Batch settlement streamlines financial transactions by grouping multiple payments into a single process, improving efficiency for businesses and reducing transaction fees. This method ensures faster reconciliation and simplifies accounting by consolidating numerous settlements at once. Discover how batch settlement can optimize your payment operations in the rest of this article.

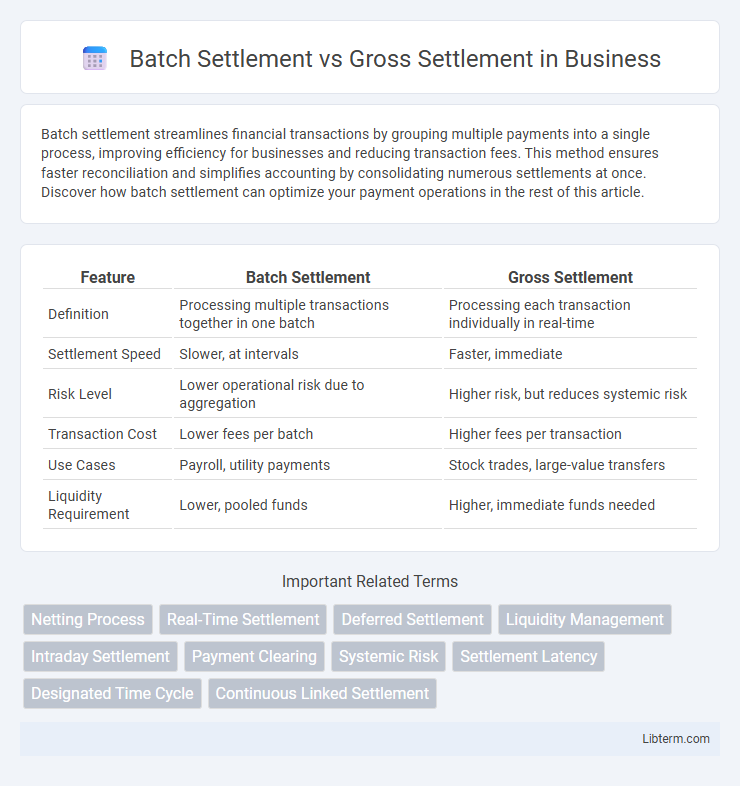

Table of Comparison

| Feature | Batch Settlement | Gross Settlement |

|---|---|---|

| Definition | Processing multiple transactions together in one batch | Processing each transaction individually in real-time |

| Settlement Speed | Slower, at intervals | Faster, immediate |

| Risk Level | Lower operational risk due to aggregation | Higher risk, but reduces systemic risk |

| Transaction Cost | Lower fees per batch | Higher fees per transaction |

| Use Cases | Payroll, utility payments | Stock trades, large-value transfers |

| Liquidity Requirement | Lower, pooled funds | Higher, immediate funds needed |

Introduction to Payment Settlement Systems

Batch settlement processes multiple payment instructions together at scheduled intervals, reducing transaction costs and increasing efficiency in payment settlement systems. Gross settlement processes each payment individually and immediately, ensuring finality and reducing credit risk but requiring higher liquidity from participating banks. Payment settlement systems utilize these methods to balance speed, risk management, and operational efficiency in transferring funds between financial institutions.

What is Batch Settlement?

Batch settlement refers to the process where multiple financial transactions are accumulated and processed together as a single group at specified intervals, improving efficiency and reducing processing costs. This method contrasts with gross settlement, which involves the immediate, individual clearing of each transaction. Batch settlement is commonly used in systems like Automated Clearing House (ACH) transfers and payroll processing to optimize transaction handling and reduce settlement risk.

What is Gross Settlement?

Gross settlement refers to the immediate, transaction-by-transaction processing of payments or securities transfers, where each transaction is settled individually without netting. This method ensures finality and reduces settlement risk by confirming that funds or securities are transferred irrevocably as soon as the transaction occurs. Central banks and large-value payment systems commonly use gross settlement to guarantee real-time settlement and enhance financial stability.

Key Differences Between Batch and Gross Settlement

Batch settlement processes multiple transactions together at scheduled intervals, reducing processing costs and increasing efficiency but introducing settlement risk due to delayed finality. Gross settlement clears individual transactions in real-time, ensuring immediate finality and minimizing credit risk at the expense of higher liquidity requirements and operational costs. The key difference lies in timing: batch settlement aggregates and settles transactions collectively, whereas gross settlement settles each transaction individually and instantaneously.

Advantages of Batch Settlement

Batch settlement groups multiple transactions for processing at specific intervals, significantly reducing the operational burden on payment systems compared to gross settlement, which processes transactions individually and instantaneously. This method enhances liquidity management by enabling financial institutions to optimize fund usage and reduce reserve requirements. Furthermore, batch settlement lowers transaction costs and increases processing efficiency, making it ideal for high-volume payment networks and retail banking environments.

Advantages of Gross Settlement

Gross settlement processes each transaction individually and immediately, significantly reducing settlement risk and enhancing liquidity management for financial institutions. This real-time processing ensures that funds are available instantly, which improves operational efficiency and mitigates counterparty risk compared to batch settlement systems. Central banks and high-value payment systems prefer gross settlement methods like RTGS for their robustness in handling large-value transfers securely and promptly.

Use Cases for Batch Settlement

Batch settlement is ideal for processing multiple transactions together, often used in retail payment systems, credit card clearing, and payroll operations where consolidating multiple payments improves efficiency and reduces costs. This approach benefits e-commerce platforms and utility companies that handle a high volume of small, regular transactions, enabling simplified reconciliation and reduced settlement risk. Batch settlement is preferred in scenarios demanding lower transaction fees and where immediate fund transfer is not critical.

Use Cases for Gross Settlement

Gross settlement processes are essential in high-value financial transactions requiring immediate finality, such as interbank fund transfers and real-time securities settlements. Central banks and large financial institutions rely on gross settlement systems like Real-Time Gross Settlement (RTGS) to minimize settlement risk and ensure transaction transparency. These use cases prioritize individual transaction processing to maintain liquidity and reduce systemic risk in critical payment ecosystems.

Risks and Security Considerations

Batch settlement processes multiple transactions together, increasing the risk of systemic delays and potential settlement failures due to accumulated errors or fraud. Gross settlement processes each transaction individually, minimizing settlement risk and providing real-time finality, which enhances security against fraud and liquidity shortfalls. Financial institutions must balance the operational efficiency of batch settlement with the reduced counterparty risk and improved transparency inherent in gross settlement systems.

Choosing the Right Settlement Method

Selecting the appropriate settlement method depends on transaction volume, speed requirements, and risk tolerance. Batch settlement consolidates payments to reduce processing costs and is ideal for high-volume, low-value transactions, while gross settlement processes individual payments instantly, minimizing credit risk for high-value or time-sensitive transfers. Evaluating liquidity availability and operational efficiency helps determine whether batch or gross settlement aligns best with business goals and regulatory compliance.

Batch Settlement Infographic

libterm.com

libterm.com