Consolidation strengthens your financial position by combining multiple debts or assets into a single, manageable entity. This process can streamline payments, reduce interest rates, and improve your credit score. Explore the rest of the article to discover how consolidation can benefit your financial journey.

Table of Comparison

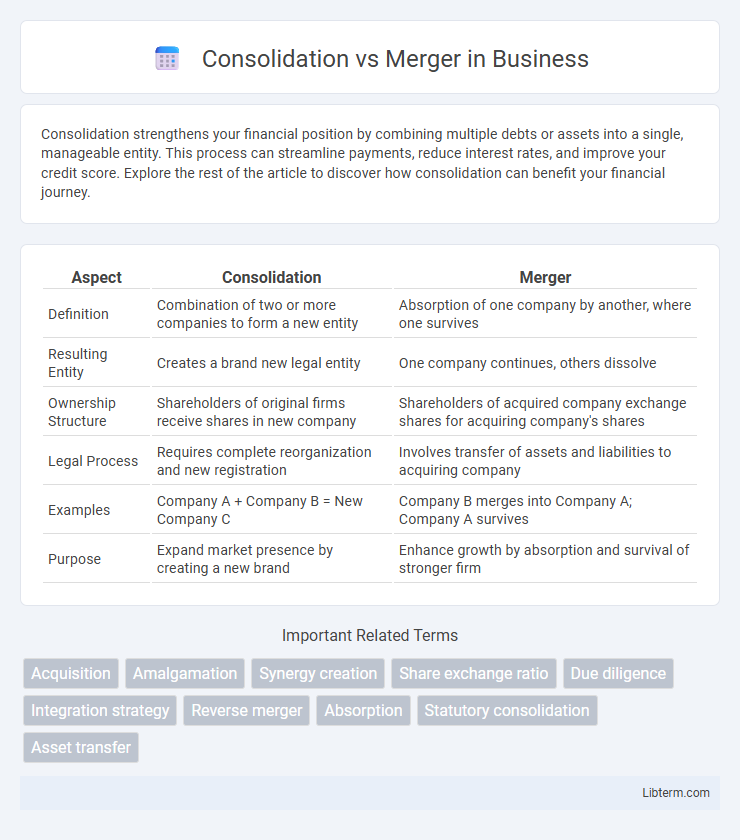

| Aspect | Consolidation | Merger |

|---|---|---|

| Definition | Combination of two or more companies to form a new entity | Absorption of one company by another, where one survives |

| Resulting Entity | Creates a brand new legal entity | One company continues, others dissolve |

| Ownership Structure | Shareholders of original firms receive shares in new company | Shareholders of acquired company exchange shares for acquiring company's shares |

| Legal Process | Requires complete reorganization and new registration | Involves transfer of assets and liabilities to acquiring company |

| Examples | Company A + Company B = New Company C | Company B merges into Company A; Company A survives |

| Purpose | Expand market presence by creating a new brand | Enhance growth by absorption and survival of stronger firm |

Introduction: Understanding Consolidation and Merger

Consolidation occurs when two or more companies combine to form an entirely new entity, dissolving the original organizations, while a merger involves one company absorbing another, with the acquiring firm retaining its identity. Both processes aim to increase market share, reduce competition, and achieve economies of scale but differ in legal structure and operational integration. Understanding these distinctions is crucial for strategic business planning, regulatory compliance, and maximizing shareholder value.

Defining Consolidation

Consolidation occurs when two or more companies combine to form an entirely new entity, pooling assets and liabilities to create a single unified organization. Unlike a merger where one company absorbs another, consolidation results in the dissolution of the original entities, establishing a new corporate structure. This process often enhances market share, operational efficiency, and resource utilization through synergistic integration.

What is a Merger?

A merger is a strategic business combination where two or more companies unite to form a single new entity, aiming to enhance competitive advantages, increase market share, and achieve operational synergies. Unlike consolidation, which involves creating a completely new company by combining all entities, a merger often involves one company absorbing another while maintaining its identity. Key examples include mergers in industries like technology and pharmaceuticals, where companies seek to leverage complementary strengths and resources.

Key Differences Between Consolidation and Merger

Consolidation forms a new entity by combining two or more companies, while mergers involve one company absorbing another without creating a new organization. In consolidation, all participating companies cease to exist independently, whereas in a merger, the acquired company loses its identity but the acquiring company remains intact. The legal and financial structures differ significantly, with consolidation requiring the creation of a new corporate entity and mergers often involving the transfer of assets and liabilities to the surviving company.

Legal Framework: Consolidation vs Merger

The legal framework for consolidation involves the unification of two or more companies into a new entity, requiring approval from each company's board and compliance with statutory regulations. In contrast, a merger typically entails one company absorbing another, with the acquiring company retaining its legal identity while the absorbed company ceases to exist. Both processes demand adherence to jurisdiction-specific corporate laws, shareholder consent, and regulatory filings, with consolidation often requiring more complex restructuring due to the formation of a new entity.

Financial Implications of Each Process

Consolidation results in the creation of a new entity, combining the assets and liabilities of the original companies, often leading to shared financial risks and improved capital structure. In contrast, a merger involves one company absorbing another, where the acquiring firm's financial statements consolidate the acquired company's assets and liabilities, potentially impacting debt ratios and earnings per share. Financial implications of consolidation typically include streamlined operations and tax advantages, while mergers can lead to increased market share and economies of scale but may also involve significant integration costs.

Advantages and Disadvantages of Consolidation

Consolidation combines two or more companies into a new entity, often leading to enhanced market share, resource optimization, and diversified product lines. Key advantages include economies of scale, improved operational efficiency, and increased competitive advantage, while disadvantages encompass cultural clashes, integration challenges, and potential job redundancies. This strategic move requires careful assessment to balance financial benefits against risks of diminished organizational identity and employee morale.

Pros and Cons of Merger Transactions

Merger transactions offer the advantage of creating a larger consolidated entity that can benefit from increased market share, enhanced operational efficiencies, and greater financial resources. However, mergers often face challenges such as cultural clashes between organizations, integration complexities, and potential regulatory scrutiny that can delay or derail the process. The success of a merger heavily depends on strategic alignment, effective communication, and thorough due diligence to mitigate risks and maximize synergies.

Real-World Examples: Consolidation vs Merger

Consolidation occurs when two companies combine to form a new entity, as seen in the 1998 merger of Bell Atlantic and GTE creating Verizon Communications, effectively consolidating their telecommunications operations. Mergers involve one company absorbing another without forming a new entity, exemplified by Facebook's acquisition of Instagram in 2012, where Instagram continued as a subsidiary within Facebook. These real-world examples illustrate how consolidation results in a fresh corporate identity, while mergers integrate companies under one existing brand.

Which Is Best? Choosing Between Consolidation and Merger

Choosing between consolidation and merger depends on the strategic objectives and financial goals of the companies involved. Consolidation creates a new entity, combining all assets and liabilities, ideal for equal partnerships aiming for a fresh brand identity and shared resources. Mergers typically involve one company absorbing another, best suited for businesses seeking growth through acquisition and maintaining existing brand strengths.

Consolidation Infographic

libterm.com

libterm.com