EBIT, or Earnings Before Interest and Taxes, measures a company's profitability by excluding interest and tax expenses from net income, providing a clear view of operational performance. Understanding EBIT helps you evaluate how well a business generates profit from its core activities without the impact of financing and tax structures. Explore the rest of the article to learn how EBIT influences investment decisions and financial analysis.

Table of Comparison

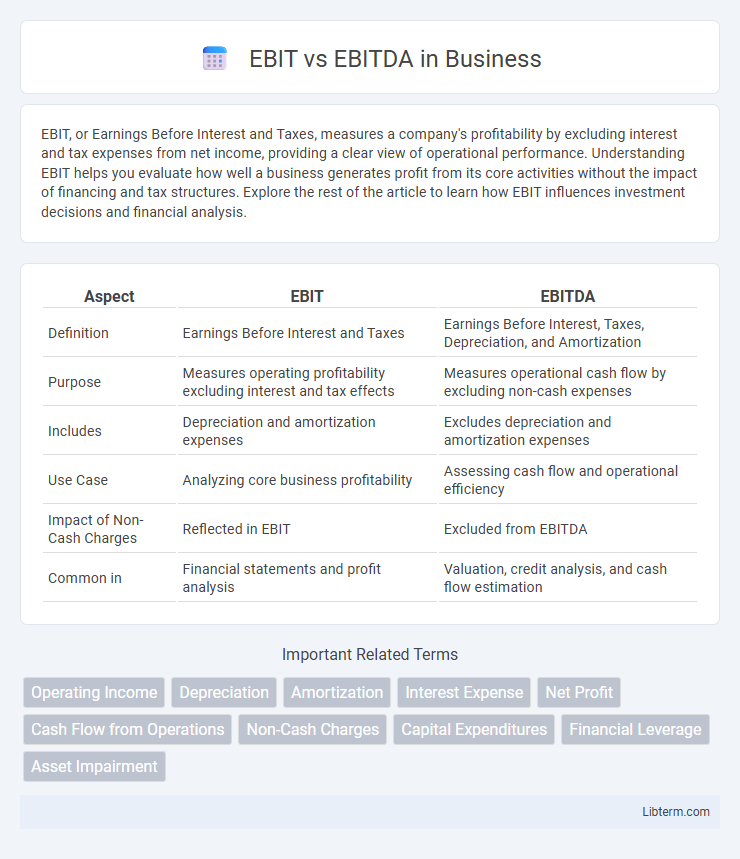

| Aspect | EBIT | EBITDA |

|---|---|---|

| Definition | Earnings Before Interest and Taxes | Earnings Before Interest, Taxes, Depreciation, and Amortization |

| Purpose | Measures operating profitability excluding interest and tax effects | Measures operational cash flow by excluding non-cash expenses |

| Includes | Depreciation and amortization expenses | Excludes depreciation and amortization expenses |

| Use Case | Analyzing core business profitability | Assessing cash flow and operational efficiency |

| Impact of Non-Cash Charges | Reflected in EBIT | Excluded from EBITDA |

| Common in | Financial statements and profit analysis | Valuation, credit analysis, and cash flow estimation |

Introduction to EBIT and EBITDA

EBIT (Earnings Before Interest and Taxes) measures a company's profitability by excluding interest and tax expenses, reflecting operating income from core business operations. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) extends EBIT by adding back non-cash expenses like depreciation and amortization, providing a clearer view of operational cash flow. Both metrics are essential for analyzing financial performance, with EBIT emphasizing profitability and EBITDA focusing on cash generation.

Definition of EBIT

EBIT (Earnings Before Interest and Taxes) measures a company's profitability by calculating earnings generated from core operations before deducting interest expenses and income taxes. It reflects operational efficiency by excluding financing and tax effects, providing insight into a firm's ability to generate profit from its business activities. Unlike EBITDA, EBIT accounts for depreciation and amortization, offering a more accurate picture of operating performance.

Definition of EBITDA

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, measures a company's operating performance by excluding non-operational expenses and non-cash charges, providing a clearer view of core profitability. Unlike EBIT, which deducts depreciation and amortization, EBITDA focuses solely on earnings from core business activities before accounting for financing and accounting decisions. This metric helps investors assess cash flow potential and compare companies with varying capital structures.

Key Differences Between EBIT and EBITDA

EBIT (Earnings Before Interest and Taxes) measures a company's profitability by calculating operating income excluding interest and tax expenses, reflecting operational efficiency. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) further excludes non-cash expenses like depreciation and amortization, providing a clearer view of cash flow from core operations. The primary difference is EBITDA's ability to highlight operational cash generation, whereas EBIT focuses on operating profit after accounting for asset wear and tear.

Calculating EBIT: Formula and Examples

EBIT (Earnings Before Interest and Taxes) is calculated using the formula: EBIT = Revenue - Operating Expenses (excluding interest and taxes). For example, if a company has $500,000 in revenue and $350,000 in operating expenses, EBIT would be $150,000. This metric focuses on operating performance by excluding non-operating costs, providing a clear view of profitability from core business activities.

Calculating EBITDA: Formula and Examples

EBITDA is calculated by adding depreciation and amortization expenses back to EBIT, using the formula EBITDA = EBIT + Depreciation + Amortization. For example, if a company reports an EBIT of $500,000, depreciation of $120,000, and amortization of $30,000, its EBITDA would be $650,000. This metric provides a clearer picture of operational profitability by excluding non-cash expenses and financing costs.

When to Use EBIT vs EBITDA

Use EBIT (Earnings Before Interest and Taxes) when assessing a company's core profitability by excluding interest and tax expenses, providing a clear view of operational efficiency. Opt for EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) to evaluate cash flow generation and operational performance without non-cash charges, especially in capital-intensive industries. Investors and analysts rely on EBIT to understand profit before financing costs, while EBITDA is preferred for comparing companies with different capital structures.

Advantages and Disadvantages of EBIT

EBIT (Earnings Before Interest and Taxes) offers a clear view of a company's operational profitability by excluding interest and tax expenses, making it useful for comparing companies with different capital structures. However, EBIT does not account for non-cash expenses like depreciation and amortization, which can distort profitability for asset-heavy businesses. Its main disadvantage lies in potentially overstating earnings for companies with significant non-cash costs, reducing its effectiveness in cash flow analysis.

Advantages and Disadvantages of EBITDA

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) provides a clearer picture of operational profitability by excluding non-cash expenses, making it useful for comparing companies across sectors with varying capital structures and tax situations. However, EBITDA can be misleading as it ignores essential costs like depreciation and amortization, which reflect asset wear and replacement needs, potentially overstating cash flow. Investors should be cautious using EBITDA alone, because it overlooks interest and taxes, which affect net profitability and financial health.

EBIT vs EBITDA: Which Metric Matters Most?

EBIT (Earnings Before Interest and Taxes) and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) both measure a company's profitability but highlight different aspects of operational performance; EBIT focuses on core earnings by including depreciation and amortization, reflecting asset utilization and cost management, while EBITDA excludes these non-cash expenses to emphasize cash flow potential. Investors and analysts prioritize EBIT when assessing operational efficiency and capital investment impact, whereas EBITDA is favored for evaluating cash generation ability and comparing companies with varying asset structures. The choice between EBIT and EBITDA depends on the industry context and financial analysis goals, making EBIT crucial for understanding profitability after capital expenses and EBITDA key for liquidity and debt servicing capacity.

EBIT Infographic

libterm.com

libterm.com