S&P Global is a leading provider of financial information, analytics, and credit ratings crucial for market participants worldwide. Its services empower investors, businesses, and governments to make informed decisions by offering comprehensive data and insights across various sectors. Explore the rest of the article to discover how S&P Global can enhance Your financial strategies and market understanding.

Table of Comparison

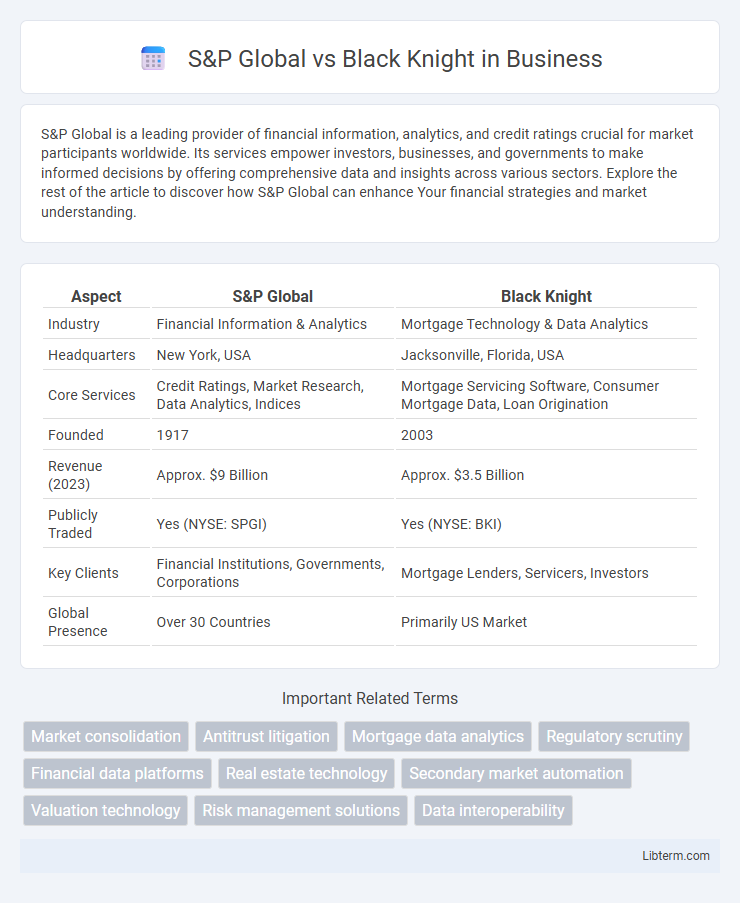

| Aspect | S&P Global | Black Knight |

|---|---|---|

| Industry | Financial Information & Analytics | Mortgage Technology & Data Analytics |

| Headquarters | New York, USA | Jacksonville, Florida, USA |

| Core Services | Credit Ratings, Market Research, Data Analytics, Indices | Mortgage Servicing Software, Consumer Mortgage Data, Loan Origination |

| Founded | 1917 | 2003 |

| Revenue (2023) | Approx. $9 Billion | Approx. $3.5 Billion |

| Publicly Traded | Yes (NYSE: SPGI) | Yes (NYSE: BKI) |

| Key Clients | Financial Institutions, Governments, Corporations | Mortgage Lenders, Servicers, Investors |

| Global Presence | Over 30 Countries | Primarily US Market |

Introduction to S&P Global and Black Knight

S&P Global is a leading provider of financial information, analytics, and credit ratings, serving markets worldwide with data that supports investment decisions and risk management. Black Knight specializes in software, data, and analytics solutions tailored for the mortgage and real estate industries, enabling lenders and servicers to streamline operations and improve efficiency. Both companies leverage advanced technologies to deliver critical insights, though S&P Global focuses broadly on capital markets while Black Knight targets the real estate finance sector.

Company Backgrounds and Profiles

S&P Global, founded in 1860, is a leading provider of financial information, analytics, and credit ratings, serving global markets with solutions in data, research, and benchmarks across industries. Black Knight, established in 2008, specializes in software, data, and analytics for the mortgage and real estate industries, offering platforms that streamline loan origination, servicing, and workflow automation. Both companies leverage advanced technology to deliver critical insights, with S&P Global focusing on broad financial market intelligence and Black Knight concentrating on housing finance and property data.

Core Services and Product Offerings

S&P Global delivers comprehensive financial intelligence, including data analytics, credit ratings, and risk assessment tools, serving capital markets and investment professionals. Black Knight specializes in mortgage technology, offering loan servicing software, origination solutions, and data analytics tailored for the real estate and mortgage industries. Both companies leverage advanced analytics but focus on distinct sectors: S&P Global predominantly supports financial markets, while Black Knight targets mortgage banking and property technology.

Market Position and Competitive Landscape

S&P Global holds a dominant market position in financial information and analytics, leveraging extensive data resources and advanced analytics platforms to serve investment professionals globally. Black Knight specializes in mortgage technology and data solutions, commanding a significant share of the mortgage servicing software market with its integrated platforms and robust data management capabilities. The competitive landscape showcases S&P Global's strength in broad financial services intelligence, while Black Knight focuses on niche mortgage fintech innovation, each capitalizing on distinct market segments.

Technology and Innovation Comparison

S&P Global leverages advanced data analytics and artificial intelligence to enhance financial market intelligence and risk assessment, driving innovation in real-time data delivery and predictive modeling. Black Knight emphasizes next-generation mortgage and real estate technology, utilizing cloud-based platforms and blockchain to streamline loan processing and improve data security. Both companies invest heavily in AI and machine learning, but S&P Global focuses on broad financial services innovation while Black Knight specializes in fintech solutions tailored to housing finance.

Financial Performance Overview

S&P Global reported a robust revenue of approximately $13 billion in 2023, driven by strong demand in its ratings and data analytics segments, achieving a net income margin of around 30%. Black Knight posted revenues near $2 billion for the same period, with growth propelled by mortgage technology solutions and software services, maintaining a net profit margin close to 20%. The financial performance comparison highlights S&P Global's scale and higher profitability, underscoring its dominant position in financial information services compared to Black Knight's niche focus in mortgage technology.

Mergers, Acquisitions, and Strategic Partnerships

S&P Global has expanded its market intelligence through strategic acquisitions like IHS Markit, enhancing data analytics and industry insights, while Black Knight focuses on consolidating mortgage and real estate technology via acquisitions such as Optimal Blue. Both companies employ mergers and strategic partnerships to strengthen their competitive positions: S&P Global leverages collaborations to integrate ESG and financial data, whereas Black Knight enhances end-to-end mortgage servicing solutions through technology alliances. These targeted moves reflect their commitment to broadening service offerings and driving innovation in financial data and mortgage technology sectors.

Regulatory and Compliance Factors

S&P Global and Black Knight operate under stringent regulatory frameworks to ensure data accuracy, transparency, and financial security, with S&P Global primarily regulated by the SEC and FINRA for its credit rating and analytics services. Black Knight, specializing in mortgage technology and servicing solutions, complies with CFPB regulations and state-level licensing requirements that safeguard consumer data and ensure compliance with housing finance laws. Both companies invest heavily in compliance infrastructure to mitigate risks and uphold industry standards critical to their respective market roles.

Industry Impact and Future Outlook

S&P Global drives significant impact in financial data analytics and credit ratings, shaping investment strategies and risk assessment across global markets. Black Knight revolutionizes the mortgage technology sector by delivering advanced software solutions and data analytics that enhance loan servicing efficiency and regulatory compliance. Both companies are poised for growth, with S&P Global expanding its AI-driven analytics capabilities and Black Knight leveraging digital transformation trends to streamline mortgage processes and improve customer experience.

Key Differences and Final Verdict

S&P Global specializes in financial data analytics, credit ratings, and market intelligence, serving a broad spectrum of industries, while Black Knight focuses primarily on mortgage technology solutions and data-driven services for the real estate and lending sectors. Key differences include S&P Global's extensive coverage of global financial markets versus Black Knight's niche expertise in mortgage servicing software and loan-level data analytics. The final verdict highlights S&P Global's dominance in comprehensive financial insights, contrasted with Black Knight's specialized innovation in mortgage technology, making each leader suited for distinct market needs.

S&P Global Infographic

libterm.com

libterm.com