Zero working capital means a company's current assets equal its current liabilities, indicating efficient short-term financial management without excess idle resources. This balance allows your business to operate smoothly, minimizing the need for additional financing while maintaining liquidity. Discover how to optimize your working capital to boost cash flow and improve operational efficiency by reading the full article.

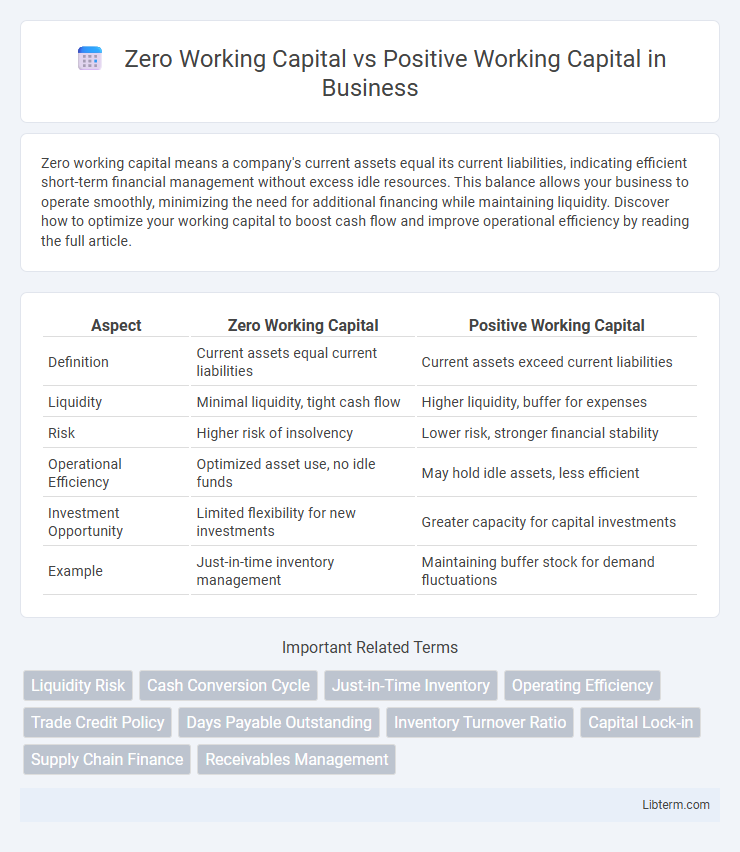

Table of Comparison

| Aspect | Zero Working Capital | Positive Working Capital |

|---|---|---|

| Definition | Current assets equal current liabilities | Current assets exceed current liabilities |

| Liquidity | Minimal liquidity, tight cash flow | Higher liquidity, buffer for expenses |

| Risk | Higher risk of insolvency | Lower risk, stronger financial stability |

| Operational Efficiency | Optimized asset use, no idle funds | May hold idle assets, less efficient |

| Investment Opportunity | Limited flexibility for new investments | Greater capacity for capital investments |

| Example | Just-in-time inventory management | Maintaining buffer stock for demand fluctuations |

Understanding Working Capital: Definition and Importance

Working capital, defined as current assets minus current liabilities, measures a company's liquidity and operational efficiency. Zero working capital indicates assets exactly cover liabilities, optimizing cash flow but risking short-term solvency. Positive working capital ensures sufficient funds for daily operations and growth, reflecting financial stability and operational flexibility.

What is Zero Working Capital?

Zero Working Capital occurs when a company's current assets exactly equal its current liabilities, indicating that it has just enough short-term assets to cover its short-term obligations without excess reserves. This financial state enables efficient use of resources by minimizing idle cash and inventory while maintaining operational liquidity. Companies aiming for zero working capital focus on optimizing cash conversion cycles and streamlining payables and receivables management to enhance working capital efficiency.

What is Positive Working Capital?

Positive working capital occurs when a company's current assets exceed its current liabilities, indicating strong liquidity and the ability to cover short-term obligations. This financial state allows businesses to invest in growth opportunities, pay off debts promptly, and maintain smooth operations without cash flow interruptions. In contrast to zero working capital, positive working capital provides a buffer against unexpected expenses and financial uncertainties.

Key Differences Between Zero and Positive Working Capital

Zero working capital indicates a business has exactly enough current assets to cover its current liabilities, reflecting highly efficient asset utilization and minimal idle resources. Positive working capital means current assets exceed current liabilities, providing liquidity buffers that support operational flexibility and reduced risk of short-term financial distress. The key difference lies in liquidity and risk management: zero working capital maximizes efficiency but may increase vulnerability to cash flow disruptions, while positive working capital enhances financial stability at the expense of potentially lower asset turnover.

Advantages of Zero Working Capital

Zero Working Capital optimizes cash flow by minimizing funds tied up in inventory and receivables, enhancing operational efficiency and liquidity. This approach reduces financing costs and risks associated with excess inventory or slow-paying customers. Companies benefit from increased flexibility and faster response to market changes by maintaining lean working capital levels.

Benefits of Positive Working Capital

Positive working capital enhances a company's liquidity, ensuring it can meet short-term obligations and invest in growth opportunities without relying on external financing. It reduces financial risk by providing a buffer against unexpected expenses or market fluctuations, improving overall operational stability. Strong positive working capital also boosts creditworthiness, facilitating better terms with suppliers and lenders, which supports sustainable business expansion.

Risks and Challenges of Zero Working Capital

Zero working capital involves maintaining minimal current assets beyond current liabilities, posing risks such as reduced liquidity and vulnerability to cash flow disruptions. Companies operating with zero working capital may struggle to cover short-term obligations during unexpected expenses or sales fluctuations. This approach can challenge operational flexibility, increasing the risk of insolvency in times of financial strain.

Risks and Challenges of Positive Working Capital

Positive working capital indicates that a company has more current assets than liabilities, which can improve liquidity but poses risks such as inefficient cash utilization and higher carrying costs for inventory and receivables. Excessive positive working capital may lead to reduced operational efficiency, tying up funds that could otherwise be invested in growth opportunities or debt reduction. Managing this balance is challenging, as companies must optimize inventory levels and receivables collections without compromising customer satisfaction or supply chain stability.

Industry Examples: Zero vs Positive Working Capital

Zero working capital is prevalent in industries like retail giants Amazon and Walmart, where fast inventory turnover and immediate cash sales minimize the need for large current assets. Positive working capital is common in manufacturing sectors such as automotive or aerospace industries, where substantial inventory and receivables are necessary to meet production and supply chain demands. These differences illustrate how operational models drive the need for either zero or positive working capital strategies.

Choosing the Right Working Capital Strategy

Choosing the right working capital strategy depends on a company's operational efficiency and risk tolerance, with zero working capital indicating minimal liquidity tied up in operations, maximizing asset utilization but increasing vulnerability to cash flow disruptions. Positive working capital ensures sufficient liquidity to cover short-term liabilities and supports operational stability, making it suitable for businesses with fluctuating cash flows or those investing in growth. Analyzing industry norms and cash conversion cycles helps determine the optimal balance between zero and positive working capital strategies for sustainable financial health.

Zero Working Capital Infographic

libterm.com

libterm.com