Spread refers to the difference between two prices, rates, or yields in financial markets, often indicating transaction costs or market liquidity. Understanding how spreads impact your trades is essential for making informed investment decisions and minimizing costs. Explore the rest of this article to learn how spreads influence various markets and strategies.

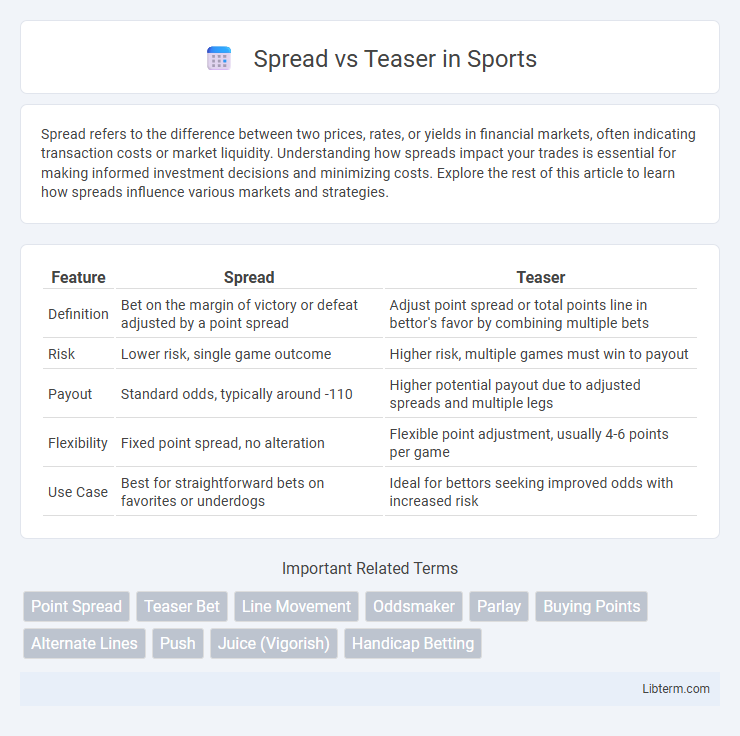

Table of Comparison

| Feature | Spread | Teaser |

|---|---|---|

| Definition | Bet on the margin of victory or defeat adjusted by a point spread | Adjust point spread or total points line in bettor's favor by combining multiple bets |

| Risk | Lower risk, single game outcome | Higher risk, multiple games must win to payout |

| Payout | Standard odds, typically around -110 | Higher potential payout due to adjusted spreads and multiple legs |

| Flexibility | Fixed point spread, no alteration | Flexible point adjustment, usually 4-6 points per game |

| Use Case | Best for straightforward bets on favorites or underdogs | Ideal for bettors seeking improved odds with increased risk |

Understanding the Basics: Spread vs Teaser

A spread refers to the difference between the interest rates of two financial instruments, often used to assess risk or profitability, while a teaser is a low initial interest rate offered to attract borrowers before it resets to a higher rate. Understanding the basics of spread vs teaser involves recognizing that spreads provide a comparative measure of yield or cost between securities, whereas teaser rates are promotional tools designed to entice short-term engagement. This distinction is crucial for investors and borrowers to accurately evaluate borrowing costs and investment returns.

Definitions: What Is a Spread? What Is a Teaser?

A spread is the difference between the bid and ask prices of a financial instrument, representing the transaction cost and liquidity of the market. A teaser is a marketing tactic or introductory offer used by lenders or brokers to attract customers with temporarily low rates or favorable terms. Understanding the spread helps traders evaluate market efficiency, while recognizing a teaser enables consumers to assess the true cost after promotional periods end.

Key Differences Between Spread and Teaser Bets

Spread bets involve wagering on the margin of victory, requiring the favorite to win by more than a specified point spread for the bet to succeed, while teaser bets allow bettors to adjust the point spread in their favor across multiple games with lower odds. Spread bets offer straightforward risks and payouts based on set margins, whereas teaser bets combine several spreads into one bet, increasing the chance of winning but reducing the payout due to adjusted lines. Understanding these key differences helps bettors balance potential returns against risk by choosing either individual spreads or multi-game teasers tailored to their strategy.

How Spread Betting Works

Spread betting involves speculating on the price movement of financial instruments without owning the underlying asset, where the spread represents the difference between the bid and ask prices set by the bookmaker. Traders place bets on whether the market price will rise above or fall below the spread, with profits or losses determined by the extent of the price movement relative to the spread. This leveraged product allows for both long and short positions, amplifying potential gains and risks based on the size and direction of the bet.

How Teaser Bets Function

Teaser bets function by allowing bettors to adjust the point spread or totals in their favor for multiple games, typically by 6 to 7 points, creating a more achievable outcome while requiring all selections to win. Unlike standard spread bets, teasers offer lower odds but enhance the chance of winning by shifting the line toward the bettor's preferred side. Sportsbooks set specific teaser rules, including minimum leg requirements and varying point adjustments based on the sport, making understanding these details crucial for maximizing teaser bet value.

Pros and Cons of Spread Bets

Spread bets allow traders to speculate on the price movement of assets without owning them, offering tax-free profits in some jurisdictions and the ability to leverage positions. However, they carry significant risks including potential losses exceeding the initial stake due to leverage, and spread costs can reduce profitability, especially in volatile markets. Moreover, lack of ownership means traders miss out on dividends or shareholder rights, limiting longer-term investment benefits.

Advantages and Disadvantages of Teaser Bets

Teaser bets allow bettors to adjust point spreads or totals to create more favorable odds, increasing the chance of winning by shifting the line in their favor. The main advantage of teaser bets is reduced risk due to the altered spread, but the trade-off includes lower payouts compared to standard spread bets. A significant disadvantage is the requirement to win all legs of the teaser parlay, increasing the risk of losing the entire bet despite the adjusted lines.

Payout Potential: Spread vs Teaser

Spread bets offer consistent payout potential with defined risk and reward ratios based on the point differences between teams. Teaser bets adjust the point spread in favor of the bettor, increasing the likelihood of winning but reducing the payout due to lower odds. Understanding the trade-off between enhanced winning chances and diminished payout is crucial when choosing between spread and teaser bets.

Risk Management Strategies for Spreads and Teasers

Spreads and teasers are advanced risk management strategies in options trading designed to limit potential losses while maximizing gains through adjusted strike prices or expiration dates. Spreads involve taking simultaneous long and short positions in related options, reducing overall risk exposure by offsetting potential losses, whereas teasers adjust point spreads or totals in sports betting, allowing bettors to modify odds in their favor with reduced risk but potentially capped winnings. Effective use of these strategies requires careful analysis of market conditions and understanding of how changing multiple variables can control risk while targeting favorable outcomes.

Choosing the Best Option: Spread or Teaser?

Choosing the best option between spread and teaser loans depends on your financial goals and risk tolerance. Spread loans typically offer higher payments with less interest savings, suitable for steady borrowers seeking short-term gains, while teaser loans attract borrowers with low initial rates that increase after the introductory period, ideal for those expecting improved credit or income. Evaluating current interest rates, loan terms, and personal financial stability helps determine whether the fixed saving of a spread or the initial affordability of a teaser aligns better with your needs.

Spread Infographic

libterm.com

libterm.com