Effective financial control ensures your organization maintains budget discipline, minimizes risks, and maximizes resource allocation for sustained growth. Implementing robust monitoring systems and accurate forecasting techniques enables timely decision-making and operational efficiency. Discover practical strategies to enhance your financial control in the rest of this article.

Table of Comparison

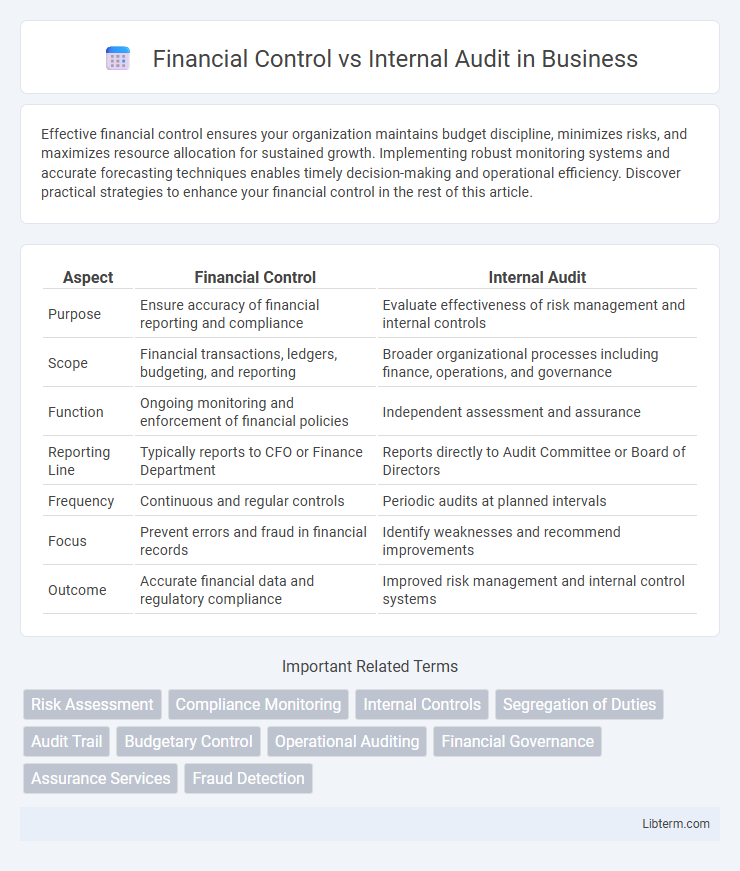

| Aspect | Financial Control | Internal Audit |

|---|---|---|

| Purpose | Ensure accuracy of financial reporting and compliance | Evaluate effectiveness of risk management and internal controls |

| Scope | Financial transactions, ledgers, budgeting, and reporting | Broader organizational processes including finance, operations, and governance |

| Function | Ongoing monitoring and enforcement of financial policies | Independent assessment and assurance |

| Reporting Line | Typically reports to CFO or Finance Department | Reports directly to Audit Committee or Board of Directors |

| Frequency | Continuous and regular controls | Periodic audits at planned intervals |

| Focus | Prevent errors and fraud in financial records | Identify weaknesses and recommend improvements |

| Outcome | Accurate financial data and regulatory compliance | Improved risk management and internal control systems |

Introduction to Financial Control and Internal Audit

Financial control encompasses the processes and procedures organizations use to manage budgets, monitor expenses, and ensure compliance with financial policies, aiming to safeguard assets and optimize financial performance. Internal audit independently evaluates the effectiveness and reliability of these financial controls, providing assurance on risk management practices and identifying areas for improvement. Both functions are essential for maintaining financial integrity and enhancing organizational governance.

Defining Financial Control: Purpose and Functions

Financial control encompasses the processes and procedures designed to safeguard assets, ensure accurate financial reporting, and promote operational efficiency within an organization. Its primary functions include budget management, monitoring expenditures, enforcing compliance with financial policies, and mitigating risks related to fraud or mismanagement. By establishing robust financial controls, companies maintain accountability and support strategic decision-making aligned with organizational goals.

Understanding Internal Audit: Scope and Objectives

Internal audit encompasses a systematic evaluation of financial and operational activities to ensure compliance with policies, risk management, and internal controls. Its scope includes assessing the effectiveness of governance processes, detecting fraud, and verifying the accuracy of financial reporting. The primary objective of internal audit is to provide independent assurance that an organization's risk management, control, and governance processes are functioning effectively.

Key Differences Between Financial Control and Internal Audit

Financial control primarily focuses on managing and overseeing an organization's financial resources, ensuring accuracy in financial reporting, budgeting, and compliance with regulatory requirements. Internal audit, on the other hand, evaluates the effectiveness of internal controls, risk management processes, and governance to provide independent assurance on operations. Key differences include financial control's operational role in maintaining financial discipline, whereas internal audit serves a consultative and assurance role by assessing control adequacy and recommending improvements.

Roles and Responsibilities of Financial Controllers

Financial controllers oversee the accuracy and integrity of an organization's financial reporting, manage budgeting processes, and ensure compliance with accounting standards and regulatory requirements. Their responsibilities include monitoring financial transactions, preparing financial statements, leading risk management efforts, and implementing internal controls to prevent fraud and errors. Unlike internal auditors who independently evaluate financial processes, financial controllers are directly responsible for maintaining daily financial operations and supporting strategic financial planning.

The Internal Audit Process: Steps and Best Practices

The internal audit process involves a systematic approach including planning, fieldwork, reporting, and follow-up to ensure organizational compliance and risk management. Best practices emphasize risk-based audit planning, effective communication with stakeholders, and detailed documentation to enhance transparency and accountability. Integration with financial control functions strengthens internal controls by providing independent assurance and identifying areas for improvement.

Importance of Segregation of Duties

Segregation of duties is critical in financial control and internal audit to prevent fraud and ensure accuracy in financial reporting. By dividing responsibilities among different individuals, organizations reduce risks related to errors and unauthorized activities. This principle strengthens internal controls and enhances the reliability of audit processes, safeguarding assets and maintaining regulatory compliance.

Impact on Organizational Risk Management

Financial control establishes structured processes and policies that ensure accuracy in financial reporting and compliance with regulations, directly reducing risks related to fraud and financial misstatement. Internal audit provides an independent evaluation of these controls, identifying gaps and recommending improvements to strengthen risk mitigation strategies. Together, they enhance an organization's risk management framework by promoting transparency, accountability, and continuous monitoring of financial risks.

Collaboration Between Financial Control and Internal Audit

Financial Control and Internal Audit collaborate closely to enhance organizational risk management and compliance by sharing detailed financial data and audit findings. Financial Control provides real-time financial reporting and variance analysis, which Internal Audit uses to identify control weaknesses and operational risks. This synergy ensures continuous monitoring, improves internal controls, and supports effective decision-making aligned with regulatory requirements.

Conclusion: Enhancing Governance Through Effective Controls

Financial control and internal audit collectively strengthen corporate governance by ensuring accurate financial reporting and compliance with regulations. Effective financial controls establish reliable processes that minimize risks, while internal audits provide independent assessments to detect and correct deficiencies. Integrating both functions promotes transparency, accountability, and continuous improvement in organizational oversight.

Financial Control Infographic

libterm.com

libterm.com