The concept of "Known Unknowns" refers to information or factors you are aware of but lack specific details about, impacting decision-making and risk assessment. Understanding these gaps enhances strategic planning and prepares you to address uncertainties effectively. Explore the rest of the article to learn how to identify and manage your Known Unknowns for better outcomes.

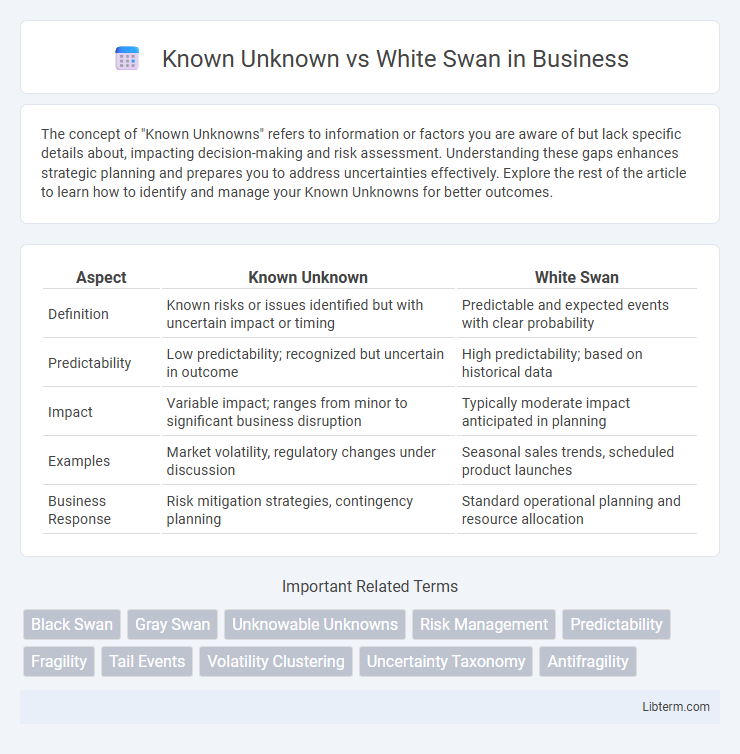

Table of Comparison

| Aspect | Known Unknown | White Swan |

|---|---|---|

| Definition | Known risks or issues identified but with uncertain impact or timing | Predictable and expected events with clear probability |

| Predictability | Low predictability; recognized but uncertain in outcome | High predictability; based on historical data |

| Impact | Variable impact; ranges from minor to significant business disruption | Typically moderate impact anticipated in planning |

| Examples | Market volatility, regulatory changes under discussion | Seasonal sales trends, scheduled product launches |

| Business Response | Risk mitigation strategies, contingency planning | Standard operational planning and resource allocation |

Understanding Known Unknowns: Definition and Context

Known unknowns refer to identifiable gaps in knowledge where the existence of a risk or uncertainty is recognized but the specifics remain unclear or unpredictable. This concept is crucial in risk management and decision-making processes, as it allows organizations to prepare for potential challenges despite incomplete information. Understanding known unknowns enables better resource allocation and strategic planning compared to white swan events, which are highly improbable and unpredictable occurrences with significant impact.

The Origin of the "White Swan" Concept

The concept of the "White Swan" originates as a counterpoint to Nassim Nicholas Taleb's "Black Swan," which describes unpredictable, high-impact events. Unlike Black Swans, White Swans refer to foreseeable, regular occurrences based on empirical evidence and historical data. The term emphasizes the importance of recognizing patterns and known risks in decision-making processes, contrasting with the uncertainty embodied by Known Unknowns and Black Swans.

Known Unknowns vs. White Swans: Key Differences

Known Unknowns represent risks or events anticipated but with unpredictable outcomes, often quantifiable through risk assessment models, while White Swans are rare, high-impact occurrences that defy conventional expectations but remain within the realm of predictability. Unlike Black Swans, White Swans are considered plausible based on existing knowledge, making them less surprising yet still significant in strategic planning. Understanding the distinction between Known Unknowns and White Swans enhances risk management by differentiating between measurable uncertainties and plausible extreme events.

Predictability and Uncertainty in Risk Assessment

Known unknowns refer to risks that are identifiable but lack precise probability estimates, allowing for some level of predictability in risk assessment. White swan events are rare, high-impact occurrences with partially understood probabilities, representing moderate uncertainty that can sometimes be anticipated with thorough analysis. Effective risk management requires distinguishing between these categories to allocate resources appropriately and develop resilient strategies against both predictable and unforeseen threats.

The Role of Cognitive Bias in Recognizing Known Unknowns

Cognitive biases such as confirmation bias and availability heuristic significantly hinder accurate identification of Known Unknowns by shaping how individuals perceive and interpret incomplete information. These biases lead to overconfidence and selective attention, causing critical uncertainties to be underestimated or overlooked. Addressing these cognitive distortions enhances the ability to differentiate Known Unknowns from unpredictable White Swan events, improving decision-making and risk assessment.

White Swans: Anticipated Events with Oversized Impact

White Swans represent anticipated events with oversized impact that are recognized but often underestimated in scope and consequence. These events differ from Known Unknowns in that their occurrence is expected, but their full ramifications are rarely accounted for in standard forecasting models. Organizations that integrate White Swan scenarios into strategic planning can better prepare for significant disruptions and leverage opportunities arising from these predictable yet impactful developments.

Case Studies: Known Unknowns in Real-World Scenarios

Case studies of known unknowns in real-world scenarios often involve risk management in complex projects where certain variables are acknowledged but their precise impact remains uncertain. For example, the aerospace industry regularly faces known unknowns such as untested weather conditions affecting flight safety, requiring adaptive measures and contingency planning. In cybersecurity, organizations anticipate potential vulnerabilities without exact threats identified, emphasizing the importance of proactive defense strategies against evolving unknown cyber risks.

White Swan Events: Historical Examples

White Swan events are predictable occurrences with significant impact, such as the 2008 Global Financial Crisis triggered by the housing market collapse and the 2004 Indian Ocean tsunami, a natural disaster with extensive devastation. The COVID-19 pandemic, while devastating and global in reach, was also anticipated by experts warning about potential zoonotic disease outbreaks. These events highlight the importance of preparedness and risk management in scenarios with known probabilities and consequences.

Strategic Planning: Preparing for White Swans and Known Unknowns

Strategic planning for known unknowns involves identifying potential risks and uncertainties that can be anticipated but not precisely predicted, allowing organizations to develop flexible contingency plans and adaptive strategies. Preparing for white swans requires an emphasis on building organizational resilience, fostering innovation, and maintaining agility to respond swiftly to rare, high-impact events that fall outside regular expectations. Integrating scenario analysis and continuous monitoring enhances decision-making capabilities, ensuring readiness for both foreseeable challenges and unprecedented disruptions.

Future Outlook: Managing Emerging Risks in a Complex World

Managing emerging risks in a complex world requires differentiating between known unknowns, which are identifiable uncertainties with potential outcomes, and white swan events, rare but predictable disruptions. Effective future outlook strategies emphasize scenario planning and adaptive risk management to anticipate and mitigate these evolving threats. Leveraging data analytics and multidisciplinary insights enhances resilience against unforeseen challenges while preparing for plausible yet impactful occurrences.

Known Unknown Infographic

libterm.com

libterm.com