Preferred stock represents a class of ownership in a corporation with fixed dividends and priority over common stock in asset liquidation. Investors seeking steady income often favor these shares for their predictable dividend payments and reduced risk compared to common stock. Explore the full article to understand how preferred stock can fit into your investment strategy.

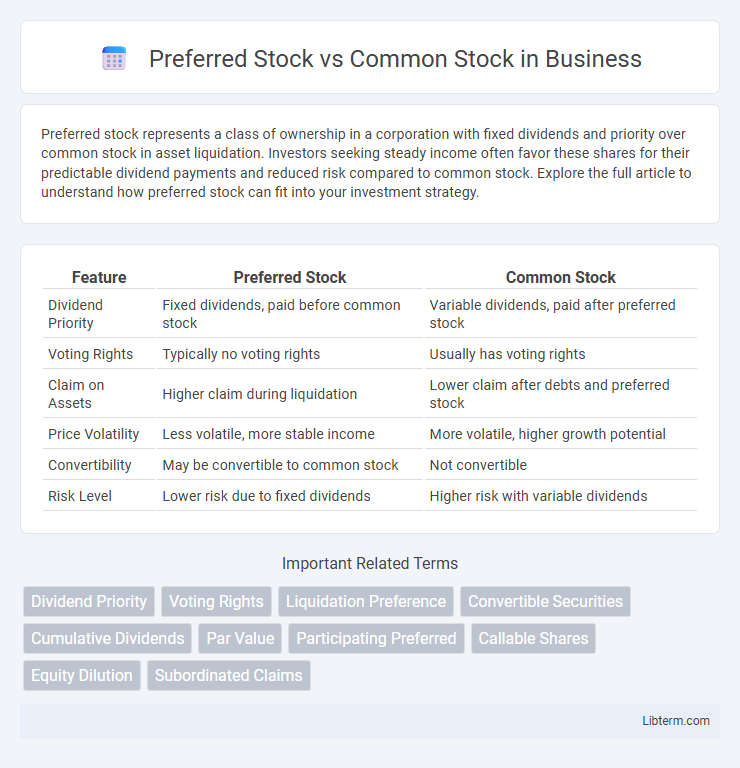

Table of Comparison

| Feature | Preferred Stock | Common Stock |

|---|---|---|

| Dividend Priority | Fixed dividends, paid before common stock | Variable dividends, paid after preferred stock |

| Voting Rights | Typically no voting rights | Usually has voting rights |

| Claim on Assets | Higher claim during liquidation | Lower claim after debts and preferred stock |

| Price Volatility | Less volatile, more stable income | More volatile, higher growth potential |

| Convertibility | May be convertible to common stock | Not convertible |

| Risk Level | Lower risk due to fixed dividends | Higher risk with variable dividends |

Introduction to Preferred vs Common Stock

Preferred stock provides investors with fixed dividends and higher claim on assets during liquidation compared to common stock, which offers voting rights and potential for capital appreciation but with more risk. Common stockholders have ownership equity, allowing influence over corporate decisions, while preferred shareholders typically lack voting power but benefit from priority in dividend payments. Understanding the distinctions between preferred and common stock is essential for aligning investment strategies with risk tolerance and income requirements.

Key Differences Between Preferred and Common Shares

Preferred stock offers fixed dividends and higher claim on assets during liquidation, unlike common stock, which provides voting rights and potential for capital appreciation. Common shareholders typically have voting power in corporate decisions, whereas preferred shareholders usually lack voting rights but receive dividend payments before common shareholders. The preference in dividends and asset claims makes preferred shares less risky but with limited upside compared to common shares.

Dividend Rights: Preferred vs Common Stockholders

Preferred stockholders receive fixed dividend payments often prioritized over common stock dividends, ensuring more consistent income. Common stockholders have variable dividends, dependent on company profits and board decisions, leading to potential fluctuations. In liquidation, preferred stockholders typically have dividend rights paid out before common stockholders, providing an added layer of financial security.

Voting Rights and Shareholder Influence

Preferred stock typically provides limited or no voting rights, restricting shareholder influence on corporate decisions compared to common stockholders. Common stockholders hold voting rights that allow them to elect the board of directors and vote on major corporate policies, directly shaping company governance. This distinction significantly impacts shareholder power, with common stock granting more control over corporate strategy and preferred stock emphasizing financial benefits like fixed dividends.

Claim on Assets in Liquidation

Preferred stockholders have a higher claim on assets than common stockholders during liquidation, ensuring they receive payouts before common shareholders. Common stockholders are last in line, only receiving remaining assets after all debts and preferred stock claims are settled. This priority makes preferred stock less risky in terms of asset recovery during company liquidation.

Risk and Return Profiles

Preferred stock generally offers lower risk and more stable returns due to fixed dividend payments, making it attractive for income-focused investors. Common stock carries higher risk with more volatile prices, but it provides greater potential for capital appreciation and voting rights in the company. Investors seeking steady income typically favor preferred stock, while those aiming for growth and increased influence prefer common stock.

Convertibility Features

Preferred stock often includes convertibility features allowing shareholders to convert preferred shares into a predetermined number of common shares, providing potential upside if the common stock's value increases. Common stock lacks such convertibility options but typically grants voting rights and full participation in company profits after preferred dividends are paid. Convertible preferred stock combines fixed dividend benefits with equity upside, attracting investors seeking income and growth potential.

Typical Investors for Each Stock Type

Preferred stock typically attracts income-focused investors seeking steady dividend payments and lower risk compared to common stock. Common stock appeals to growth-oriented investors willing to tolerate higher volatility for potential capital appreciation and voting rights in corporate decisions. Institutional investors often prefer preferred shares for portfolio stability, while retail investors commonly invest in common stock for long-term growth opportunities.

Pros and Cons of Preferred and Common Stock

Preferred stock offers shareholders fixed dividends and priority over common stockholders in asset liquidation, making it a safer investment, but it typically lacks voting rights and has limited potential for capital appreciation. Common stock provides voting power and greater upside potential through price appreciation and dividends, but it carries higher risk due to lower claim priority during bankruptcy and dividend variability. Investors must weigh the stability and income consistency of preferred stock against the growth opportunities and influence on company decisions offered by common stock.

Which Stock Type Is Right for You?

Preferred stock offers fixed dividends and priority over common stock in asset distribution during liquidation, making it suitable for investors seeking steady income with lower risk. Common stock provides voting rights and potential for higher capital gains, appealing to those willing to tolerate market volatility for long-term growth. Assess your financial goals, risk tolerance, and income needs to determine whether preferred or common stock aligns better with your investment strategy.

Preferred Stock Infographic

libterm.com

libterm.com