Advisory fees are charges paid to financial advisors for providing investment guidance and portfolio management services. These fees typically reflect a percentage of the assets under management, aligning the advisor's incentives with your financial growth. Explore the rest of this article to understand how advisory fees impact your investments and how to choose the best advisor for your needs.

Table of Comparison

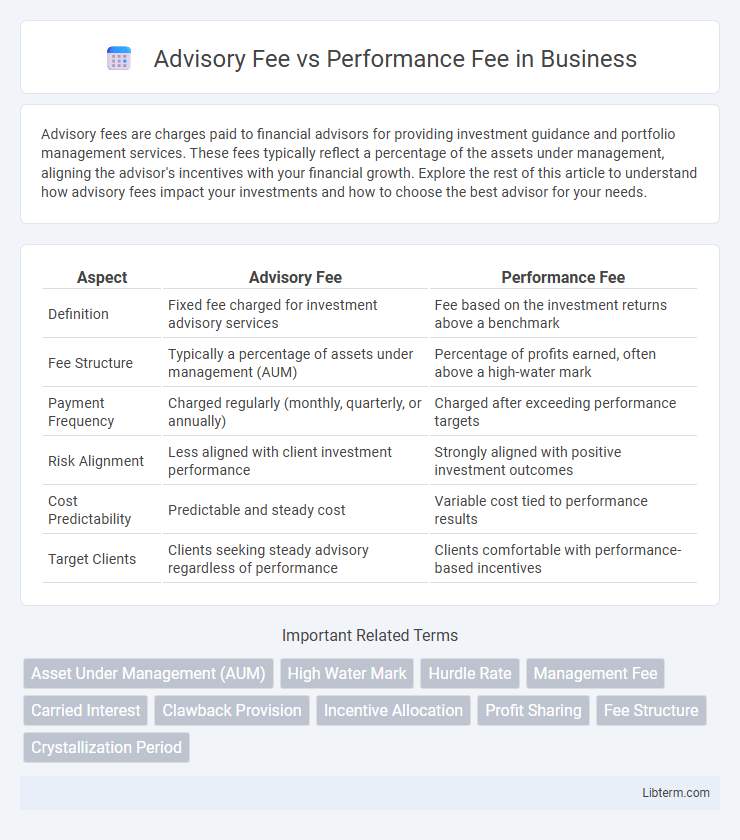

| Aspect | Advisory Fee | Performance Fee |

|---|---|---|

| Definition | Fixed fee charged for investment advisory services | Fee based on the investment returns above a benchmark |

| Fee Structure | Typically a percentage of assets under management (AUM) | Percentage of profits earned, often above a high-water mark |

| Payment Frequency | Charged regularly (monthly, quarterly, or annually) | Charged after exceeding performance targets |

| Risk Alignment | Less aligned with client investment performance | Strongly aligned with positive investment outcomes |

| Cost Predictability | Predictable and steady cost | Variable cost tied to performance results |

| Target Clients | Clients seeking steady advisory regardless of performance | Clients comfortable with performance-based incentives |

Introduction to Advisory and Performance Fees

Advisory fees are fixed charges paid to investment managers for portfolio management and financial advice, typically calculated as a percentage of assets under management (AUM). Performance fees reward fund managers based on the fund's returns exceeding a predefined benchmark or hurdle rate, aligning the manager's interests with investor gains. Understanding the differences between advisory and performance fees is crucial for investors evaluating cost structures and potential incentives behind various investment vehicles.

Understanding Advisory Fees: Definition and Structure

Advisory fees are charges paid to financial advisors for ongoing portfolio management and personalized investment guidance, typically calculated as a fixed percentage of assets under management (AUM). These fees cover services such as financial planning, asset allocation, and regular portfolio monitoring, regardless of investment performance. Understanding the structure of advisory fees helps investors evaluate cost-effectiveness and align fee models with their financial goals.

What Are Performance Fees? Key Concepts Explained

Performance fees are compensation structures in investment management that reward managers based on the portfolio's positive returns, typically calculated as a percentage of the profits earned above a predefined benchmark or hurdle rate. These fees align the interests of fund managers and investors by incentivizing superior performance while also incorporating high-water marks to ensure fees are only charged on new gains. Understanding the key concepts of performance fees includes recognizing their role in hedge funds, private equity, and mutual funds, where they contrast with advisory fees, which are usually fixed percentages of assets under management regardless of performance.

Differences Between Advisory and Performance Fees

Advisory fees are fixed charges based on a percentage of assets under management, typically paid regardless of investment performance, reflecting ongoing portfolio management services. Performance fees depend on achieving specific investment returns, incentivizing managers by linking compensation to the fund's success or profit generation. The primary difference lies in stability versus variability: advisory fees provide consistent income, while performance fees align manager rewards directly with investment outcomes.

Pros and Cons of Advisory Fee Structures

Advisory fees typically provide predictable, stable income for investment managers by charging a fixed percentage of assets under management, which simplifies budgeting for clients but may not always align the advisor's incentives with investment performance. This fee structure encourages consistent portfolio monitoring but can result in charges during periods of underperformance, potentially diminishing investor satisfaction. On the downside, advisory fees might lead to complacency in actively seeking superior returns since compensation is not directly linked to performance outcomes.

Advantages and Disadvantages of Performance Fees

Performance fees align investment manager incentives with client returns by rewarding managers for achieving positive results, encouraging diligent portfolio management and potentially higher gains. However, performance fees can lead to increased risk-taking, as managers might pursue aggressive strategies to maximize rewards, and investors may face higher overall costs during strong market performance. This fee structure also adds complexity to fee calculations and can create conflicts of interest if short-term gains are prioritized over long-term stability.

Factors to Consider When Choosing a Fee Structure

When choosing between advisory fees and performance fees, investors should evaluate factors such as investment goals, risk tolerance, and expected portfolio performance. Advisory fees offer predictable costs based on assets under management, making budgeting easier, while performance fees align the advisor's compensation with investment returns, potentially motivating better results but increasing overall costs during strong performance periods. Understanding fee transparency, impact on long-term returns, and advisor incentives is essential for selecting a fee structure that aligns with financial objectives.

Impact on Client-Investor Relationships

Advisory fees provide a stable revenue stream for investment managers, fostering trust through consistent service regardless of portfolio performance, which can strengthen long-term client-investor relationships. Performance fees align managers' incentives with clients' success by rewarding outperformance, but may introduce conflicts if risk-taking increases, potentially impacting investor confidence. Balancing advisory and performance fees helps maintain transparency and loyalty by ensuring clients feel aligned with their manager's goals and risk tolerance.

Regulatory Considerations for Advisory vs Performance Fees

Regulatory considerations for advisory fees primarily involve transparency requirements, clear disclosure of fee structures, and adherence to fiduciary duties under regulations such as the Investment Advisers Act of 1940. Performance fees, governed by stricter rules like the SEC's Rule 205-3, necessitate specific safeguards to prevent conflicts of interest, including "high-water marks" to ensure fees are based on net profits and proper client consent. Both fee types demand comprehensive reporting and compliance protocols to protect investors and align fees with their investment outcomes.

Which Fee Model Is Right for You?

Choosing between advisory fees and performance fees depends on your investment goals and risk tolerance. Advisory fees charge a fixed percentage of assets managed, providing predictable costs but less direct alignment with portfolio success. Performance fees, often a share of profits above a benchmark, incentivize managers to exceed targets but may lead to higher costs during strong market periods.

Advisory Fee Infographic

libterm.com

libterm.com