Merger strategies can significantly reshape company dynamics, driving growth and competitive advantage in crowded markets. Understanding the financial, cultural, and operational impacts of a merger is essential for successful integration and long-term success. Explore the rest of the article to learn how your business can navigate merger complexities effectively.

Table of Comparison

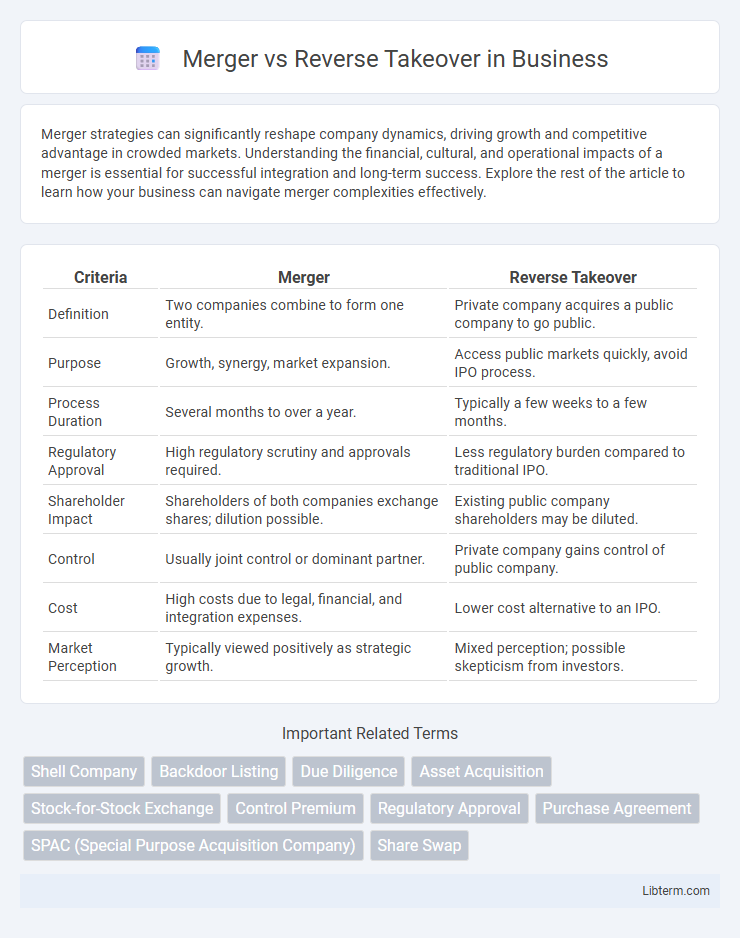

| Criteria | Merger | Reverse Takeover |

|---|---|---|

| Definition | Two companies combine to form one entity. | Private company acquires a public company to go public. |

| Purpose | Growth, synergy, market expansion. | Access public markets quickly, avoid IPO process. |

| Process Duration | Several months to over a year. | Typically a few weeks to a few months. |

| Regulatory Approval | High regulatory scrutiny and approvals required. | Less regulatory burden compared to traditional IPO. |

| Shareholder Impact | Shareholders of both companies exchange shares; dilution possible. | Existing public company shareholders may be diluted. |

| Control | Usually joint control or dominant partner. | Private company gains control of public company. |

| Cost | High costs due to legal, financial, and integration expenses. | Lower cost alternative to an IPO. |

| Market Perception | Typically viewed positively as strategic growth. | Mixed perception; possible skepticism from investors. |

Introduction to Mergers and Reverse Takeovers

Mergers involve the consolidation of two or more companies into a single entity to achieve synergies, expand market share, or diversify operations. Reverse takeovers (RTOs) occur when a private company acquires a public company, allowing the private company to become publicly traded without a traditional initial public offering (IPO). Both strategies offer alternative paths for business growth and access to capital markets, with mergers emphasizing integration and RTOs focusing on speed and market entry.

Definition of a Merger

A merger is a strategic business transaction where two companies combine to form a single entity, often to enhance market share, reduce costs, or expand capabilities. Unlike reverse takeovers, which involve a private company acquiring a public company to bypass initial public offering processes, mergers emphasize mutual agreement and integration of resources. Key examples include the Vodafone-Mannesmann merger, illustrating how mergers create synergies and streamline operations within competitive industries.

Definition of a Reverse Takeover (RTO)

A Reverse Takeover (RTO) occurs when a private company acquires a publicly listed company to bypass the lengthy and complex initial public offering (IPO) process. This strategic move allows the private company to quickly become publicly traded by absorbing the public company's listing status. Unlike traditional mergers where two companies combine, an RTO involves the private firm effectively taking control of the public entity to gain market access.

Key Differences Between Merger and Reverse Takeover

A merger involves two companies combining to form a new entity, typically to enhance market share, resources, or synergies, whereas a reverse takeover (RTO) allows a private company to become publicly traded by acquiring a publicly listed shell company. Key differences include the strategic purpose: mergers focus on business integration and growth, while reverse takeovers prioritize quick access to public capital markets without an initial public offering (IPO). Additionally, mergers often require extensive regulatory approvals, whereas reverse takeovers generally involve fewer regulatory hurdles and can be faster to execute.

Advantages of Mergers

Mergers offer significant advantages such as enhanced market share, increased operational efficiency, and expanded resource pools. They enable companies to combine strengths, reduce competition, and achieve economies of scale, leading to higher profitability and shareholder value. Unlike reverse takeovers, mergers provide a more straightforward integration process and greater strategic alignment between merging entities.

Advantages of Reverse Takeovers

Reverse takeovers offer a faster, cost-effective path for private companies to become publicly traded without undergoing the traditional initial public offering (IPO) process, significantly reducing regulatory complexities and expenses. This approach enables immediate access to capital markets, enhancing liquidity and providing shareholders with a clear valuation benchmark. Moreover, reverse takeovers maintain greater control for existing management compared to mergers, minimizing dilution and preserving strategic direction.

Disadvantages and Risks of Mergers

Mergers often involve significant integration challenges, including culture clashes, operational disruptions, and loss of key personnel, which can reduce overall synergies. Financial risks include overvaluation of the target company, unforeseen liabilities, and high transaction costs that strain the combined entity's balance sheet. Regulatory hurdles and antitrust issues can delay approvals or force divestitures, increasing uncertainty and complicating the merger process.

Disadvantages and Risks of Reverse Takeovers

Reverse takeovers carry significant risks including potential undisclosed liabilities from the private company, leading to financial instability. Market perception may be negative due to skepticism around the transparency and regulatory scrutiny of these transactions. Furthermore, integration challenges and management conflicts can arise, impairing operational efficiency and long-term growth prospects.

Factors to Consider When Choosing Between Merger and RTO

Key factors to consider when choosing between a merger and a reverse takeover include the company's strategic goals, financial health, and regulatory requirements. A merger typically demands more extensive due diligence and integration efforts, ideal for companies seeking long-term collaboration and synergy. In contrast, a reverse takeover offers quicker public listing access with less regulatory scrutiny, suitable for firms prioritizing speed and cost efficiency in capital market entry.

Real-World Examples: Merger vs Reverse Takeover

The merger between Disney and Pixar in 2006 exemplifies a traditional merger, creating a new combined entity to leverage mutual strengths, while the 2013 reverse takeover of Burger King by Justice Holdings allowed Burger King to go public efficiently by acquiring an existing public company. Real-world examples highlight that mergers often involve mutual agreement to blend operations, whereas reverse takeovers provide a faster, cost-efficient method for private companies to enter public markets. Companies like Virgin Galactic utilized reverse takeovers to bypass the lengthy IPO process, demonstrating strategic differences in market entry approaches.

Merger Infographic

libterm.com

libterm.com