting the ball into the opponent's basket | Pass leading directly to a teammate's successful shot |

| Primary Role | Offensive contribution through scoring | Playmaking and facilitating team offense |

| Measurement | Total points scored in a game or season | Total assists credited per game or season |

| Statistical Impact | Reflects individual scoring ability | Indicates vision and teamwork skills |

| Key Players | Shooting guards, forwards, scorers | Point guards, playmakers |

| Example Metric | 30 points per game | 10 dimes (assists) per game |

Understanding Points and Dimes: Definitions and Basics

Points and dimes are both terms used in mortgage lending to describe upfront fees paid at closing. A point represents 1% of the loan amount and is typically used to buy down the interest rate, lowering monthly payments. Dimes, while less common, refer to smaller increments of fee payment or interest adjustment, often used in specific loan structures or to cover minor costs.

Historical Context: Points and Dimes in Financial Markets

Points and dimes have historically served as fundamental units of price movement in financial markets, particularly in futures and options trading. A point typically represents a full unit change in an asset's price, while a dime, equivalent to one-tenth of a point, allows traders to measure smaller increments of price fluctuations and volatility more precisely. This division into points and dimes enhances market transparency and helps traders accurately gauge asset value changes and execute more nuanced trading strategies.

Points vs Dimes: Key Differences Explained

Points and dimes are terms related to interest rates in mortgage loans but differ in payment structure and purpose. Points, also known as discount points, are upfront fees paid to lower the loan's interest rate, with one point equaling 1% of the loan amount, while dimes refer to smaller increments affecting interest rate adjustments or fees. Understanding the distinction between points, which reduce long-term borrowing costs, and dimes, often used in rate adjustments, is crucial for optimizing mortgage financing strategies.

Usage in Stock Trading: Points vs Dimes

In stock trading, points represent the absolute change in a stock's price, where one point equals one dollar per share, making it a straightforward metric for measuring gains or losses. Dimes refer to a price increment of ten cents and are commonly used to track smaller price movements within highly liquid stocks or options, providing granular insight into market fluctuations. Traders often analyze both points and dimes to gauge market momentum and execute precise entry or exit strategies based on the stock's price volatility.

Application in Sports Betting: Points and Dimes Demystified

In sports betting, points and dimes refer to the increments by which odds or point spreads change, with points typically representing a full unit movement and dimes indicating a 0.1 or tenth unit shift. Points shifts often reflect significant market or team performance changes, influencing betting strategies and payout calculations more dramatically than dimes. Understanding the difference between these increments enables bettors to interpret line movements more accurately and optimize wagers based on subtle odds adjustments.

Importance in Forex & Commodities Trading

Points and dimes represent crucial units of measurement in Forex and commodities trading, directly impacting profit and loss calculations. In Forex, a point typically refers to the smallest price movement, often a pip, essential for precise trade execution and risk management. In commodities trading, dimes denote price changes measured in tenths of a cent, helping traders assess market volatility and make informed decisions.

How Financial Pros Use Points and Dimes

Financial professionals strategically leverage points to maximize credit card rewards and loyalty programs, converting them into significant travel, cashback, or merchandise benefits. Experts meticulously track dimes by monitoring small dollar transactions to manage budgets and optimize savings efficiently. Combining points accumulation with dimes management allows savvy investors to enhance overall financial returns and improve cash flow control.

Real-World Examples: Points vs Dimes in Practice

In mortgage lending, Points are upfront fees paid to lower interest rates, such as paying 2 points on a $300,000 loan equating to $6,000 to reduce the rate by 0.25%. Conversely, Dimes refer to smaller fractional payments often seen in credit card interest calculations, where a daily periodic rate applied to the outstanding balance accrues incremental interest charges. Real-world application shows borrowers might opt to pay points when planning long-term homeownership to save on interest, while dimes represent frequent, smaller cost increments in short-term credit usage.

Common Misconceptions About Points and Dimes

Points and dimes in mortgage lending are often confused, but points represent 1% of the loan amount paid upfront to reduce interest rates, while dimes refer to smaller, less common fees. A common misconception is that paying points always saves money long-term, but this depends on how long the borrower stays in the home and overall loan terms. Borrowers should carefully evaluate the break-even period to determine whether paying points or dimes aligns with their financial goals.

Choosing the Right Metric: When to Use Points or Dimes

Choosing the right metric between points and dimes depends on the context of customer behavior analysis and transaction tracking. Points are best suited for loyalty programs where cumulative user engagement or reward accumulation needs to be quantified, while dimes excel in tracking smaller monetary increments or specific spending events. Businesses aiming to optimize rewards strategies should consider using points for broad engagement measures and dimes for detailed transaction value insights.

Points Infographic

libterm.com

libterm.com