Cash acquisition involves one company purchasing another using cash rather than stocks or other securities, providing immediate liquidity to the sellers. This method ensures a straightforward transaction with clear valuation, often preferred in competitive bids or when quick closure is needed. Discover how cash acquisitions can impact your business strategy and financial planning in the full article.

Table of Comparison

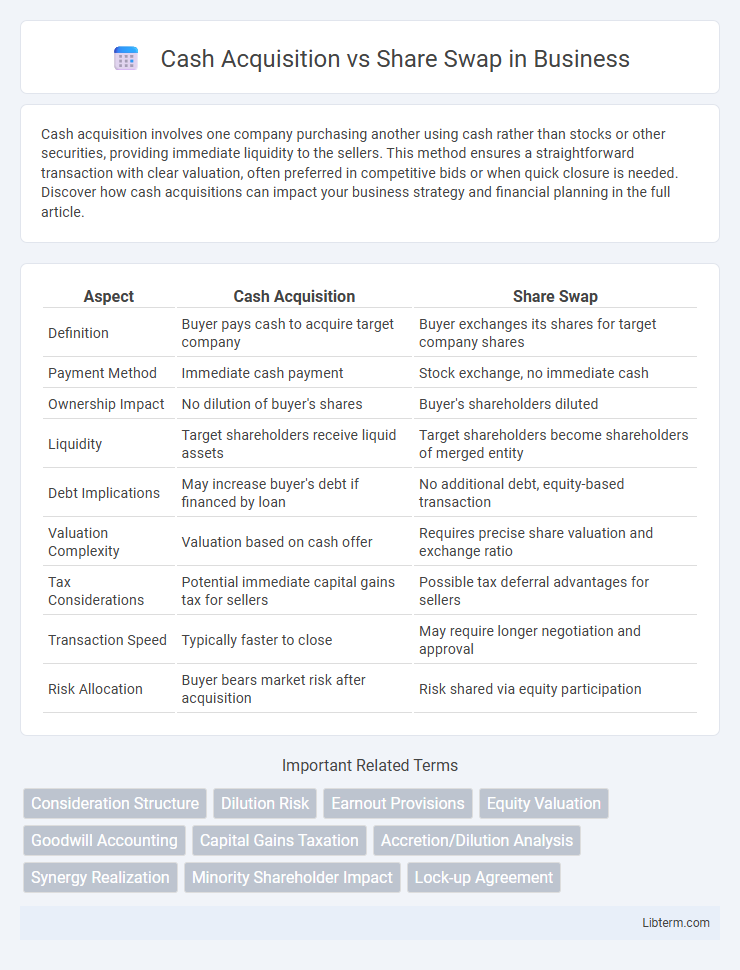

| Aspect | Cash Acquisition | Share Swap |

|---|---|---|

| Definition | Buyer pays cash to acquire target company | Buyer exchanges its shares for target company shares |

| Payment Method | Immediate cash payment | Stock exchange, no immediate cash |

| Ownership Impact | No dilution of buyer's shares | Buyer's shareholders diluted |

| Liquidity | Target shareholders receive liquid assets | Target shareholders become shareholders of merged entity |

| Debt Implications | May increase buyer's debt if financed by loan | No additional debt, equity-based transaction |

| Valuation Complexity | Valuation based on cash offer | Requires precise share valuation and exchange ratio |

| Tax Considerations | Potential immediate capital gains tax for sellers | Possible tax deferral advantages for sellers |

| Transaction Speed | Typically faster to close | May require longer negotiation and approval |

| Risk Allocation | Buyer bears market risk after acquisition | Risk shared via equity participation |

Introduction to Cash Acquisition and Share Swap

Cash acquisition involves one company purchasing another using cash payments, providing immediate liquidity to shareholders of the target firm. Share swap entails the acquiring company offering its own shares to the target company's shareholders in exchange for ownership, enabling equity-based transactions without immediate cash outflow. Both methods facilitate mergers and acquisitions but differ in financial structure and impact on shareholder control.

Key Differences Between Cash Acquisition and Share Swap

Cash acquisition involves purchasing a company's shares or assets using cash, providing immediate liquidity to the sellers, whereas share swap entails exchanging the seller's shares for shares in the acquiring company, facilitating ownership transfer without cash outflow. Key differences include risk assumption, with cash acquisitions transferring risk entirely to the buyer, while share swaps distribute post-merger risks between both parties based on stock performance. Valuation complexity is higher in share swaps due to fluctuating stock prices, contrasting with the fixed and straightforward valuation in cash acquisitions.

Strategic Objectives Behind Each Method

Cash acquisition enables companies to gain full control over target assets quickly, supporting strategic goals like market expansion, operational integration, and financial consolidation. Share swaps facilitate mergers by aligning shareholder interests, preserving cash reserves, and fostering long-term partnerships or joint ventures, often enhancing capital structure flexibility. Each method serves distinct strategic objectives: cash acquisitions prioritize immediate ownership and control, while share swaps emphasize collaborative growth and shared risk management.

Financial Implications for Buyers and Sellers

Cash acquisition provides buyers with immediate ownership transfer and clear valuation but requires substantial liquidity, impacting cash flow and potentially increasing debt levels. Sellers receive instant payment, offering certainty and reduced risk, but forgo potential future upside linked to the company's equity performance. Share swaps align seller interests with the company's future growth, preserving cash for buyers, though they introduce valuation risks and potential share dilution for existing shareholders.

Impact on Shareholder Value

Cash acquisition offers immediate liquidity to shareholders, providing certainty of value and eliminating market risk associated with share price fluctuations. Share swaps, by contrast, allow shareholders to participate in the future growth of the combined company but expose them to integration risks and potential dilution. The impact on shareholder value depends on deal structure, synergies realized, and market perception, with cash deals typically favored for short-term certainty, while share swaps may enhance long-term value creation.

Tax Considerations and Compliance Issues

Cash acquisitions often trigger immediate taxable events for shareholders, leading to capital gains tax liabilities based on the sale of shares. Share swaps may qualify for tax-deferred treatment under specific sections of tax codes, provided they meet compliance criteria such as continuity of interest and business purpose requirements. Both methods require meticulous adherence to regulatory frameworks, including securities laws and tax reporting obligations, to avoid penalties and ensure proper valuation and disclosure.

Risks and Challenges Associated with Each Approach

Cash acquisition risks include liquidity constraints, high debt burden, and potential strain on company cash flow, while challenges involve valuation accuracy and integration costs. Share swap risks involve dilution of existing shareholders' equity and potential misalignment of interests, with challenges in assessing fair exchange ratios and managing post-merger cultural integration. Both approaches face regulatory scrutiny and market sentiment impact, affecting deal success and shareholder value preservation.

Case Studies Illustrating Cash Acquisition and Share Swap

Case studies of cash acquisition highlight Walmart's 2018 purchase of Flipkart for $16 billion, emphasizing immediate ownership transfer and cash flow impact. In contrast, the Share Swap method is exemplified by the 2016 merger between US Airways and American Airlines, where equity exchange enabled a strategic alliance without upfront cash disbursement. These examples illustrate how cash acquisitions provide liquidity advantages, while share swaps facilitate value-based mergers, aligning shareholder interests.

Factors Influencing the Choice Between Methods

Factors influencing the choice between cash acquisition and share swap include company valuation, liquidity position, and tax implications. Companies with strong cash reserves prefer cash acquisitions for immediate control and simplicity, while those seeking to preserve cash flow or align interests favor share swaps. Market conditions and shareholder approval also significantly impact the selection of the appropriate merger method.

Conclusion: Selecting the Optimal Acquisition Strategy

Selecting the optimal acquisition strategy depends on the acquiring company's financial health, market conditions, and shareholder preferences. Cash acquisitions offer immediate liquidity and simplicity but may strain cash reserves, while share swaps preserve cash flow and leverage stock value but can dilute ownership. Evaluating factors such as tax implications, control retention, and long-term strategic goals ensures a well-informed decision between cash acquisition and share swap.

Cash Acquisition Infographic

libterm.com

libterm.com