EPS (Earnings Per Share) measures a company's profitability allocated to each outstanding share of common stock, offering investors insight into individual share value. Net Income represents the total profit after all expenses and taxes, reflecting the company's overall financial performance. Explore the rest of the article to understand how these metrics impact your investment decisions.

Table of Comparison

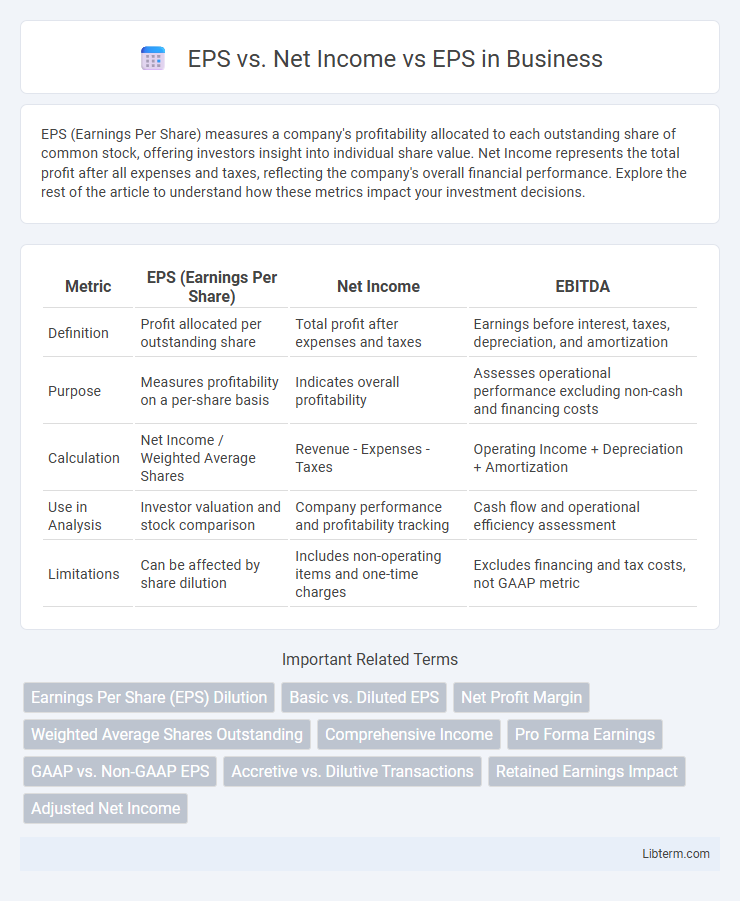

| Metric | EPS (Earnings Per Share) | Net Income | EBITDA |

|---|---|---|---|

| Definition | Profit allocated per outstanding share | Total profit after expenses and taxes | Earnings before interest, taxes, depreciation, and amortization |

| Purpose | Measures profitability on a per-share basis | Indicates overall profitability | Assesses operational performance excluding non-cash and financing costs |

| Calculation | Net Income / Weighted Average Shares | Revenue - Expenses - Taxes | Operating Income + Depreciation + Amortization |

| Use in Analysis | Investor valuation and stock comparison | Company performance and profitability tracking | Cash flow and operational efficiency assessment |

| Limitations | Can be affected by share dilution | Includes non-operating items and one-time charges | Excludes financing and tax costs, not GAAP metric |

Understanding EPS: Definition and Importance

Earnings Per Share (EPS) represents the portion of a company's profit allocated to each outstanding share of common stock, serving as a key indicator of profitability. Net Income, the total profit after all expenses and taxes, is the fundamental figure from which EPS is derived by dividing it by the weighted average number of shares outstanding. Understanding EPS helps investors assess a company's financial health and profitability on a per-share basis, enabling more accurate comparisons between companies regardless of size.

What is Net Income? Key Concepts

Net income represents a company's total profit after deducting all expenses, taxes, and costs from total revenue, serving as a crucial indicator of financial health. It directly impacts Earnings Per Share (EPS), which measures the portion of net income allocated to each outstanding share, reflecting profitability on a per-share basis. Understanding net income helps investors assess a company's ability to generate earnings, manage expenses, and sustain long-term growth.

EPS vs. Net Income: Core Differences

Earnings Per Share (EPS) measures the profitability allocated to each outstanding share, calculated by dividing net income minus dividends on preferred stock by the average outstanding shares. Net Income represents the total profit of a company after all expenses, taxes, and costs have been deducted from total revenue, reflecting the bottom-line earnings. The core difference lies in that EPS standardizes net income per share, providing investors a per-share profitability metric, whereas net income shows overall company profitability without relation to share count.

How EPS is Calculated

Earnings Per Share (EPS) is calculated by dividing Net Income minus Dividends on Preferred Stock by the average outstanding shares during a specific period, providing a per-share profit metric. Net Income represents the company's total profit after all expenses, taxes, and costs are deducted from total revenue. The EPS metric enables investors to assess profitability on a per-share basis, making it a crucial indicator for comparing company performance and stock valuation.

Key Factors Influencing Net Income

Net income is primarily influenced by revenue growth, cost of goods sold (COGS), operating expenses, taxes, and interest expenses, which directly impact profitability. EPS (Earnings Per Share) is derived by dividing net income by the outstanding shares, reflecting a company's profitability on a per-share basis and affected by share dilution or buybacks. Understanding changes in sales volume, gross margin, operating efficiency, and tax rates is crucial for accurately assessing variations in net income and corresponding EPS fluctuations.

Impact of Shares Outstanding on EPS

Earnings Per Share (EPS) is calculated by dividing Net Income by the weighted average shares outstanding, making the share count a critical factor in EPS valuation. An increase in shares outstanding through stock issuance or dilution reduces EPS, even if net income remains constant, impacting investor perception and stock valuation. Companies aiming to improve EPS often engage in share buybacks to reduce outstanding shares, thereby boosting EPS without actual profit growth.

Why Investors Focus on EPS Over Net Income

Investors prioritize Earnings Per Share (EPS) over net income because EPS provides a more precise measure of profitability on a per-share basis, allowing for better comparison across companies with different share counts. EPS directly reflects the portion of a company's profit allocated to each outstanding share, which impacts stock valuation and investment decisions. Net income shows total profit but can be misleading without considering the number of shares, making EPS a critical metric for assessing shareholder value.

Limitations of Using Only EPS or Net Income

Earnings Per Share (EPS) and Net Income each provide valuable insights into a company's profitability but have limitations when used independently. EPS can be skewed by share buybacks or issuances, making it less reliable without considering changes in outstanding shares, while Net Income does not account for the number of shares and can mislead investors about per-share profitability. Relying solely on EPS or Net Income ignores other crucial metrics like cash flow, debt levels, and revenue growth, which are essential for a comprehensive financial analysis.

Real-life Examples: EPS vs. Net Income Analysis

Earnings Per Share (EPS) measures profitability on a per-share basis, providing investors insight into a company's financial health, while Net Income represents the total profit after expenses. For instance, Apple Inc. reported a Net Income of $99.8 billion in 2023, with an EPS of $6.45, highlighting how high net income translates into robust shareholder value. Evaluating EPS versus Net Income helps investors understand profit scalability in relation to outstanding shares, crucial for comparing companies with different share counts.

Which Metric Should You Use: EPS or Net Income?

EPS (Earnings Per Share) offers a per-share perspective by dividing net income by outstanding shares, making it crucial for investors evaluating stock value and company profitability on a shareholder level. Net Income represents the total profit of a company after all expenses, providing a broad measure of overall financial performance but without reflecting the share distribution impact. Use EPS when comparing profitability across companies with different share counts or assessing stock performance; rely on Net Income for understanding the company's absolute earnings strength and operational success.

EPS vs. Net Income Infographic

libterm.com

libterm.com