Position building is a critical SEO strategy focused on improving your website's ranking on search engine results pages through targeted keyword optimization and authoritative backlink acquisition. Enhancing your site's position increases visibility, drives organic traffic, and establishes your brand's credibility in competitive markets. Explore the rest of this article to discover effective position building techniques that can elevate your online presence.

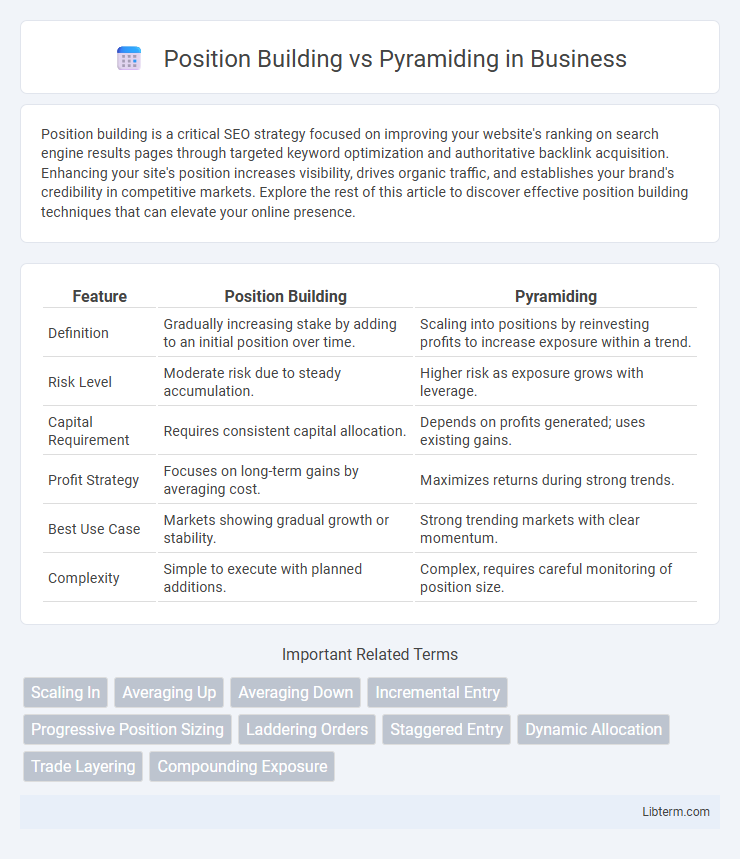

Table of Comparison

| Feature | Position Building | Pyramiding |

|---|---|---|

| Definition | Gradually increasing stake by adding to an initial position over time. | Scaling into positions by reinvesting profits to increase exposure within a trend. |

| Risk Level | Moderate risk due to steady accumulation. | Higher risk as exposure grows with leverage. |

| Capital Requirement | Requires consistent capital allocation. | Depends on profits generated; uses existing gains. |

| Profit Strategy | Focuses on long-term gains by averaging cost. | Maximizes returns during strong trends. |

| Best Use Case | Markets showing gradual growth or stability. | Strong trending markets with clear momentum. |

| Complexity | Simple to execute with planned additions. | Complex, requires careful monitoring of position size. |

Introduction to Position Building and Pyramiding

Position building involves gradually accumulating shares of a security over time to establish a significant investment stake without causing drastic price fluctuations, ensuring better entry points and risk management. Pyramiding is a trading strategy where investors use unrealized profits from existing positions to leverage and acquire additional shares, amplifying potential gains while increasing exposure. Both methods focus on optimizing market entry but differ in capital allocation and risk tolerance during the accumulation process.

Defining Position Building

Position building refers to the gradual accumulation of assets over time to establish a significant market stake, allowing investors to enter or increase holdings without causing drastic price fluctuations. This strategy often involves strategic purchasing at various price levels, aiming to optimize entry points while managing risk exposure. Unlike pyramiding, which relies on using unrealized profits to fund additional entries, position building focuses on deliberate, planned acquisition based on thorough market analysis.

What is Pyramiding in Trading?

Pyramiding in trading is a strategy where traders increase their position size by adding to existing profitable trades, using unrealized gains as margin to amplify potential returns. This technique leverages compounding profits to maximize exposure while minimizing initial capital outlay, commonly employed in trending markets. Unlike position building, which involves establishing a full position over time, pyramiding specifically layers additional trades on winning positions to accelerate growth.

Core Differences Between Position Building and Pyramiding

Position building involves gradually accumulating shares over time to establish a strong market presence, while pyramiding uses unrealized gains from existing positions as collateral to invest in more shares, leveraging profits. Unlike position building, which emphasizes steady entry and risk control, pyramiding accelerates exposure by reinvesting profits, increasing both potential returns and risk. The core difference lies in risk management: position building prioritizes incremental growth, whereas pyramiding relies on leveraging gains to amplify position size.

Advantages of Position Building Strategies

Position building strategies allow traders to gradually accumulate assets, minimizing market impact and avoiding sudden price spikes commonly associated with large orders. This approach enables better risk management by distributing entry points over time, reducing exposure to short-term volatility. Consistent accumulation during favorable market conditions enhances the potential for long-term gains while maintaining flexibility to adjust positions as trends develop.

Benefits and Risks of Pyramiding Techniques

Pyramiding involves increasing a position by using unrealized profits as margin for new trades, which can amplify gains during strong trends but also magnify losses if the market reverses. This technique benefits traders by leveraging profits to enhance returns without additional capital, yet it carries significant risks including margin calls and exacerbated drawdowns. Effective pyramiding requires strict risk management and market timing to avoid rapid portfolio depletion.

Key Scenarios to Use Position Building

Position building is ideal in volatile markets where traders want to accumulate shares gradually to avoid price slippage, allowing entry at multiple levels. It suits long-term investment strategies, enabling cost averaging and minimizing risk during price fluctuations. Pyramiding, conversely, works best in strong trending markets to maximize gains by adding to winning positions but requires precise timing and risk management.

Best Practices for Safe Pyramiding

Safe pyramiding involves adding to winning positions cautiously by scaling in incrementally, ensuring each new layer is supported by strong price momentum and clear technical signals. Risk management best practices include setting strict stop-loss levels at each stage and avoiding over-leveraging to prevent large drawdowns. Position building focuses on initial entry sizing, whereas pyramiding optimizes gains by layering trades, emphasizing disciplined monitoring and exit strategies to preserve capital.

Common Mistakes in Both Approaches

Common mistakes in position building involve overextending capital too quickly without proper risk management, leading to significant losses when market conditions shift unexpectedly. In pyramiding, traders often err by increasing positions too aggressively based on short-term gains, which can amplify losses and reduce overall portfolio stability. Both approaches suffer when traders fail to set appropriate stop-loss levels and ignore market volatility, resulting in amplified risk and potential capital erosion.

Choosing the Right Strategy for Your Trading Style

Position building allows traders to incrementally add shares over time to establish a larger stake, suitable for those favoring long-term growth and lower risk exposure. Pyramiding involves using unrealized profits to increase position size during winning trades, ideal for aggressive traders with a high risk tolerance seeking to maximize gains quickly. Selecting the strategy depends on your risk appetite, trading horizon, and market volatility tolerance to align with your overall investment goals.

Position Building Infographic

libterm.com

libterm.com