Capital expenditures represent significant investments made by a company to acquire or upgrade physical assets such as machinery, buildings, or technology, essential for long-term growth and operational efficiency. These expenditures impact your financial planning and cash flow management while influencing the company's depreciation and tax strategies. Explore the rest of this article to understand how capital expenditures can shape your business's future success.

Table of Comparison

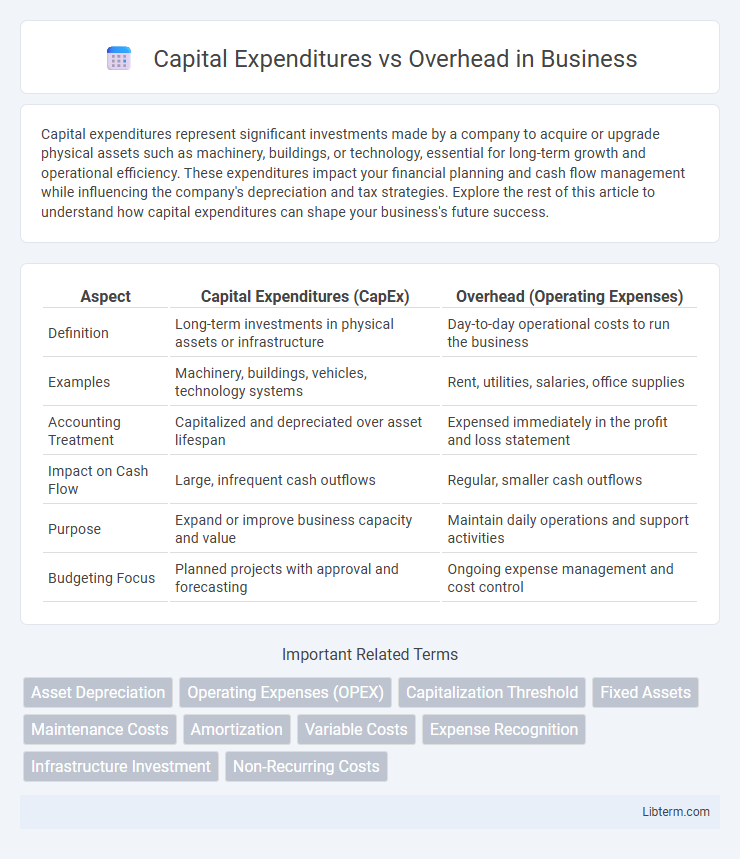

| Aspect | Capital Expenditures (CapEx) | Overhead (Operating Expenses) |

|---|---|---|

| Definition | Long-term investments in physical assets or infrastructure | Day-to-day operational costs to run the business |

| Examples | Machinery, buildings, vehicles, technology systems | Rent, utilities, salaries, office supplies |

| Accounting Treatment | Capitalized and depreciated over asset lifespan | Expensed immediately in the profit and loss statement |

| Impact on Cash Flow | Large, infrequent cash outflows | Regular, smaller cash outflows |

| Purpose | Expand or improve business capacity and value | Maintain daily operations and support activities |

| Budgeting Focus | Planned projects with approval and forecasting | Ongoing expense management and cost control |

Understanding Capital Expenditures

Capital expenditures (CapEx) are investments in long-term assets such as property, equipment, or infrastructure that enhance a company's productive capacity and are recorded on the balance sheet. Unlike overhead costs, which are ongoing operational expenses like rent, utilities, and administrative salaries, CapEx represents capitalized costs that depreciate over time. Understanding Capital Expenditures is critical for financial planning, asset management, and assessing a company's growth potential and cash flow requirements.

Defining Overhead Costs

Overhead costs refer to the ongoing expenses necessary to operate a business that are not directly tied to producing goods or services, such as rent, utilities, and administrative salaries. These fixed and variable costs support the company's daily functions and are essential for maintaining business infrastructure. Differentiating overhead from capital expenditures highlights that overhead involves recurring expenses, whereas capital expenditures are investments in long-term assets.

Key Differences Between CapEx and Overhead

Capital expenditures (CapEx) refer to funds used by a company to acquire, upgrade, or maintain physical assets such as property, equipment, or technology, often involving significant one-time investments. Overhead costs, on the other hand, represent ongoing operational expenses necessary to run the business, including rent, utilities, and administrative salaries, which do not directly contribute to asset acquisition. The key difference lies in CapEx being capitalized and depreciated over time, while overhead is expensed immediately in the accounting period.

Examples of Capital Expenditures

Examples of capital expenditures include purchasing machinery, acquiring land, constructing buildings, and investing in technology infrastructure. These investments are long-term assets essential for business growth and operational capacity. Unlike overhead costs, capital expenditures are capitalized and depreciated over their useful life.

Common Types of Overhead Expenses

Common types of overhead expenses include rent, utilities, administrative salaries, and office supplies, which are necessary for daily operations but do not directly contribute to production. Capital expenditures, in contrast, involve significant investments in assets like machinery, buildings, or technology that provide long-term value. Understanding the distinction helps businesses manage budgeting effectively by categorizing costs into operational overhead or long-term capital investments.

Impact on Financial Statements

Capital expenditures (CapEx) increase the value of fixed assets on the balance sheet and are capitalized, affecting depreciation expenses over time on the income statement. Overhead costs are recorded as operating expenses, directly reducing net income in the period incurred. The distinction impacts cash flow classification, with CapEx shown in investing activities and overhead in operating activities on the cash flow statement.

Tax Implications: CapEx vs. Overhead

Capital expenditures (CapEx) involve significant investments in assets that are depreciated over time, allowing businesses to deduct depreciation expenses annually and potentially lower taxable income across multiple years. In contrast, overhead costs are typically treated as operating expenses, which are fully deductible in the tax year they are incurred, providing immediate tax benefits. Understanding the timing and nature of these deductions is crucial for optimizing tax strategy and cash flow management.

Budgeting Strategies for CapEx and Overhead

Effective budgeting strategies for Capital Expenditures (CapEx) prioritize long-term asset investments such as equipment, infrastructure, and technology upgrades to support business growth and operational efficiency. Overhead budgeting focuses on managing ongoing operational expenses like rent, utilities, and administrative salaries by implementing cost control measures and forecasting fixed versus variable costs. Integrating detailed financial analysis and predictive modeling enhances the accuracy of both CapEx and overhead budgets, optimizing resource allocation and cash flow management.

Managing CapEx for Business Growth

Managing capital expenditures (CapEx) effectively involves prioritizing investments in long-term assets like machinery, technology, and infrastructure that drive sustainable business growth. Unlike overhead costs, which cover ongoing operational expenses, optimizing CapEx requires strategic planning to balance immediate cash flow constraints with future expansion goals. Careful forecasting and rigorous project evaluation ensure that CapEx delivers maximum return on investment, supporting scalability and competitive advantage.

Reducing Overhead to Improve Profit Margins

Reducing overhead expenses directly enhances profit margins by lowering recurring operational costs without sacrificing business efficiency. Strategic expense management, such as renegotiating supplier contracts and optimizing utility consumption, maximizes cost savings while maintaining essential functions. Improved overhead control allows companies to allocate more capital towards growth initiatives, creating a stronger financial foundation compared to focusing solely on capital expenditures.

Capital Expenditures Infographic

libterm.com

libterm.com