Operating assets are essential resources used by a company in its daily operations to generate revenue, including machinery, inventory, and accounts receivable. Effective management of these assets ensures smooth business performance and maximizes profitability. Explore the rest of the article to learn how optimizing your operating assets can significantly enhance your company's success.

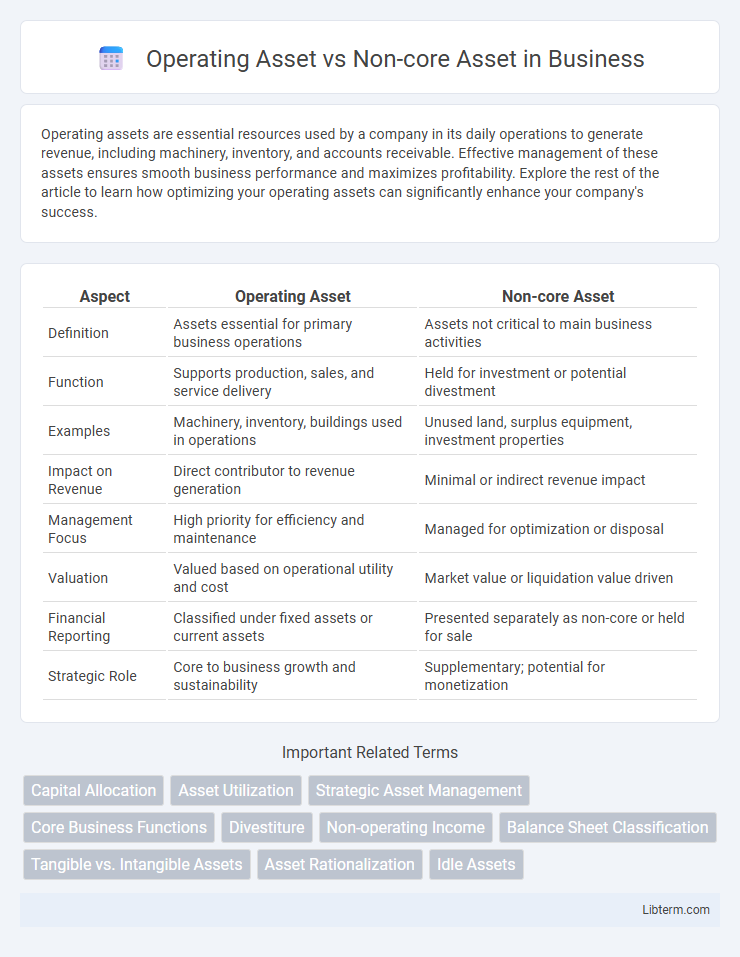

Table of Comparison

| Aspect | Operating Asset | Non-core Asset |

|---|---|---|

| Definition | Assets essential for primary business operations | Assets not critical to main business activities |

| Function | Supports production, sales, and service delivery | Held for investment or potential divestment |

| Examples | Machinery, inventory, buildings used in operations | Unused land, surplus equipment, investment properties |

| Impact on Revenue | Direct contributor to revenue generation | Minimal or indirect revenue impact |

| Management Focus | High priority for efficiency and maintenance | Managed for optimization or disposal |

| Valuation | Valued based on operational utility and cost | Market value or liquidation value driven |

| Financial Reporting | Classified under fixed assets or current assets | Presented separately as non-core or held for sale |

| Strategic Role | Core to business growth and sustainability | Supplementary; potential for monetization |

Introduction to Operating Assets and Non-core Assets

Operating assets refer to the resources essential for a company's core business operations, including machinery, inventory, and facilities directly involved in production or service delivery. Non-core assets are those not critical to primary business functions, often comprising surplus properties, investments, or divisions that can be divested without impacting main operations. Distinguishing between operating and non-core assets aids in strategic decision-making, optimizing asset management, and enhancing financial performance.

Defining Operating Assets: Meaning and Examples

Operating assets are essential resources actively used in daily business operations to generate revenue, including machinery, inventory, buildings, and accounts receivable. These assets directly contribute to core activities such as production, sales, and service delivery, distinguishing them from non-core assets like surplus real estate or investments that do not support primary business functions. Examples of operating assets include manufacturing equipment, office computers, and company vehicles essential for operational efficiency.

Understanding Non-core Assets: Meaning and Examples

Non-core assets refer to business holdings that are not essential to a company's primary operations and strategic goals, often including surplus real estate, underutilized equipment, or minority stakes in unrelated businesses. Identifying these assets allows companies to optimize capital allocation by divesting or repurposing them to improve operational efficiency and focus on growth sectors. Examples include excess office buildings, legacy manufacturing units, or investments in non-strategic ventures that do not contribute directly to core revenue streams.

Key Differences Between Operating and Non-core Assets

Operating assets directly contribute to a company's core business operations and revenue generation, including machinery, inventory, and accounts receivable. Non-core assets are holdings that are not essential to the primary business activities, such as surplus real estate, investments, or discontinued product lines. The key differences include their impact on cash flow, with operating assets driving ongoing profitability, while non-core assets are often sold or liquidated to improve financial flexibility or focus strategic direction.

Importance of Operating Assets in Business Operations

Operating assets, such as machinery, inventory, and accounts receivable, are critical for generating revenue and sustaining daily business functions, directly impacting profitability and efficiency. These assets ensure uninterrupted production and service delivery, forming the backbone of a company's operational capabilities. Non-core assets, by contrast, are typically non-essential and can be divested to improve focus on core operational strengths and enhance financial flexibility.

The Role of Non-core Assets in Corporate Strategy

Non-core assets, typically non-essential to a company's primary operations, play a strategic role by providing liquidity and funding for core business investments or debt reduction. Divesting non-core assets can streamline operations, enhance focus on operating assets, and improve overall financial performance. Effective management of non-core assets enables companies to optimize capital allocation and support long-term growth objectives.

Financial Impact of Operating vs Non-core Assets

Operating assets generate core revenue and directly contribute to a company's profitability by enhancing efficiency and supporting ongoing business activities. Non-core assets, often considered surplus or non-essential, may be monetized to improve liquidity or reduce debt but do not impact daily operations or revenue streams significantly. The financial impact of operating assets is continuous and integral, while non-core assets provide discrete financial benefits through divestitures or restructuring.

Asset Reclassification: When Assets Change Categories

Operating assets are essential for a company's core business functions, including machinery, inventory, and property used directly in production or service delivery. Non-core assets, such as excess real estate or investments, are not integral to daily operations and may be classified for potential divestiture. Asset reclassification occurs when a company changes an asset's category, reflecting shifts in strategic focus or operational use, impacting financial statements and asset management strategies.

Asset Management Strategies for Maximizing Value

Operating assets are essential resources actively used in a company's core business operations, while non-core assets are peripheral holdings not critical to day-to-day activities. Asset management strategies for maximizing value involve optimizing operating assets through efficient utilization and maintenance to enhance productivity, and selectively divesting or repurposing non-core assets to free up capital and reduce cost. Leveraging data analytics and market insights allows for informed decision-making, ensuring non-core assets contribute to overall financial health without detracting from primary business goals.

Conclusion: Optimizing Asset Utilization for Business Growth

Maximizing operating asset efficiency directly enhances core business performance, driving sustainable revenue and profitability. Divesting non-core assets reallocates capital to high-impact areas, fostering innovation and competitive advantage. Strategic alignment of asset utilization underpins long-term growth and shareholder value creation.

Operating Asset Infographic

libterm.com

libterm.com