Redemption value refers to the amount an investor will receive when a financial instrument, such as a bond or preferred stock, is redeemed before maturity or at its maturity date. This value is crucial in assessing the potential return and liquidity of an investment, impacting your overall portfolio strategy. Explore the rest of the article to understand how redemption value affects your investment decisions and financial planning.

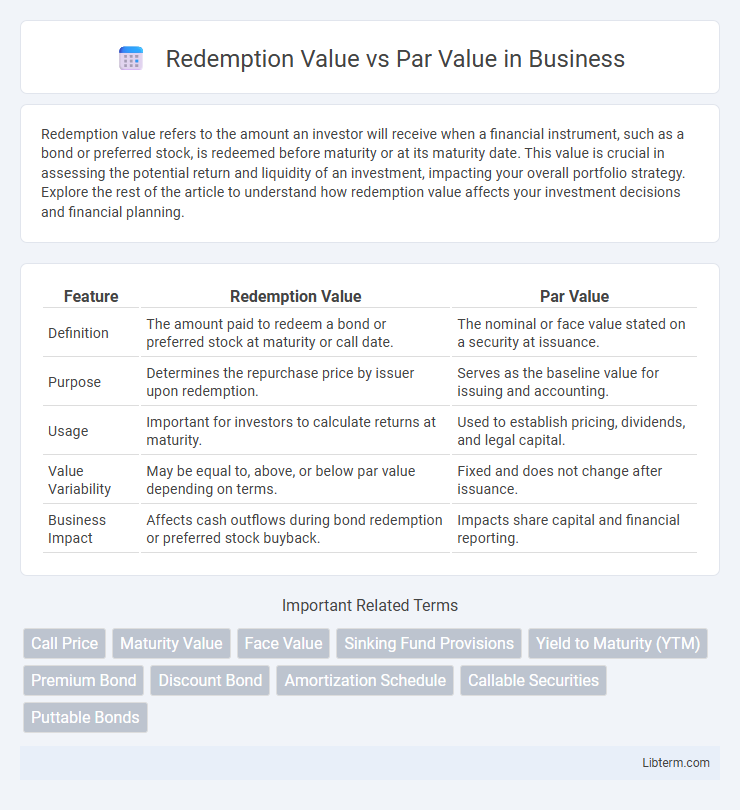

Table of Comparison

| Feature | Redemption Value | Par Value |

|---|---|---|

| Definition | The amount paid to redeem a bond or preferred stock at maturity or call date. | The nominal or face value stated on a security at issuance. |

| Purpose | Determines the repurchase price by issuer upon redemption. | Serves as the baseline value for issuing and accounting. |

| Usage | Important for investors to calculate returns at maturity. | Used to establish pricing, dividends, and legal capital. |

| Value Variability | May be equal to, above, or below par value depending on terms. | Fixed and does not change after issuance. |

| Business Impact | Affects cash outflows during bond redemption or preferred stock buyback. | Impacts share capital and financial reporting. |

Introduction to Redemption Value and Par Value

Redemption value represents the amount a bond issuer agrees to pay to bondholders upon maturity or early redemption, often including a premium over the bond's face value. Par value, also known as face value, is the original amount printed on the bond certificate, indicating the principal repayment amount. Understanding the distinction between redemption value and par value is essential for evaluating bond investments and their potential returns.

Defining Par Value: Basics and Importance

Par value represents the nominal or face value of a bond or stock, serving as the baseline amount assigned at issuance. It establishes the minimum legal capital that a company must maintain to protect creditors and investors. Understanding par value is crucial for investors as it influences dividend calculations and redemption terms in financial securities.

Understanding Redemption Value in Finance

Redemption value in finance refers to the amount a bond issuer pays to redeem the bond before its maturity date, which can be higher than the par value to compensate investors for early termination. Understanding redemption value is crucial for investors as it affects the actual return on bond investments, especially for callable bonds that can be redeemed at a premium. Comparing redemption value to par value helps investors evaluate potential gains or losses when bonds are called back prior to maturity.

Key Differences Between Redemption Value and Par Value

Redemption value refers to the amount paid to the bondholder when a bond is redeemed before or at maturity, often including a premium above the par value. Par value is the nominal or face value of a bond, representing the amount the issuer agrees to repay at maturity, typically $1,000 per bond in the U.S. The key difference lies in that par value is the principal amount stated on the bond, while redemption value may vary due to call premiums, early redemption, or bond terms outlined in the indenture agreement.

Significance of Par Value in Bonds and Stocks

Par value represents the nominal or face value of a bond or stock, serving as the baseline amount investors receive at maturity or share issuance. In bonds, par value is critical for calculating interest payments, as coupon rates are applied to this value. In stocks, par value holds minimal financial significance but establishes the minimum price at which shares can initially be issued, influencing corporate legal capital requirements.

Factors Influencing Redemption Value

Redemption value is primarily influenced by prevailing interest rates, the issuer's credit risk, and the time remaining until maturity, whereas par value remains fixed as the bond's face value at issuance. Changes in market interest rates affect the redemption price because bonds callable before maturity may be redeemed at a premium or discount relative to par value. The issuer's financial health impacts the likelihood of early redemption, making credit risk a key factor in assessing redemption value.

Real-World Examples: Redemption Value vs Par Value

Redemption value is the amount paid to bondholders when a bond matures or is called before maturity, often differing from the bond's par value, which is its face value at issuance. For instance, a callable corporate bond issued with a par value of $1,000 might have a redemption value set at $1,050 to compensate investors for early call risk. Treasury bonds usually redeem at par value, whereas callable municipal bonds might redeem at a premium redemption value to incentivize bondholder acceptance of early redemption.

Impact on Investors and Issuers

Redemption value represents the amount paid to investors at maturity or call date, often influencing investor decisions due to potential premium or discount relative to the par value, which is the nominal face value of the bond. For investors, a redemption value above par means higher returns, while issuers face increased costs if required to redeem bonds above par, affecting their capital structure and refinancing strategies. Issuers benefit from redeeming bonds at par or below, reducing liabilities, whereas investors must assess redemption risk to optimize portfolio yield and risk management.

How Redemption Value and Par Value Affect Returns

Redemption value impacts returns by determining the actual amount received at maturity, often including premiums above the par value, influencing the total yield realized by investors. Par value, typically the bond's face value, serves as the baseline for calculating interest payments and principal repayment, directly affecting expected income and capital preservation. The difference between redemption value and par value can lead to gains or losses, altering the effective return on the investment beyond the stated coupon rate.

Conclusion: Choosing Between Redemption Value and Par Value

Selecting between redemption value and par value depends on an investor's financial goals and market conditions. Redemption value represents the amount payable upon maturity or call, often including premiums, while par value is the bond's face value at issuance, crucial for calculating interest payments. Investors prioritizing predictable returns might favor par value, whereas those seeking potential gains from early redemption should consider redemption value.

Redemption Value Infographic

libterm.com

libterm.com