Maximizing profitability requires a strategic approach to managing costs and increasing revenue streams through market analysis and efficient operations. Understanding key financial metrics helps you make informed decisions that drive sustainable growth. Explore the rest of the article to uncover actionable insights for boosting your profitability.

Table of Comparison

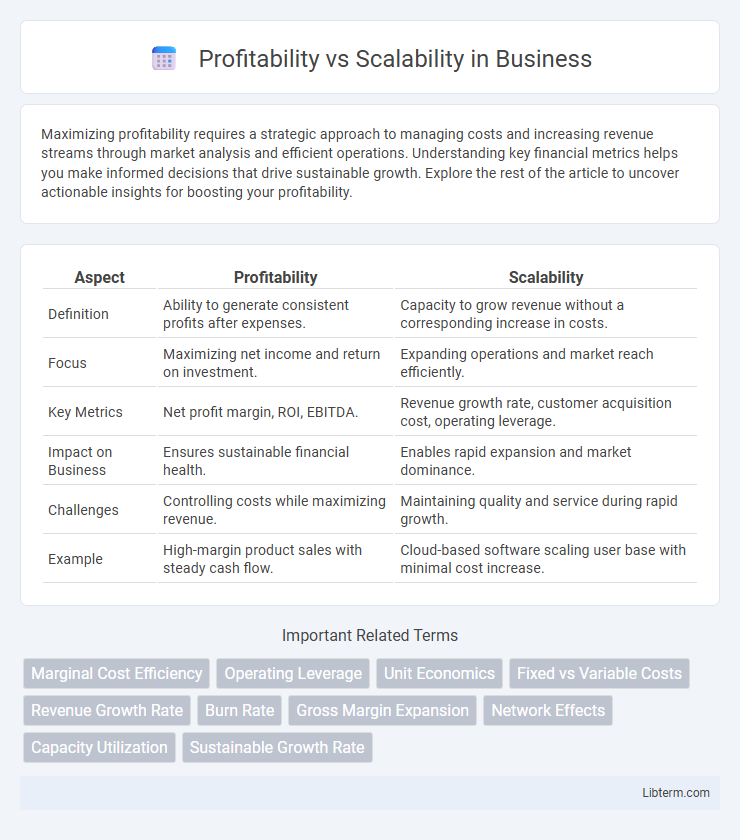

| Aspect | Profitability | Scalability |

|---|---|---|

| Definition | Ability to generate consistent profits after expenses. | Capacity to grow revenue without a corresponding increase in costs. |

| Focus | Maximizing net income and return on investment. | Expanding operations and market reach efficiently. |

| Key Metrics | Net profit margin, ROI, EBITDA. | Revenue growth rate, customer acquisition cost, operating leverage. |

| Impact on Business | Ensures sustainable financial health. | Enables rapid expansion and market dominance. |

| Challenges | Controlling costs while maximizing revenue. | Maintaining quality and service during rapid growth. |

| Example | High-margin product sales with steady cash flow. | Cloud-based software scaling user base with minimal cost increase. |

Understanding Profitability and Scalability

Profitability measures a business's ability to generate income exceeding its expenses, reflecting financial health through metrics like net profit margin and return on investment. Scalability evaluates the capacity to grow revenue without a proportional increase in costs, emphasizing efficient resource management and system adaptability. Understanding profitability ensures sustainable operations, while mastering scalability drives long-term expansion and competitive advantage.

Key Differences Between Profitability and Scalability

Profitability measures a company's ability to generate net income relative to its expenses, focusing on sustainable revenue growth and cost management. Scalability assesses a business's capacity to increase output or revenue without a significant rise in operational costs, enabling exponential growth potential. Key differences include profitability's emphasis on immediate financial returns, while scalability prioritizes long-term growth through efficient resource utilization.

Why Profitability Matters for Business Survival

Profitability is essential for business survival because it ensures sustainable cash flow to cover operating expenses and invest in growth opportunities. Without profitability, a company cannot maintain its financial health, leading to increased risks of debt and insolvency. Strong profit margins enable businesses to weather economic downturns and adapt to changing market conditions, securing long-term viability.

The Importance of Scalability for Growth

Scalability enables businesses to efficiently handle increasing workloads and market demands without proportional increases in costs, directly impacting long-term profitability. Prioritizing scalable systems and processes supports sustained growth by allowing companies to expand operations, enter new markets, and innovate without sacrificing financial stability. Investing in scalability frameworks ensures that growth potential is maximized while maintaining or improving profit margins.

Common Misconceptions: Profitability vs Scalability

Profitability is often misunderstood as the primary indicator of business success, while scalability is mistakenly seen as a guaranteed path to long-term growth. Many confuse rapid scaling with immediate profitability, neglecting that scalable models require strategic investments and operational adjustments before yielding substantial profits. Enterprises must differentiate that profitability reflects current financial health, whereas scalability measures potential to handle increased demand efficiently without proportional cost increases.

Balancing Profitability with Scalability Strategies

Balancing profitability with scalability strategies requires focusing on sustainable growth that does not compromise immediate financial health. Implementing scalable business models, such as subscription services or automated processes, allows companies to expand revenue streams while maintaining or improving profit margins. Prioritizing cost-efficient technology and resource allocation supports long-term scalability without undercutting profitability metrics.

Profitability Metrics Every Business Should Track

Profitability metrics such as gross profit margin, net profit margin, and return on investment are crucial indicators every business should monitor to ensure financial health. Tracking these metrics enables companies to evaluate operational efficiency, cost management, and revenue generation effectiveness. Consistent analysis of profitability metrics guides informed decision-making for sustainable growth and competitive advantage.

Scalability Challenges and How to Overcome Them

Scalability challenges often stem from limited infrastructure, inefficient processes, and insufficient capital to support growth, leading to bottlenecks and reduced performance. Overcoming these obstacles involves investing in flexible cloud-based systems, automating workflows, and securing diversified funding sources to ensure smooth expansion. Adopting scalable technologies and fostering agile team structures enhances capacity to handle increased demand while maintaining quality and profitability.

Case Studies: Companies Focusing on Profitability vs Scalability

Case studies reveal that companies like WhatsApp prioritized scalability early, growing their user base rapidly with minimal initial revenue, which later enabled significant profitability through monetization strategies. In contrast, firms such as Patagonia emphasize profitability by maintaining sustainable growth and high-margin products, focusing on long-term financial health over rapid expansion. These examples demonstrate how aligning business models with either profitability or scalability strategies impacts organizational goals and market positioning.

Choosing the Right Approach: Profitability, Scalability, or Both?

Choosing the right approach between profitability and scalability depends on business goals and market conditions. Profitability ensures immediate cash flow and sustainable operations through efficient cost management and high margins, while scalability targets long-term growth potential by expanding customer base and optimizing processes. Businesses aiming for both must balance investment in scalable infrastructure with strategies to maintain profit margins during growth stages.

Profitability Infographic

libterm.com

libterm.com