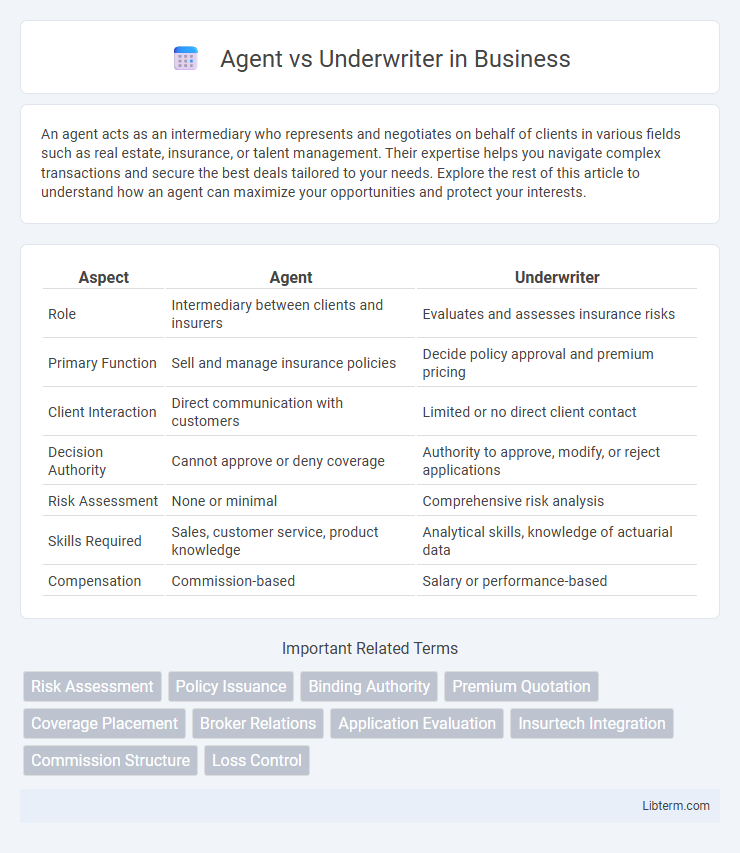

An agent acts as an intermediary who represents and negotiates on behalf of clients in various fields such as real estate, insurance, or talent management. Their expertise helps you navigate complex transactions and secure the best deals tailored to your needs. Explore the rest of this article to understand how an agent can maximize your opportunities and protect your interests.

Table of Comparison

| Aspect | Agent | Underwriter |

|---|---|---|

| Role | Intermediary between clients and insurers | Evaluates and assesses insurance risks |

| Primary Function | Sell and manage insurance policies | Decide policy approval and premium pricing |

| Client Interaction | Direct communication with customers | Limited or no direct client contact |

| Decision Authority | Cannot approve or deny coverage | Authority to approve, modify, or reject applications |

| Risk Assessment | None or minimal | Comprehensive risk analysis |

| Skills Required | Sales, customer service, product knowledge | Analytical skills, knowledge of actuarial data |

| Compensation | Commission-based | Salary or performance-based |

Introduction: Understanding Agents and Underwriters

Agents serve as intermediaries who represent insurance buyers, facilitating policy selection and purchase, while underwriters assess risk levels to determine policy terms and pricing. Understanding their distinct roles is essential for navigating the insurance industry effectively and ensuring appropriate coverage. Agents prioritize customer needs and sales, whereas underwriters focus on financial risk evaluation and policy approval.

Roles and Responsibilities of an Agent

An insurance agent acts as the primary point of contact between clients and insurance companies, responsible for assessing client needs, explaining policy options, and facilitating the purchase of insurance coverage. Agents collect premiums, manage client records, and provide ongoing customer service while ensuring compliance with regulatory requirements. They do not assume risk but work to match clients with appropriate policies underwritten and evaluated by underwriters.

Key Functions of an Underwriter

Underwriters assess risks by analyzing applications, financial documents, and credit histories to determine insurance eligibility and premium rates. They apply standardized guidelines and actuarial data to evaluate potential losses, ensuring the insurer's profitability and compliance with regulations. Risk assessment, policy approval, and continuous monitoring of policy performance are essential functions that differentiate underwriters from agents, who primarily focus on client acquisition and sales.

Agent vs Underwriter: Core Differences

Agents act as intermediaries between clients and insurance companies, primarily responsible for selling policies and providing customer service. Underwriters evaluate risk by analyzing applications and deciding whether to approve, modify, or reject insurance coverage based on statistical data and risk assessment criteria. The core difference lies in agents focusing on policy distribution and client interaction, while underwriters concentrate on risk evaluation and policy approval.

Required Skills and Qualifications

Agents require strong interpersonal and communication skills to effectively sell insurance policies and build client trust, alongside comprehensive knowledge of insurance products and market trends. Underwriters must possess analytical skills, attention to detail, and expertise in risk assessment, often supported by qualifications in finance, business, or insurance-related fields. Both roles benefit from proficiency in regulatory compliance and industry-specific software to enhance decision-making and accuracy.

The Client Interaction Perspective

Agents act as direct liaisons to clients, offering personalized advice and tailored insurance options that address individual needs. Underwriters evaluate risk and determine policy terms without direct client contact, focusing on data assessment and risk management. Client interaction primarily occurs through agents who translate underwriting decisions into understandable coverage solutions.

Risk Assessment Approaches

Agents primarily gather client information and provide initial risk assessments based on observable factors and customer disclosures, facilitating policy recommendations. Underwriters conduct detailed risk analysis using actuarial data, statistical models, and historical loss records to evaluate the likelihood and potential impact of claims. This thorough risk quantification enables underwriters to determine policy terms, premiums, and coverage limits with precision.

Legal and Regulatory Obligations

Agents primarily act as intermediaries between clients and insurance companies, ensuring compliance with licensing requirements and fiduciary duties while submitting accurate applications and disclosures. Underwriters hold responsibility for assessing risks in accordance with regulatory standards, adhering to state and federal insurance laws to approve or reject coverage based on established underwriting guidelines. Both roles must maintain rigorous documentation and transparency to meet legal obligations and prevent violations such as misrepresentation or unfair trade practices.

Career Paths and Growth Opportunities

Agent career paths emphasize client interaction, commission-based income, and building a personal sales portfolio, offering rapid growth through networking and sales performance. Underwriters focus on risk assessment, policy approval, and analytical expertise, with career advancement toward senior underwriter or risk management roles driven by experience and technical skills. Both careers provide specialized opportunities in insurance companies, but agents tend to grow through relationship-building while underwriters advance via analytical and decision-making proficiency.

Choosing the Right Path: Agent or Underwriter

Choosing between an agent and an underwriter depends on your career goals within the insurance industry. Agents specialize in client relationships and policy sales, focusing on customer acquisition and retention, while underwriters evaluate risk, analyze applications, and determine policy terms to protect the insurer's financial interests. Understanding the distinct responsibilities and required skill sets of each role is essential for aligning your professional strengths with the right career path.

Agent Infographic

libterm.com

libterm.com