Transparent accounting ensures that financial records are clear, accurate, and easy to understand, fostering trust among stakeholders and regulatory bodies. By maintaining open disclosure of financial activities, companies enhance accountability and reduce the risk of fraud or mismanagement. Discover how transparent accounting can benefit your business and improve financial integrity by reading the rest of this article.

Table of Comparison

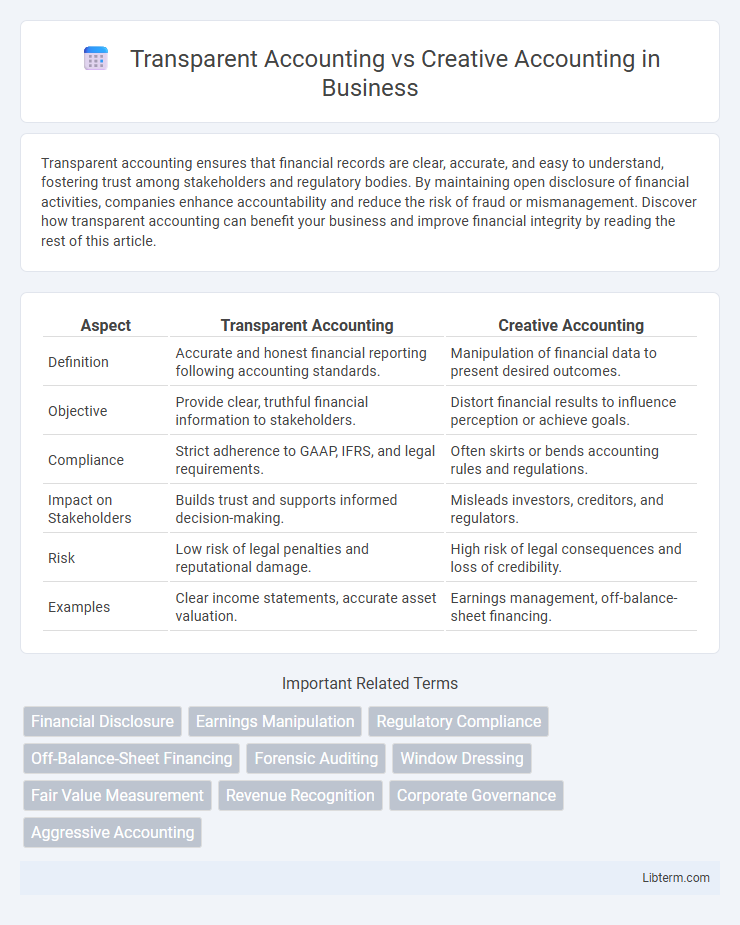

| Aspect | Transparent Accounting | Creative Accounting |

|---|---|---|

| Definition | Accurate and honest financial reporting following accounting standards. | Manipulation of financial data to present desired outcomes. |

| Objective | Provide clear, truthful financial information to stakeholders. | Distort financial results to influence perception or achieve goals. |

| Compliance | Strict adherence to GAAP, IFRS, and legal requirements. | Often skirts or bends accounting rules and regulations. |

| Impact on Stakeholders | Builds trust and supports informed decision-making. | Misleads investors, creditors, and regulators. |

| Risk | Low risk of legal penalties and reputational damage. | High risk of legal consequences and loss of credibility. |

| Examples | Clear income statements, accurate asset valuation. | Earnings management, off-balance-sheet financing. |

Understanding Transparent Accounting

Transparent accounting involves clear, accurate financial reporting that adheres strictly to established accounting standards such as GAAP or IFRS, ensuring stakeholders receive reliable information. It emphasizes full disclosure of financial statements, avoiding manipulation or omission of critical data to provide a true and fair view of a company's financial health. Transparent accounting builds trust with investors, regulators, and other stakeholders by maintaining integrity and accountability in financial practices.

What is Creative Accounting?

Creative accounting involves the manipulation of financial statements to present a more favorable image of a company's financial position, often by exploiting accounting loopholes or applying subjective judgments. Unlike transparent accounting, which adheres strictly to established accounting standards and promotes clarity and accuracy, creative accounting may obscure true financial performance and mislead stakeholders. This practice can include techniques such as revenue recognition timing, off-balance-sheet financing, and aggressive expense capitalization.

Key Differences Between Transparent and Creative Accounting

Transparent accounting involves clear, accurate financial reporting that adheres strictly to regulatory standards, ensuring stakeholders receive a true representation of a company's financial health. Creative accounting manipulates financial data within legal boundaries to present a more favorable view, often obscuring actual performance and risking misleading investors or regulators. Key differences include transparency levels, ethical considerations, and the impact on decision-making, with transparent accounting fostering trust and creative accounting potentially undermining it.

Benefits of Transparent Accounting

Transparent accounting ensures accurate financial reporting, enhancing stakeholder trust and facilitating better investment decisions. It promotes regulatory compliance and reduces risks of fraud or mismanagement by providing clear insights into a company's financial health. Increased transparency also improves operational efficiency by enabling timely identification of financial discrepancies and strengthening corporate governance.

Risks Associated with Creative Accounting

Creative accounting involves manipulating financial data to present a misleadingly favorable picture, increasing the risk of inaccurate reporting and potential legal consequences. Transparent accounting ensures accurate, honest financial disclosures, reducing risks such as regulatory penalties, investor mistrust, and financial instability. Companies practicing creative accounting face heightened scrutiny from auditors and regulators, which can damage reputation and lead to significant financial losses.

Legal and Ethical Implications

Transparent accounting adheres to legal standards and ethical principles by providing accurate, complete, and verifiable financial information, ensuring stakeholder trust and regulatory compliance. Creative accounting exploits legal loopholes and subjective judgments to manipulate financial statements, often blurring ethical boundaries and increasing the risk of legal sanctions or reputational damage. Companies practicing transparent accounting demonstrate accountability and integrity, while those engaging in creative accounting face heightened scrutiny from regulators and ethical criticism from industry watchdogs.

Impact on Stakeholder Trust

Transparent accounting enhances stakeholder trust by providing clear, accurate financial information that reflects a company's true economic condition, fostering confidence among investors, creditors, and regulators. Creative accounting, involving manipulative practices to present a misleading financial position, erodes trust by obscuring the company's actual performance and increasing perceived risk. Stakeholders rely on transparency for informed decision-making, making ethical accounting practices crucial for maintaining credibility and long-term business relationships.

Regulatory Frameworks and Compliance

Transparent accounting strictly adheres to established regulatory frameworks such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), ensuring full compliance and accurate financial representation. Creative accounting often exploits loopholes in financial regulations, bending or interpreting standards to present misleading financial information without outright illegal activity. Regulatory bodies like the Securities and Exchange Commission (SEC) and financial auditors play crucial roles in enforcing transparency and detecting manipulative accounting practices.

Case Studies: Successes and Failures

Transparent accounting practices, exemplified by firms like Patagonia and Unilever, have fostered investor trust and regulatory compliance, leading to sustained growth and positive public perception. In contrast, creative accounting cases such as Enron and WorldCom illustrate how manipulation of financial statements can temporarily inflate profits but ultimately result in legal consequences and company collapse. These case studies emphasize the critical importance of adherence to transparent accounting standards for long-term business viability and stakeholder confidence.

Choosing the Right Approach for Your Business

Transparent accounting emphasizes accurate, clear financial reporting that complies with regulatory standards to build stakeholder trust and ensure long-term business sustainability. Creative accounting involves manipulating financial data within legal limits to present a more favorable view, but it risks reputational damage and legal consequences if discovered. Businesses should prioritize transparent accounting to enhance credibility, attract investment, and maintain compliance, reserving creative accounting only for ethical financial planning within established guidelines.

Transparent Accounting Infographic

libterm.com

libterm.com