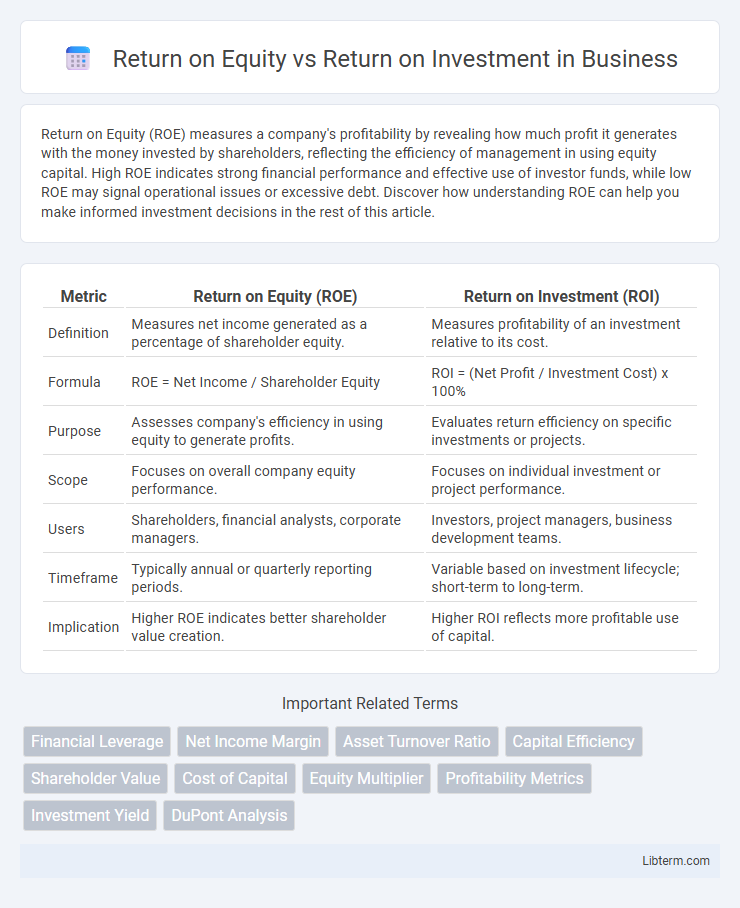

Return on Equity (ROE) measures a company's profitability by revealing how much profit it generates with the money invested by shareholders, reflecting the efficiency of management in using equity capital. High ROE indicates strong financial performance and effective use of investor funds, while low ROE may signal operational issues or excessive debt. Discover how understanding ROE can help you make informed investment decisions in the rest of this article.

Table of Comparison

| Metric | Return on Equity (ROE) | Return on Investment (ROI) |

|---|---|---|

| Definition | Measures net income generated as a percentage of shareholder equity. | Measures profitability of an investment relative to its cost. |

| Formula | ROE = Net Income / Shareholder Equity | ROI = (Net Profit / Investment Cost) x 100% |

| Purpose | Assesses company's efficiency in using equity to generate profits. | Evaluates return efficiency on specific investments or projects. |

| Scope | Focuses on overall company equity performance. | Focuses on individual investment or project performance. |

| Users | Shareholders, financial analysts, corporate managers. | Investors, project managers, business development teams. |

| Timeframe | Typically annual or quarterly reporting periods. | Variable based on investment lifecycle; short-term to long-term. |

| Implication | Higher ROE indicates better shareholder value creation. | Higher ROI reflects more profitable use of capital. |

Introduction to Return on Equity (ROE) and Return on Investment (ROI)

Return on Equity (ROE) measures a company's profitability by revealing how much profit generates with shareholders' equity, expressed as a percentage. Return on Investment (ROI) evaluates the efficiency of an investment by comparing the net gain to the initial cost, providing insight into the return achieved relative to the investment amount. Both ROE and ROI are key financial metrics used to assess performance, but ROE focuses on equity holders while ROI can apply to a broader range of investments.

Definition and Formula: ROE

Return on Equity (ROE) measures a company's profitability by revealing how much net income is generated as a percentage of shareholders' equity, calculated using the formula ROE = Net Income / Shareholders' Equity. This metric assesses the efficiency with which a firm uses investors' funds to generate earnings. In contrast, Return on Investment (ROI) evaluates the overall return from any investment relative to its cost, focusing on broader asset performance rather than equity alone.

Definition and Formula: ROI

Return on Equity (ROE) measures a company's profitability by revealing how much profit a company generates with the money shareholders have invested, calculated as Net Income divided by Shareholder's Equity. Return on Investment (ROI) evaluates the efficiency of an investment or compares the efficiency of several investments, calculated as (Net Profit from Investment - Cost of Investment) divided by Cost of Investment and expressed as a percentage. While ROE focuses on returns for equity holders, ROI provides a broader perspective on the overall profitability of any investment.

Key Differences Between ROE and ROI

Return on Equity (ROE) measures a company's profitability by revealing how much profit is generated with shareholders' equity, while Return on Investment (ROI) evaluates the efficiency of an investment by comparing net profit relative to the initial investment cost. ROE focuses specifically on equity holders' returns, highlighting financial leverage and internal company performance, whereas ROI encompasses broader investment scenarios, including projects or asset acquisitions, regardless of financing structure. Key differences also include ROE's use in assessing corporate management effectiveness and ROI's applicability in comparing diverse investments across industries.

Advantages of Using ROE

Return on Equity (ROE) provides a clear measure of profitability by showing how effectively a company generates income from shareholders' equity, offering investors insight into management's efficiency in utilizing invested capital. ROE emphasizes shareholder value creation, making it a crucial metric for evaluating performance relative to equity rather than total assets, which distinguishes it from Return on Investment (ROI). This focus on equity maximizes relevance for shareholders seeking to assess the financial health and growth potential of their investments.

Advantages of Using ROI

Return on Investment (ROI) provides a broader measure of profitability by evaluating the efficiency of an investment relative to its total cost, making it ideal for comparing different projects or business units. Unlike Return on Equity (ROE), which focuses solely on shareholder equity, ROI incorporates all invested capital, offering a comprehensive assessment of asset utilization. This advantage enables businesses to make informed decisions across diverse investment opportunities, enhancing overall financial strategy and resource allocation.

Limitations of ROE

Return on Equity (ROE) measures a company's profitability relative to shareholders' equity but can be misleading due to its sensitivity to financial leverage and debt levels, which may inflate the metric without improving operational performance. Unlike Return on Investment (ROI), which provides a broader view by considering total invested capital, ROE does not account for the cost of debt, potentially overstating profitability in highly leveraged firms. Investors should be cautious when comparing ROE across industries or companies with varying capital structures, as differences in equity levels can distort true performance assessments.

Limitations of ROI

Return on Investment (ROI) lacks consideration of the investment duration, which can mislead stakeholders by presenting high returns over shorter periods as superior without context. ROI also fails to account for the cost of capital and risk factors, potentially overstating the profitability of risky projects compared to Return on Equity (ROE). Furthermore, ROI does not differentiate between operational efficiency and financial leverage, limiting its effectiveness in comprehensive performance evaluation.

Choosing Between ROE and ROI for Business Analysis

Choosing between Return on Equity (ROE) and Return on Investment (ROI) depends on the specific financial focus of a business analysis. ROE measures a company's profitability relative to shareholders' equity, making it ideal for assessing how effectively equity capital is being utilized, while ROI evaluates the efficiency of an overall investment or project regardless of funding source. Businesses prioritize ROE when emphasizing shareholder value and equity utilization, whereas ROI is preferred for broader investment performance comparisons across different assets or projects.

Conclusion: ROE vs ROI in Financial Decision Making

Return on Equity (ROE) measures a company's profitability relative to shareholders' equity, providing insight into how effectively management is using invested capital. Return on Investment (ROI) evaluates the efficiency of a specific investment by comparing returns to its cost, making it essential for project-level financial decisions. In financial decision making, ROE is crucial for assessing overall corporate performance and shareholder value, while ROI guides targeted investment choices, ensuring resources are allocated to the most profitable opportunities.

Return on Equity Infographic

libterm.com

libterm.com