A forward contract is a customized agreement between two parties to buy or sell an asset at a specified price on a future date, providing a way to hedge against price fluctuations. These contracts are commonly used in commodities, currencies, and interest rates to lock in costs or revenues and manage financial risk effectively. Discover how forward contracts can secure your financial strategies by exploring the detailed insights in the rest of this article.

Table of Comparison

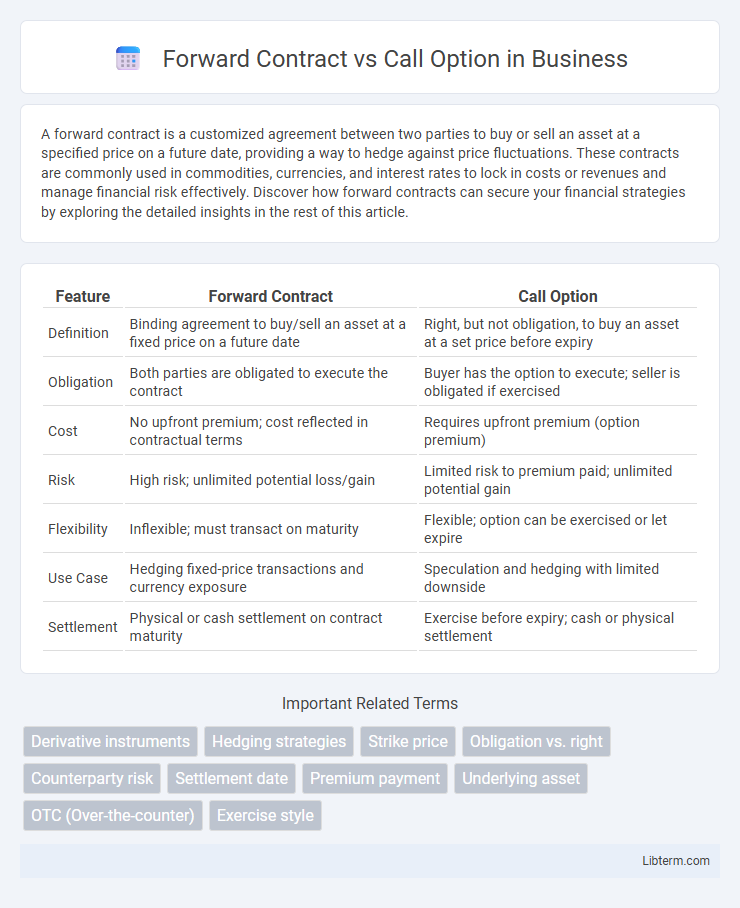

| Feature | Forward Contract | Call Option |

|---|---|---|

| Definition | Binding agreement to buy/sell an asset at a fixed price on a future date | Right, but not obligation, to buy an asset at a set price before expiry |

| Obligation | Both parties are obligated to execute the contract | Buyer has the option to execute; seller is obligated if exercised |

| Cost | No upfront premium; cost reflected in contractual terms | Requires upfront premium (option premium) |

| Risk | High risk; unlimited potential loss/gain | Limited risk to premium paid; unlimited potential gain |

| Flexibility | Inflexible; must transact on maturity | Flexible; option can be exercised or let expire |

| Use Case | Hedging fixed-price transactions and currency exposure | Speculation and hedging with limited downside |

| Settlement | Physical or cash settlement on contract maturity | Exercise before expiry; cash or physical settlement |

Understanding Forward Contracts: Key Features

Forward contracts are customized agreements between two parties to buy or sell an asset at a predetermined price on a specific future date, offering precise hedging against price fluctuations. Unlike standardized options, forward contracts obligate both parties to execute the deal at maturity, eliminating optionality and often involving over-the-counter trading. Key features include tailored contract terms, direct counterparty risk, and no upfront premium, making forward contracts essential tools for managing future price risk in commodities, currencies, and financial instruments.

Overview of Call Options: Core Concepts

Call options grant the buyer the right, but not the obligation, to purchase an underlying asset at a predetermined strike price before or at expiration. Unlike forward contracts, call options provide leveraged exposure with limited downside risk, as the maximum loss is confined to the premium paid. Key parameters influencing call options include the strike price, premium, time to expiration, and underlying asset volatility, all of which affect the option's intrinsic and time value.

Structure and Mechanics: Forward Contract vs Call Option

A forward contract is a private agreement obligating the buyer to purchase and the seller to deliver an asset at a predetermined price on a specific future date, involving no upfront premium but subject to counterparty risk. In contrast, a call option grants the buyer the right, without obligation, to purchase an asset at a specified strike price before or at expiration, requiring an upfront premium and providing limited risk to the buyer. The forward contract results in a binding obligation for both parties, while the call option offers flexibility by allowing the buyer to decide whether to exercise the option based on favorable market conditions.

Risk Profiles: Comparing Forward Contracts and Call Options

Forward contracts involve an obligation to buy or sell an asset at a predetermined price on a specified future date, exposing both parties to significant counterparty risk and unlimited downside if market prices move unfavorably. Call options grant the buyer the right, but not the obligation, to purchase an asset at a set strike price before expiration, limiting the buyer's risk to the premium paid while offering upside potential if the asset price exceeds the strike price. The asymmetric risk profile of call options contrasts with the symmetric, binding commitment of forward contracts, making options less risky for buyers but potentially more expensive than forwards.

Payoff Diagrams: Visualizing Differences

Forward contract payoff diagrams show a linear relationship where the buyer's profit increases as the underlying asset price rises above the contract price, reflecting unlimited upside and downside risk. Call option payoff diagrams display a nonlinear shape with limited downside risk to the premium paid and unlimited upside potential once the underlying asset price exceeds the strike price. The key visual difference lies in the forward contract's straight line crossing the origin and the call option's payoff curve starting below zero (due to the premium) and flattening at the strike price.

Hedging Strategies: Which Instrument to Use?

Forward contracts provide a guaranteed price for buying or selling an asset at a future date, making them ideal for businesses seeking to eliminate price risk entirely in hedging strategies. Call options offer the right, but not the obligation, to purchase an asset at a predetermined strike price, allowing more flexibility and potential upside if prices move favorably. Companies choose forward contracts when certainty and fixed costs are essential, while call options suit scenarios prioritizing limited downside risk and the opportunity to benefit from favorable market movements.

Flexibility and Customization: Forward vs Call Option

Forward contracts offer high flexibility and customization as they are private agreements tailored to the specific terms, amounts, and settlement dates agreed upon by the parties. Call options provide less customization, with standardized contract terms traded on exchanges, but they offer flexibility in the form of the right--not the obligation--to buy the underlying asset. The bespoke nature of forwards suits hedgers seeking precise risk management, while call options appeal to investors valuing limited downside risk and strategic optionality.

Cost Implications: Premiums and Margins

Forward contracts generally require no upfront premiums but may involve margin requirements or collateral to mitigate counterparty risk. Call options demand payment of a premium upfront, representing the maximum potential loss, with no margin calls needed unless the option is exercised. The choice between forwards and calls impacts liquidity and capital allocation due to differences in initial costs and risk exposure management.

Real-World Applications: Industry Use Cases

Forward contracts are extensively used in commodity trading industries such as agriculture, oil, and metals to lock in prices and manage price volatility risks over a specified period. Call options are preferred in financial markets and corporate treasury management to gain the right, without obligation, to purchase assets like stocks or currencies, offering flexible risk control and speculative opportunities. Businesses utilize forward contracts for predictable budgeting, while call options support strategic investment decisions in uncertain market conditions.

Choosing the Right Tool: Forward Contract or Call Option?

Choosing the right tool between a forward contract and a call option depends on risk tolerance and market outlook. Forward contracts lock in a fixed price for buying or selling an asset at a future date, offering certainty but exposing parties to obligations regardless of market movements. Call options provide the right, without the obligation, to buy an asset at a predetermined price, allowing flexibility to capitalize on favorable price changes while limiting potential losses to the premium paid.

Forward Contract Infographic

libterm.com

libterm.com