Internal Rate of Return (IRR) is a key financial metric used to evaluate the profitability of potential investments by calculating the discount rate that makes the net present value (NPV) of all cash flows equal to zero. Understanding IRR helps you compare projects, making it easier to identify investments that maximize your returns. Dive deeper into the article to learn how to calculate IRR and apply it effectively to your financial decisions.

Table of Comparison

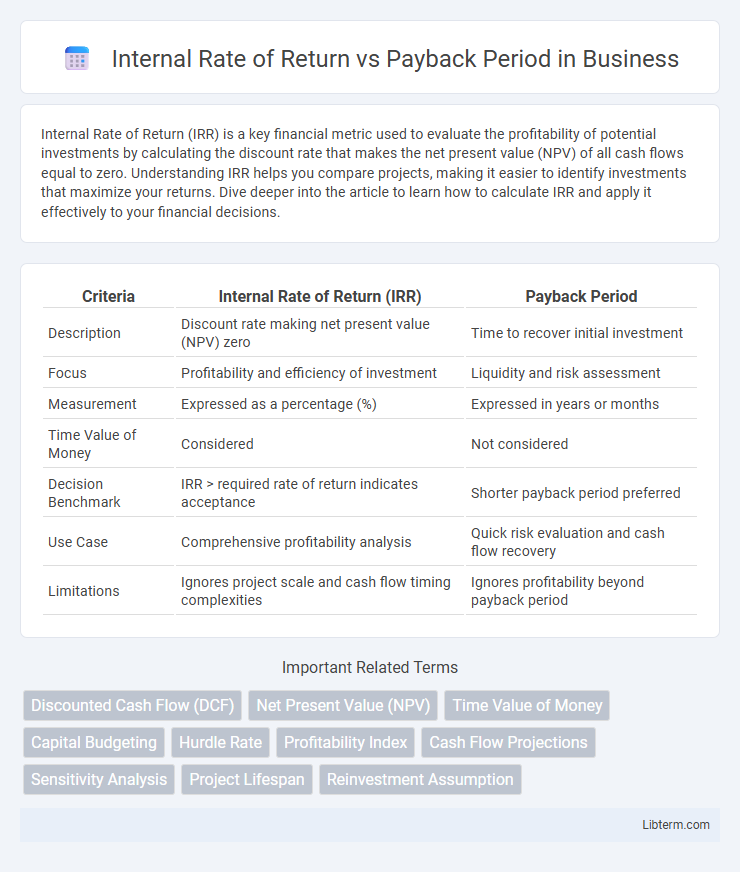

| Criteria | Internal Rate of Return (IRR) | Payback Period |

|---|---|---|

| Description | Discount rate making net present value (NPV) zero | Time to recover initial investment |

| Focus | Profitability and efficiency of investment | Liquidity and risk assessment |

| Measurement | Expressed as a percentage (%) | Expressed in years or months |

| Time Value of Money | Considered | Not considered |

| Decision Benchmark | IRR > required rate of return indicates acceptance | Shorter payback period preferred |

| Use Case | Comprehensive profitability analysis | Quick risk evaluation and cash flow recovery |

| Limitations | Ignores project scale and cash flow timing complexities | Ignores profitability beyond payback period |

Introduction to Investment Appraisal Methods

Internal Rate of Return (IRR) and Payback Period are fundamental investment appraisal methods used to evaluate project viability and profitability. IRR calculates the discount rate that makes the net present value (NPV) of cash flows zero, emphasizing the project's rate of return, while the Payback Period measures the time required to recover the initial investment, highlighting liquidity and risk. Both metrics support capital budgeting decisions by providing insights into project profitability and financial feasibility but differ in complexity and focus timeframe.

Understanding Internal Rate of Return (IRR)

Internal Rate of Return (IRR) measures the profitability of potential investments by calculating the discount rate that makes the net present value (NPV) of cash flows equal to zero. IRR provides a percentage value representing the expected annual return, facilitating comparison across projects with varying sizes and durations. Understanding IRR helps investors assess the efficiency of an investment, often leading to more informed decision-making compared to the Payback Period, which only indicates how quickly initial costs are recouped.

Exploring the Payback Period Method

The Payback Period method calculates the time required to recover the initial investment from cash inflows, emphasizing liquidity and risk reduction. Unlike the Internal Rate of Return (IRR), which considers the time value of money and overall profitability, the Payback Period is simpler and more intuitive for quick decision-making. This method is particularly useful for projects where cash flow timing and capital recovery speed are critical factors for investors.

Key Differences Between IRR and Payback Period

Internal Rate of Return (IRR) measures the profitability of an investment by calculating the discount rate that makes the net present value (NPV) zero, emphasizing long-term cash flows and overall project viability. In contrast, the Payback Period calculates the time required to recover the initial investment, focusing solely on liquidity and risk by ignoring the time value of money and cash flows beyond the payback cutoff. IRR provides a percentage return useful for comparing projects, while Payback Period offers a simple risk assessment tool, making them complementary but fundamentally different financial metrics.

Advantages of Using Internal Rate of Return

Internal Rate of Return (IRR) provides a comprehensive measure of an investment's profitability by accounting for the time value of money, unlike the Payback Period which only measures how quickly initial costs are recovered. IRR enables comparison between projects of different scales and durations by expressing returns as a percentage, facilitating better decision-making for long-term investments. This metric assists investors in evaluating the efficiency and potential growth of projects by considering all future cash flows, making it a more accurate tool for investment appraisal.

Benefits and Limitations of the Payback Period

The Payback Period method offers the benefit of simplicity and quick assessment of investment risk by measuring how fast initial capital can be recovered, providing a straightforward metric for liquidity preference. However, its limitations include ignoring the time value of money and cash flows beyond the payback cut-off, potentially misrepresenting project profitability and long-term value creation. This contrast makes the Payback Period less reliable compared to the Internal Rate of Return (IRR), which incorporates the entire cash flow stream and discounting effects for a comprehensive evaluation.

Application Scenarios: When to Use IRR or Payback Period

The Internal Rate of Return (IRR) is best applied in long-term investment projects where the focus is on profitability and overall yield, making it ideal for comparing projects with different cash flow patterns. The Payback Period is more suitable for short-term projects or businesses prioritizing liquidity and quick recovery of initial capital, as it measures how fast the invested funds can be recouped. Companies often use IRR in capital budgeting decisions for large-scale investments, while Payback Period is preferred in risk-sensitive environments or when evaluating projects with high uncertainty.

Real-World Examples Comparing IRR and Payback Period

Real-world examples illustrate that the Internal Rate of Return (IRR) provides a more comprehensive profitability measure than the Payback Period by accounting for the time value of money and total project returns. For instance, a renewable energy project with a high initial outlay may have a longer payback period but yield a superior IRR, reflecting its long-term value. Conversely, short-term retail investments often show faster payback periods but lower IRRs, highlighting the limitations of using payback period as the sole decision metric.

Common Pitfalls in Investment Evaluation

Internal Rate of Return (IRR) often misleads investors due to multiple project rates or unrealistic reinvestment assumptions, causing overestimation of profitability. Payback Period ignores cash flows beyond the recovery time and lacks consideration for the time value of money, leading to potential undervaluation of long-term benefits. Relying solely on IRR or Payback Period without complementary metrics like Net Present Value (NPV) results in incomplete investment evaluation and increased risk of misguided decisions.

Conclusion: Choosing the Right Method for Your Project

Selecting the appropriate evaluation method depends on your project's financial goals and risk tolerance. The Internal Rate of Return (IRR) provides a comprehensive measure of profitability by accounting for the time value of money, making it ideal for long-term investments with multiple cash flows. In contrast, the Payback Period emphasizes liquidity and risk reduction by highlighting how quickly initial investments are recovered, which benefits projects requiring fast capital turnover.

Internal Rate of Return Infographic

libterm.com

libterm.com